Region:Middle East

Author(s):Shubham

Product Code:KRAB6167

Pages:82

Published On:October 2025

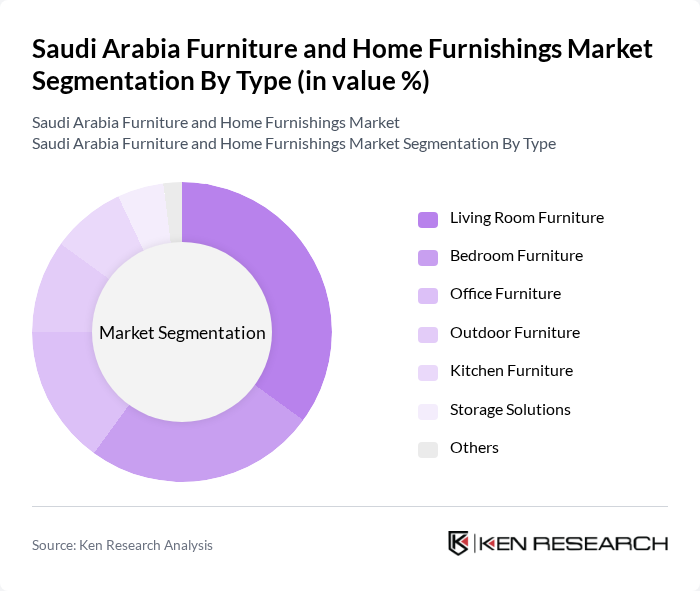

By Type:The furniture market in Saudi Arabia is diverse, encompassing various types of products that cater to different consumer needs. The living room furniture segment is particularly dominant, driven by the increasing focus on home aesthetics and comfort. Bedroom furniture follows closely, as consumers invest in personal spaces for relaxation. Office furniture is also gaining traction due to the rise of remote work and the need for functional home office setups. Outdoor furniture is becoming popular as more people seek to enhance their outdoor living spaces. Kitchen furniture and storage solutions are essential for maximizing space in homes, while other categories include niche products that cater to specific consumer preferences.

By End-User:The end-user segmentation of the furniture market in Saudi Arabia reveals a strong demand from residential consumers, who prioritize comfort and aesthetics in their homes. The commercial sector, including offices and retail spaces, is also a significant contributor, driven by the need for functional and stylish furniture solutions. The hospitality sector is witnessing growth as hotels and restaurants invest in high-quality furnishings to enhance guest experiences. Government projects are increasingly incorporating modern furniture designs, reflecting a shift towards contemporary styles in public spaces.

The Saudi Arabia Furniture and Home Furnishings Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Saudi Arabia, Al-Futtaim Group, Home Centre, Pan Emirates, Abdul Latif Jameel Home, Al-Muhaidib Group, Al-Hokair Group, Al-Nahdi Medical Company, Al-Jazira Furniture, Al-Mansour Furniture, Al-Suwaidi Group, Al-Rajhi Group, Al-Muhaidib Furniture, Al-Faisaliah Group, Al-Salam Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia furniture and home furnishings market is poised for significant growth, driven by urbanization, rising disposable incomes, and a booming real estate sector. As consumers increasingly seek quality and innovative designs, manufacturers will need to adapt to changing preferences. The integration of technology in furniture design and the demand for sustainable products will shape future offerings. Additionally, the expansion of e-commerce platforms will facilitate access to a broader customer base, enhancing market dynamics and competition.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Kitchen Furniture Storage Solutions Others |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Material | Wood Metal Plastic Fabric |

| By Design Style | Contemporary Traditional Rustic Industrial |

| By Functionality | Multi-functional Furniture Space-saving Solutions Customizable Options Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Furniture Sales | 150 | Store Managers, Sales Executives |

| Home Furnishings Manufacturing | 100 | Production Managers, Quality Control Supervisors |

| Consumer Preferences in Home Decor | 200 | Homeowners, Interior Designers |

| Online Furniture Retailing | 120 | E-commerce Managers, Digital Marketing Specialists |

| Market Trends and Innovations | 80 | Industry Analysts, Product Development Managers |

The Saudi Arabia Furniture and Home Furnishings Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and an increasing focus on home improvement and interior design.