Region:Middle East

Author(s):Dev

Product Code:KRAC8835

Pages:84

Published On:November 2025

By Type:The market is segmented into various types of electric wheelchairs, including Standard Electric Wheelchairs, Heavy-Duty Electric Wheelchairs, Lightweight Electric Wheelchairs, Folding Electric Wheelchairs, All-Terrain Electric Wheelchairs, Pediatric Electric Wheelchairs, and Others. Among these, Standard Electric Wheelchairs dominate the market due to their affordability and versatility, making them the preferred choice for many consumers. The increasing demand for lightweight and folding options is also notable, as they cater to the needs of users seeking portability and ease of use.

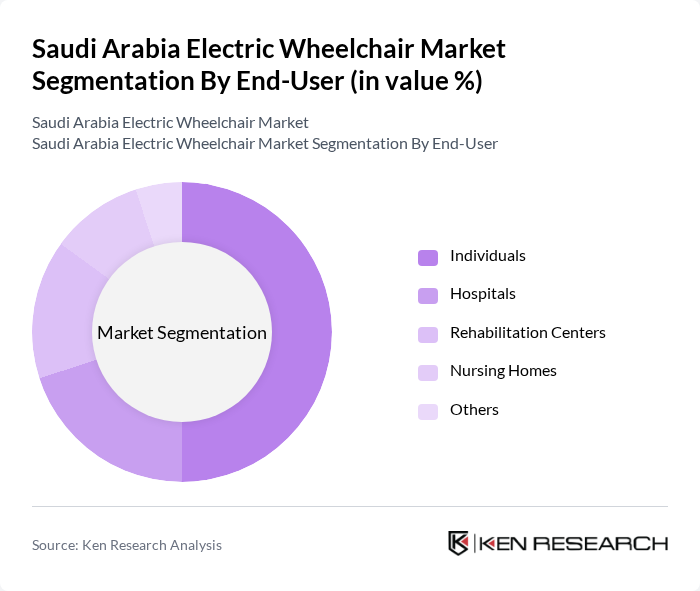

By End-User:The electric wheelchair market is segmented by end-users, including Individuals, Hospitals, Rehabilitation Centers, Nursing Homes, and Others. The individual segment holds the largest share, driven by the increasing number of elderly individuals and those with disabilities seeking mobility solutions. Hospitals and rehabilitation centers are also significant users, as they require electric wheelchairs for patient care and rehabilitation purposes. The growing trend of home healthcare is further boosting the demand in the individual segment.

The Saudi Arabia Electric Wheelchair Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sunrise Medical, Permobil, Invacare Corporation, Pride Mobility Products Corp., Drive Medical, Quantum Rehab, TGA Mobility, Karman Healthcare, Hoveround Corporation, Medline Industries, Ottobock, Numotion, Carex Health Brands, Graham Field Health Products, Seating Matters contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric wheelchair market in Saudi Arabia appears promising, driven by demographic shifts and technological innovations. As the elderly population continues to grow and awareness of disabilities increases, demand for electric wheelchairs is expected to rise. Additionally, advancements in technology will enhance product offerings, making them more appealing to consumers. The government's commitment to improving healthcare infrastructure will further support market expansion, ensuring that electric wheelchairs become more accessible to those in need.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Electric Wheelchairs Heavy-Duty Electric Wheelchairs Lightweight Electric Wheelchairs Folding Electric Wheelchairs All-Terrain Electric Wheelchairs Pediatric Electric Wheelchairs Others |

| By End-User | Individuals Hospitals Rehabilitation Centers Nursing Homes Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Battery-Powered Electric Wheelchairs Solar-Powered Electric Wheelchairs Hybrid Electric Wheelchairs Others |

| By Application | Indoor Use Outdoor Use Sports and Recreation Others |

| By Investment Source | Private Investment Government Funding Non-Profit Organizations Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 45 | Physiotherapists, Occupational Therapists |

| Wheelchair Users | 65 | Individuals with mobility impairments, Caregivers |

| Healthcare Policy Makers | 28 | Government Officials, NGO Representatives |

| Retailers and Distributors | 42 | Mobility Aid Retail Managers, Supply Chain Coordinators |

| Insurance Providers | 35 | Claims Adjusters, Policy Underwriters |

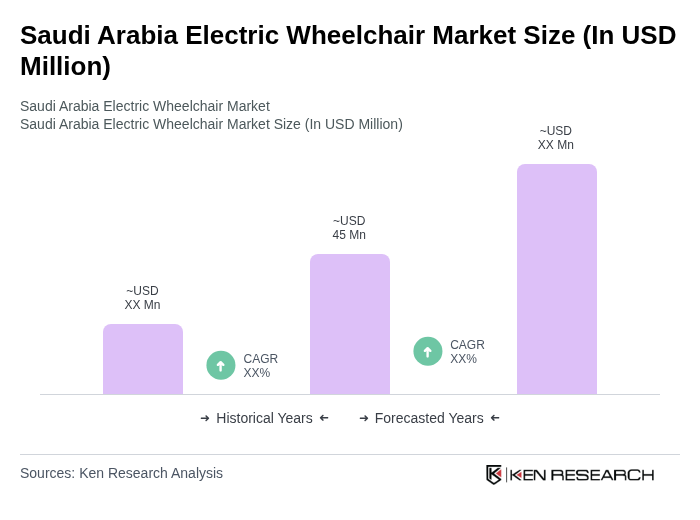

The Saudi Arabia Electric Wheelchair Market is valued at approximately USD 45 million, reflecting a significant growth trend driven by an increasing aging population, rising awareness of mobility solutions, and advancements in technology enhancing electric wheelchair functionality and comfort.