Region:Middle East

Author(s):Rebecca

Product Code:KRAA9418

Pages:96

Published On:November 2025

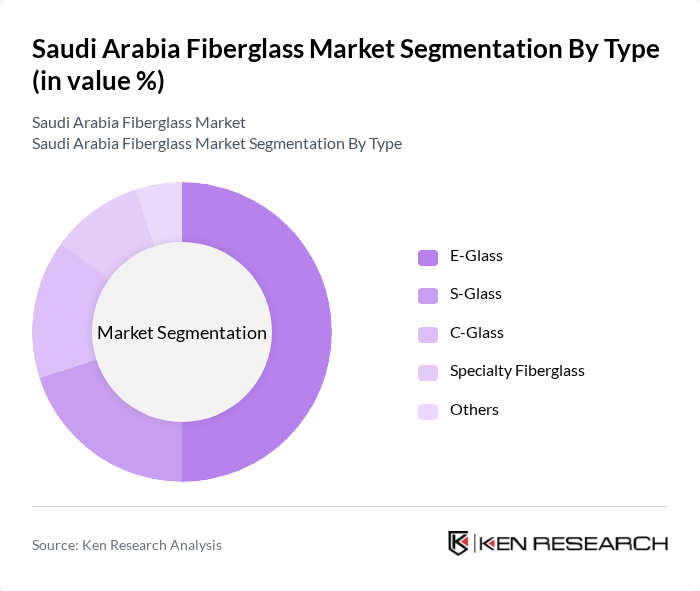

By Type:The fiberglass market can be segmented into various types, including E-Glass, S-Glass, C-Glass, Specialty Fiberglass, and Others. E-Glass is the most widely used type due to its excellent electrical insulation properties and cost-effectiveness, making it a preferred choice in construction and automotive applications. S-Glass, known for its high strength and thermal resistance, is gaining traction in aerospace and military applications. Specialty fiberglass caters to niche markets, providing tailored solutions for specific industrial needs.

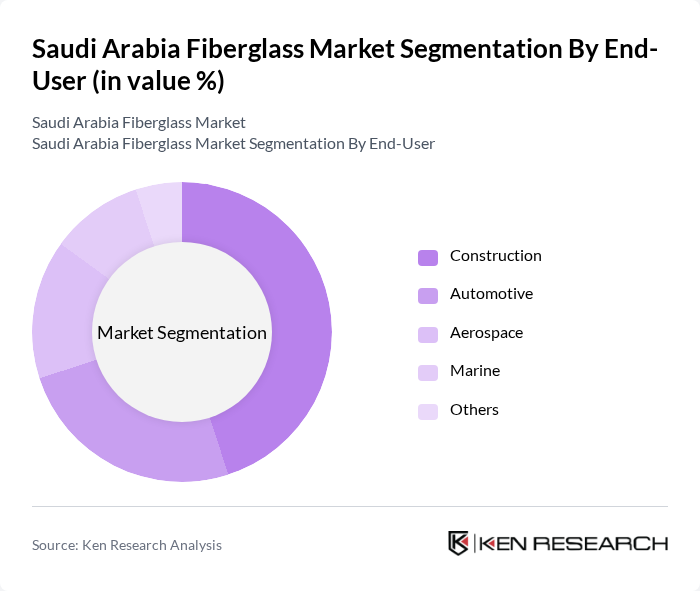

By End-User:The end-user segmentation includes Construction, Automotive, Aerospace, Marine, and Others. The construction sector is the largest consumer of fiberglass, driven by the increasing number of infrastructure projects and the demand for lightweight materials. The automotive industry is also a significant user, as manufacturers seek to enhance fuel efficiency and reduce vehicle weight. Aerospace and marine applications are growing, with fiberglass being favored for its strength-to-weight ratio and corrosion resistance. The wind energy sector is emerging as a fast-growing segment, supported by Saudi Arabia’s renewable energy initiatives .

The Saudi Arabia Fiberglass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Fiberglass Insulation Company, Jushi Group Co., Ltd., Owens Corning, Saint-Gobain, PPG Industries, Hexcel Corporation, Nippon Electric Glass Co., Ltd., AGY Holding Corp., Sika AG, Solvay S.A., Mitsubishi Chemical Corporation, Toray Industries, Inc., Teijin Limited, Johns Manville, Knauf Insulation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fiberglass market in Saudi Arabia appears promising, driven by ongoing investments in infrastructure and renewable energy. As the government continues to implement Vision 2030, the demand for fiberglass in construction and energy sectors is expected to rise. Additionally, advancements in production technologies will likely enhance the material's applications, making it more appealing to various industries. The focus on sustainability will further propel the market, as companies seek eco-friendly materials to meet regulatory standards and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | E-Glass S-Glass C-Glass Specialty Fiberglass Others |

| By End-User | Construction Automotive Aerospace Marine Others |

| By Application | Reinforcement Insulation Composites Coatings Others |

| By Manufacturing Process | Hand Lay-Up Spray-Up Pultrusion Filament Winding Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Applications | 120 | Project Managers, Procurement Officers |

| Automotive Industry Usage | 90 | Manufacturing Engineers, Quality Control Managers |

| Marine Fiberglass Applications | 60 | Boat Manufacturers, Marine Engineers |

| Insulation and Composites Market | 50 | Product Development Managers, R&D Specialists |

| Consumer Goods Sector | 40 | Marketing Managers, Supply Chain Analysts |

The Saudi Arabia Fiberglass Market is valued at approximately USD 1.05 billion, driven by increasing demand for lightweight and durable materials across various industries, particularly construction and automotive, as well as significant investments in infrastructure development.