South Africa Furniture and Home Furnishings Market Overview

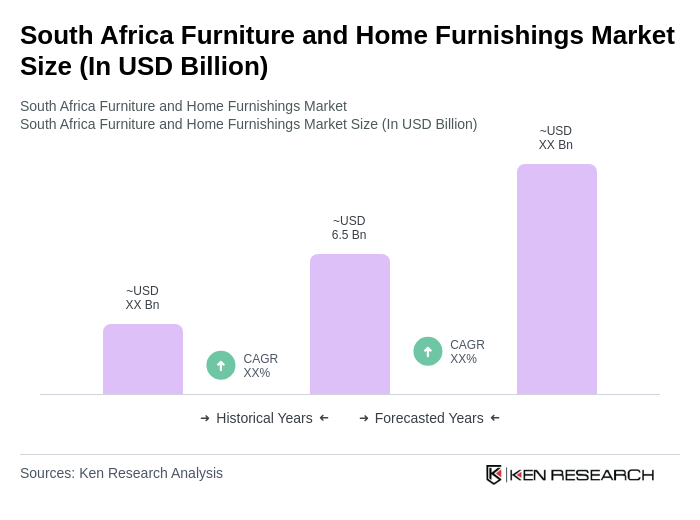

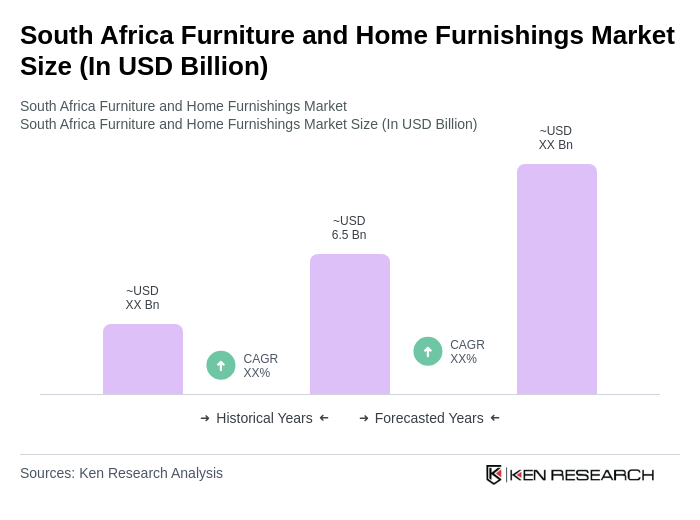

- The South Africa Furniture and Home Furnishings Market is valued at USD 6.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing trend towards home improvement, digital showrooms, and interior design. The market has seen a surge in demand for both residential and commercial furniture, with consumers showing a strong preference for sustainable, customizable, and space-efficient products. Notably, the indoor segment dominates, supported by the popularity of modular and multifunctional furniture, especially in urban households seeking to maximize limited space .

- Key cities such as Johannesburg, Cape Town, and Durban dominate the market due to their large populations and economic activities. Johannesburg, as the economic hub, has a high concentration of retail outlets and furniture manufacturers, while Cape Town attracts a significant number of tourists, boosting demand in the hospitality sector. Durban's strategic port location facilitates the import of raw materials and finished goods, further enhancing its market position .

- In 2023, the South African government implemented the Furniture Industry Development Programme, aimed at promoting local manufacturing and reducing reliance on imports. This initiative, under the oversight of the Department of Trade, Industry and Competition (dtic), is governed by the "Furniture Industry Master Plan, 2021" issued by the dtic. The programme includes financial incentives for manufacturers, support for small and medium enterprises (SMEs), and requirements for local content in public procurement, fostering innovation and sustainability within the industry .

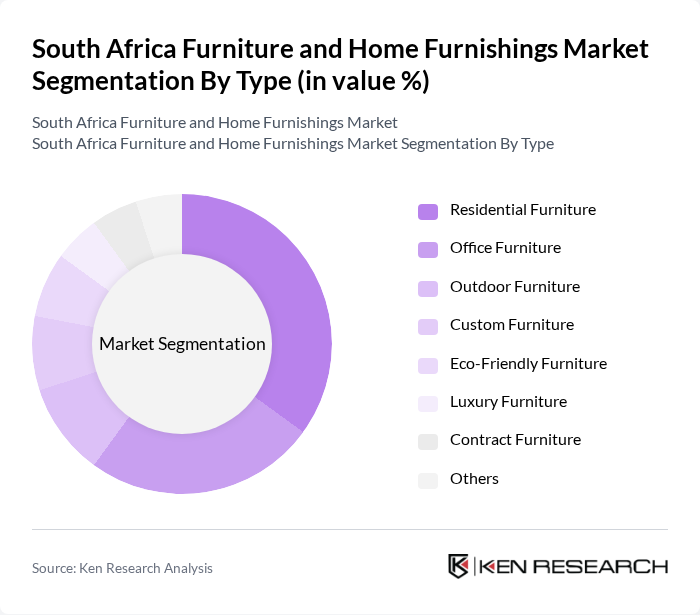

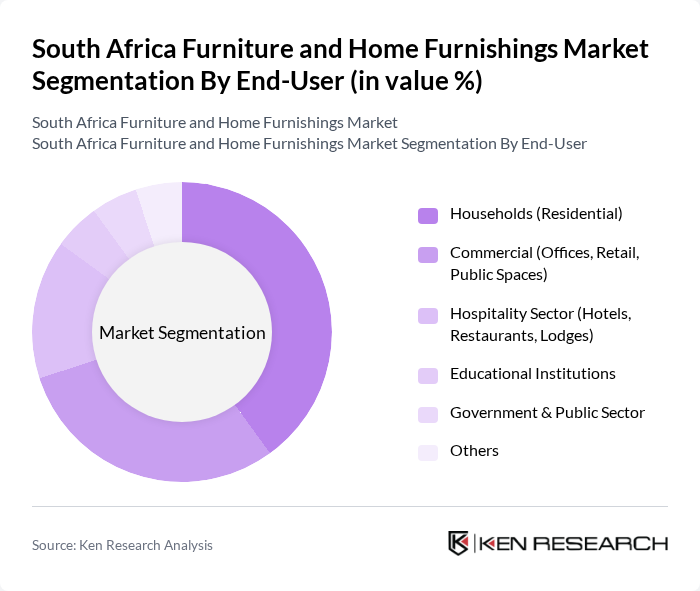

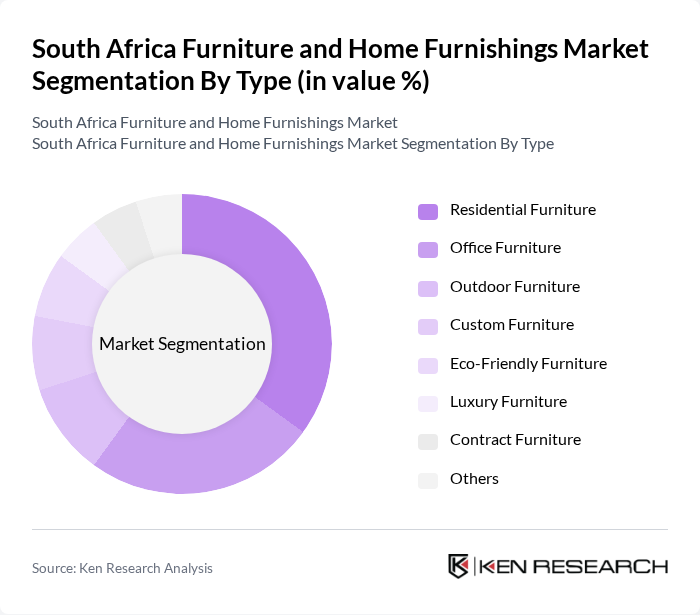

South Africa Furniture and Home Furnishings Market Segmentation

By Type:The market can be segmented into various types of furniture, including Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Eco-Friendly Furniture, Luxury Furniture, Contract Furniture, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse nature of the market. The indoor category, comprising living room, bedroom, and kitchen furniture, holds the largest share, driven by evolving home decoration trends and the demand for multifunctional and modular solutions .

By End-User:The end-user segmentation includes Households (Residential), Commercial (Offices, Retail, Public Spaces), Hospitality Sector (Hotels, Restaurants, Lodges), Educational Institutions, Government & Public Sector, and Others. This segmentation highlights the various applications of furniture across different sectors, catering to both individual and organizational needs. The residential segment leads, supported by the rise in homeownership and home improvement activities, while the commercial and hospitality sectors are expanding due to increased investments in office spaces and tourism infrastructure .

South Africa Furniture and Home Furnishings Market Competitive Landscape

The South Africa Furniture and Home Furnishings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Steinhoff International Holdings N.V., JD Group, Lewis Group Limited, Ellerines Holdings Limited, Coricraft, @Home, Weylandts, Mobelli Furniture + Living, Decofurn Factory Shop, Furniture City, Rochester Furniture, Dial-a-Bed, Bradlows, Russells, Boardmans contribute to innovation, geographic expansion, and service delivery in this space.

South Africa Furniture and Home Furnishings Market Industry Analysis

Growth Drivers

- Rising Urbanization:Urbanization in South Africa is accelerating, with the urban population projected to reach 60% in the future, up from 55% in the past. This shift is driving demand for furniture as urban dwellers seek to furnish smaller living spaces. The South African government has invested approximately ZAR 1.5 billion in urban development projects, enhancing infrastructure and housing, which further stimulates the furniture market. Increased urban living necessitates modern, space-efficient furniture solutions, propelling market growth.

- Increased Disposable Income:The average disposable income in South Africa is expected to rise to ZAR 30,000 per month in the future, reflecting a 10% increase from the past. This growth in disposable income allows consumers to allocate more funds towards home furnishings. As households experience improved financial conditions, spending on furniture and home decor is anticipated to increase significantly, with a projected rise in sales of ZAR 5 billion in the furniture sector, enhancing overall market dynamics.

- Growing E-commerce Adoption:E-commerce sales in South Africa are projected to reach ZAR 50 billion in the future, up from ZAR 30 billion in the past. This surge is driven by increased internet penetration, which is expected to hit 70% in the future. The convenience of online shopping is reshaping consumer behavior, leading to a significant rise in online furniture sales. Retailers are investing in digital platforms, enhancing customer experience, and expanding their reach, which is crucial for capturing the growing online market segment.

Market Challenges

- Economic Instability:South Africa's economy is projected to grow at a modest rate of 1.5% in the future, hindered by high unemployment rates, which currently stand at 34%. This economic uncertainty affects consumer confidence and spending power, leading to cautious purchasing behavior in the furniture market. Retailers may face declining sales as consumers prioritize essential goods over discretionary spending, creating a challenging environment for market growth.

- Supply Chain Disruptions:The South African furniture industry is grappling with ongoing supply chain disruptions, exacerbated by global events and local logistical challenges. Shipping costs have surged by 20% since the past, impacting the availability of raw materials. Additionally, delays in transportation and increased lead times are affecting production schedules. These disruptions can lead to inventory shortages, ultimately hindering sales and market expansion efforts in the furniture sector.

South Africa Furniture and Home Furnishings Market Future Outlook

The South African furniture market is poised for transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative, space-saving furniture will rise. Additionally, the integration of smart technology into furniture design is expected to gain traction, appealing to tech-savvy consumers. Retailers will need to adapt to these trends, focusing on sustainability and customization to meet the diverse needs of the market, ensuring resilience against economic fluctuations.

Market Opportunities

- Expansion of Online Retail:The rapid growth of e-commerce presents a significant opportunity for furniture retailers. In the future, online sales are expected to account for 25% of total furniture sales, driven by improved logistics and digital marketing strategies. Retailers can leverage this trend to reach a broader audience, enhance customer engagement, and increase sales through targeted online campaigns.

- Customization Trends:There is a growing demand for customized furniture solutions, with 40% of consumers expressing interest in personalized designs. This trend allows manufacturers to differentiate their offerings and cater to specific consumer preferences. By investing in customization capabilities, companies can enhance customer satisfaction and loyalty, ultimately driving sales growth in a competitive market landscape.