Region:Middle East

Author(s):Dev

Product Code:KRAC1965

Pages:84

Published On:October 2025

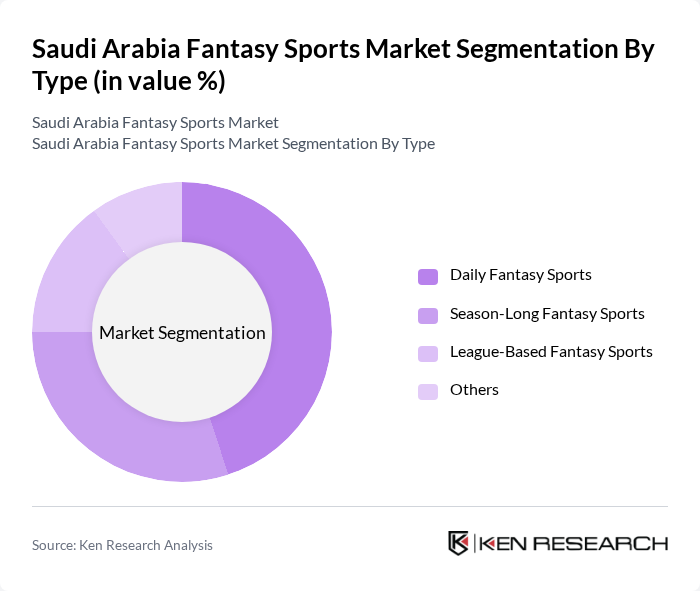

By Type:The segmentation by type includes Daily Fantasy Sports, Season-Long Fantasy Sports, League-Based Fantasy Sports, and Others. Daily Fantasy Sports has gained significant traction due to its fast-paced nature, appealing to users who prefer quick engagement and immediate results. Season-Long Fantasy Sports attracts dedicated fans who enjoy long-term strategy and commitment throughout entire sporting seasons. League-Based Fantasy Sports fosters community and competition among users, creating social engagement opportunities, while the 'Others' category includes niche offerings that cater to specific interests such as eSports fantasy leagues and individual sport competitions.

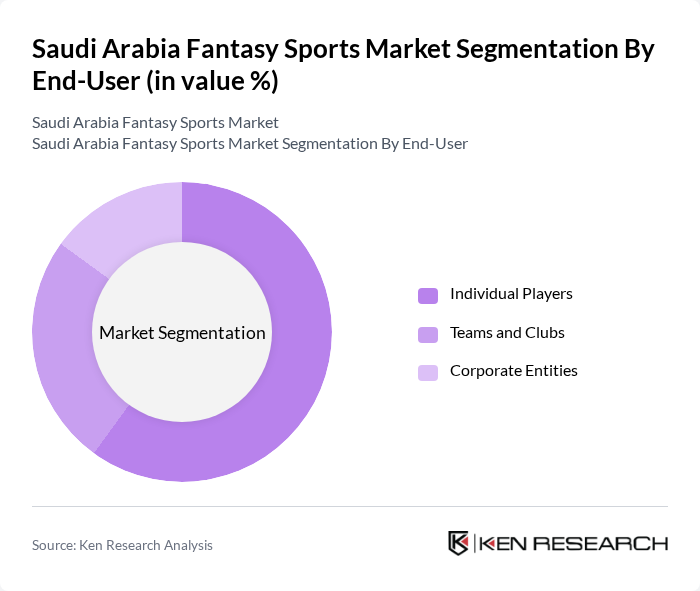

By End-User:The end-user segmentation includes Individual Players, Teams and Clubs, and Corporate Entities. Individual Players dominate the market as they represent the largest user base, driven by the desire for personal engagement and competition. Teams and Clubs leverage fantasy sports for fan engagement and marketing initiatives, utilizing these platforms to strengthen supporter connections and generate additional revenue streams. Corporate Entities utilize these platforms for team-building and employee engagement activities, recognizing the value of fantasy sports in fostering workplace camaraderie and competitive spirit.

The Saudi Arabia Fantasy Sports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dream Sports Group, FanDuel, DraftKings Inc., BetMakers Technology Group, SportRadar, Oulala Games, Scout Gaming Group, Khelraja, MyTeam11, Dream11, MPL (Mobile Premier League), 11Wickets, Fanfight, Howzat, BalleBaazi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia fantasy sports market appears promising, driven by technological advancements and a growing sports culture. As mobile platforms continue to expand, user engagement is expected to rise, particularly among younger demographics. Additionally, partnerships with local sports organizations can enhance credibility and attract a broader audience. The integration of innovative game formats and features will likely further stimulate interest, positioning the market for substantial growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Daily Fantasy Sports Season-Long Fantasy Sports League-Based Fantasy Sports Others |

| By End-User | Individual Players Teams and Clubs Corporate Entities |

| By Game Type | Football/Soccer Basketball Cricket Others (e.g., eSports, MMA) |

| By Platform | Mobile Applications Web-Based Platforms Social Media Integration |

| By Demographics | Age Groups (Under 25, 25-40, Above 40) Gender Income Levels |

| By Marketing Channel | Digital Marketing Traditional Advertising Sponsorships |

| By Payment Method | Credit/Debit Cards E-Wallets Bank Transfers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fantasy Sports Players | 120 | Active Users, Casual Gamers |

| Sports Enthusiasts | 90 | Fans of Major Sports Leagues, Event Attendees |

| Game Developers | 45 | Product Managers, Software Engineers |

| Marketing Professionals | 60 | Brand Managers, Digital Marketing Specialists |

| Regulatory Experts | 40 | Legal Advisors, Compliance Officers |

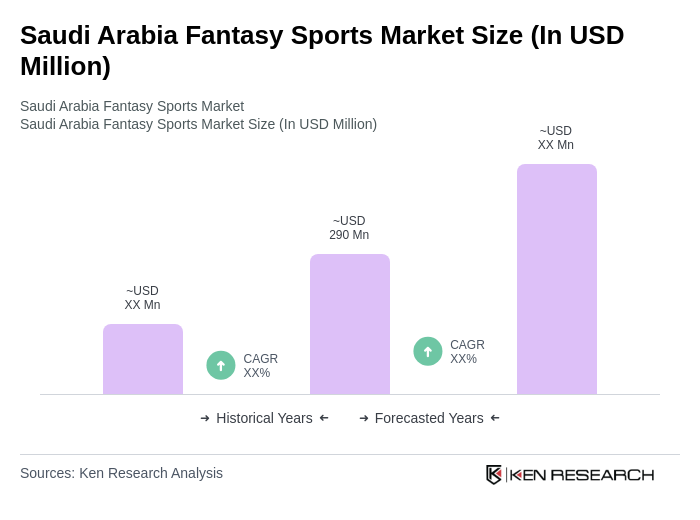

The Saudi Arabia Fantasy Sports Market is valued at approximately USD 290 million, reflecting significant growth driven by the increasing popularity of sports, particularly football and cricket, and the rise of digital platforms facilitating participation.