Region:Middle East

Author(s):Rebecca

Product Code:KRAD7551

Pages:85

Published On:December 2025

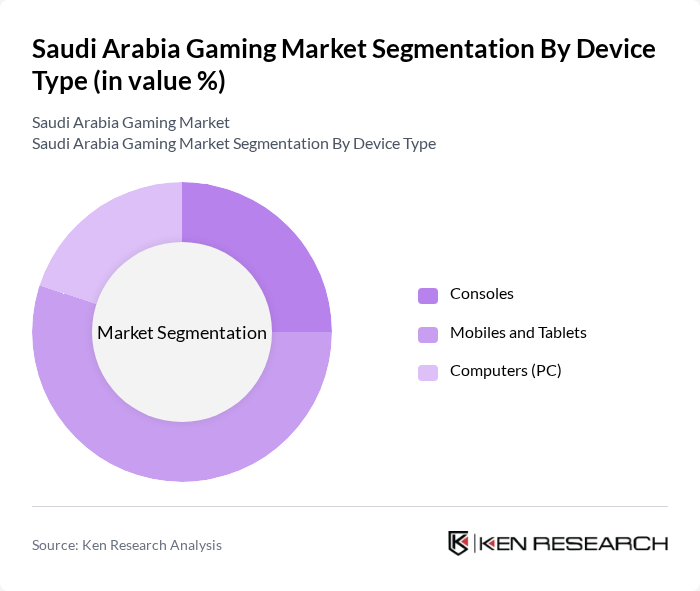

By Device Type:The gaming market in Saudi Arabia is segmented by device type into consoles, mobiles and tablets, and computers (PC). Among these, mobiles and tablets dominate the market due to their accessibility and the increasing number of mobile gamers. The convenience of mobile gaming, coupled with the availability of a wide range of games, has led to a significant rise in the number of users engaging in mobile gaming. Consoles and PCs also have a dedicated user base, particularly among competitive gamers and those seeking high-quality graphics and immersive experiences.

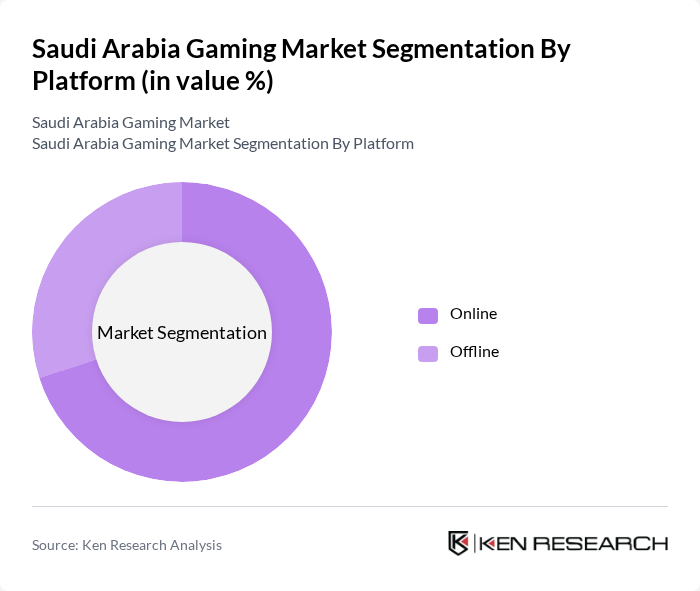

By Platform:The gaming market is also segmented by platform into online and offline gaming. Online gaming is the leading segment, driven by the increasing availability of high-speed internet and the popularity of multiplayer games. The rise of esports and online tournaments has further fueled this growth, attracting a large number of players and viewers. Offline gaming, while still relevant, is gradually declining as more gamers prefer the connectivity and social aspects of online platforms.

The Saudi Arabia Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Savvy Games Group, Saudi Esports Federation (SEF), Saudi Telecom Company (STC), MBC Group, NEOM (Gaming & Esports Initiatives), Amazon (Twitch), Riot Games, Electronic Arts (EA), Activision Blizzard, Sony Interactive Entertainment (PlayStation), Microsoft Gaming (Xbox), Tencent Games, NetEase Games, PUBG Corporation (KRAFTON), Zain KSA contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi gaming market is poised for significant transformation, driven by technological advancements and a growing consumer base. The integration of augmented reality (AR) and virtual reality (VR) technologies is expected to enhance gaming experiences, attracting more players. Additionally, the rise of subscription-based gaming services will likely reshape how consumers access games, promoting a shift towards digital consumption. As local developers gain support, the market will see increased innovation and a broader range of gaming options catering to diverse audiences.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Consoles Mobiles and Tablets Computers (PC) |

| By Platform | Online Offline |

| By Revenue Stream | In-Game Purchases Game Purchases (Premium / Paid Downloads) Advertising Subscription Services |

| By Game Type | Adventure / Role-Playing Games (RPG) Puzzles Social / Casual Games Strategy Simulation Sports and Racing Others |

| By Gamer Profile | Casual Gamers Competitive Gamers Professional Esports Players Game Developers / Creators |

| By Age Group | Children Teens / Youth Adults |

| By Region (Within Saudi Arabia) | Northern and Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah, Madinah) Eastern Region (incl. Dammam, Khobar, Dhahran) Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 120 | Casual Gamers, Mobile Game Developers |

| Console Gaming Enthusiasts | 100 | Console Gamers, Retail Managers |

| PC Gaming Community | 80 | PC Gamers, eSports Organizers |

| Game Development Sector | 60 | Game Designers, Marketing Executives |

| Gaming Influencers and Streamers | 50 | Content Creators, Social Media Managers |

The Saudi Arabia gaming market is valued at approximately USD 2.4 billion, driven by factors such as smartphone penetration, a young population, and government investments in gaming infrastructure and esports initiatives.