Region:Middle East

Author(s):Rebecca

Product Code:KRAA9420

Pages:99

Published On:November 2025

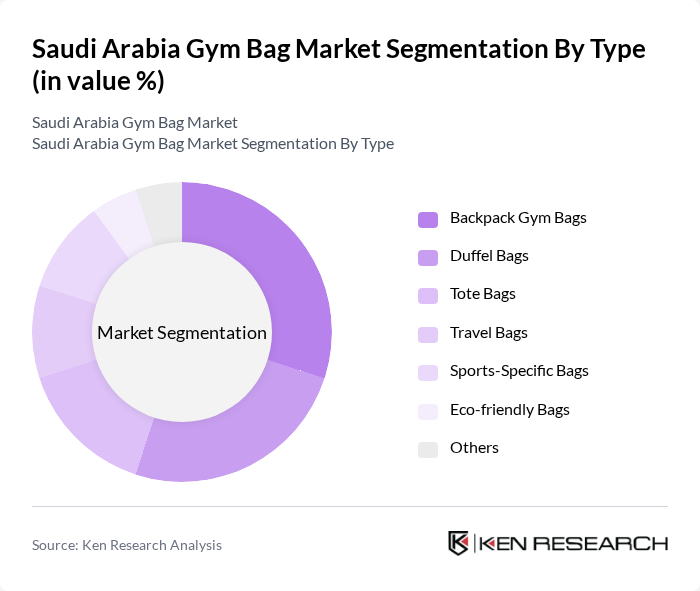

By Type:The market can be segmented into various types of gym bags, including Backpack Gym Bags, Duffel Bags, Tote Bags, Travel Bags, Sports-Specific Bags, Eco-friendly Bags, and Others. Each type serves different consumer needs and preferences, with specific designs and functionalities tailored for various activities.

The Backpack Gym Bags segment is currently dominating the market due to their versatility and convenience. They are favored by consumers for their ergonomic design, allowing for easy carrying and organization of gym essentials. The rise in outdoor activities and travel has also contributed to the popularity of this segment, as these bags can be used for various purposes beyond the gym. Additionally, the trend towards sustainable materials has led to an increase in eco-friendly backpack options, further enhancing their appeal .

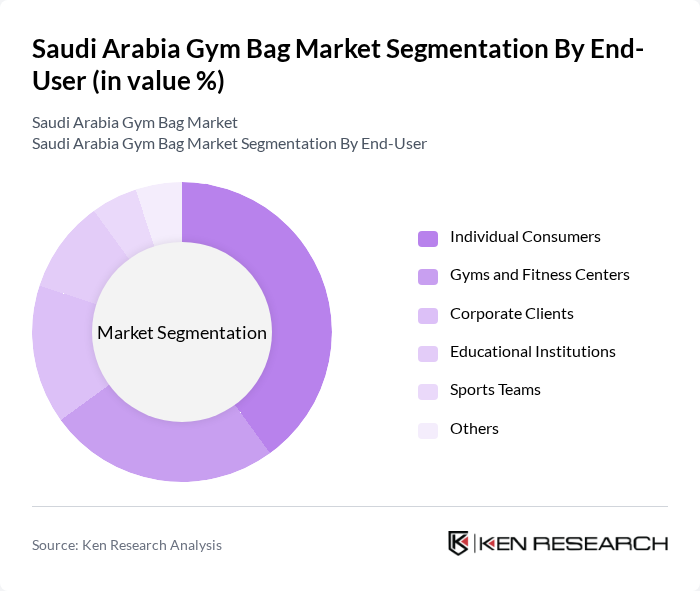

By End-User:The market can be segmented based on end-users, including Individual Consumers, Gyms and Fitness Centers, Corporate Clients, Educational Institutions, Sports Teams, and Others. Each segment has unique requirements and purchasing behaviors that influence the overall market dynamics.

The Individual Consumers segment leads the market, driven by the growing trend of fitness and wellness among the general population. As more individuals prioritize health and fitness, the demand for gym bags has surged. This segment is characterized by diverse consumer preferences, with many seeking stylish, functional, and affordable options. The increasing number of fitness enthusiasts and the rise of social media influencers promoting fitness lifestyles have further fueled the growth of this segment .

The Saudi Arabia Gym Bag Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike Inc., Adidas AG, Puma SE, Under Armour Inc., Decathlon SE, The North Face (VF Corporation), ASICS Corporation, New Balance Athletics Inc., Reebok International Ltd., Samsonite International SA, Antler Ltd., Delsey SA contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia gym bag market is poised for significant growth, driven by increasing health awareness and a burgeoning fitness culture. As more consumers prioritize fitness, the demand for gym bags will likely rise. Additionally, the integration of technology in gym bags, such as built-in charging ports and fitness tracking features, is expected to attract tech-savvy consumers. Brands that focus on sustainability and eco-friendly materials will also find a growing market segment, aligning with global trends towards responsible consumption.

| Segment | Sub-Segments |

|---|---|

| By Type | Backpack Gym Bags Duffel Bags Tote Bags Travel Bags Sports-Specific Bags Eco-friendly Bags Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Corporate Clients Educational Institutions Sports Teams Others |

| By Material | Polyester Nylon Canvas Leather Eco-friendly Materials Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Brand Positioning | Premium Brands Mid-tier Brands Budget Brands Others |

| By User Demographics | Age Group Gender Lifestyle Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Enthusiasts | 100 | Gym Members, Personal Trainers |

| Retail Sector Insights | 60 | Store Managers, Sales Representatives |

| Online Shoppers | 80 | E-commerce Users, Fitness Bloggers |

| Brand Loyalty Analysis | 50 | Brand Advocates, Regular Buyers |

| Market Trend Observers | 40 | Industry Analysts, Market Researchers |

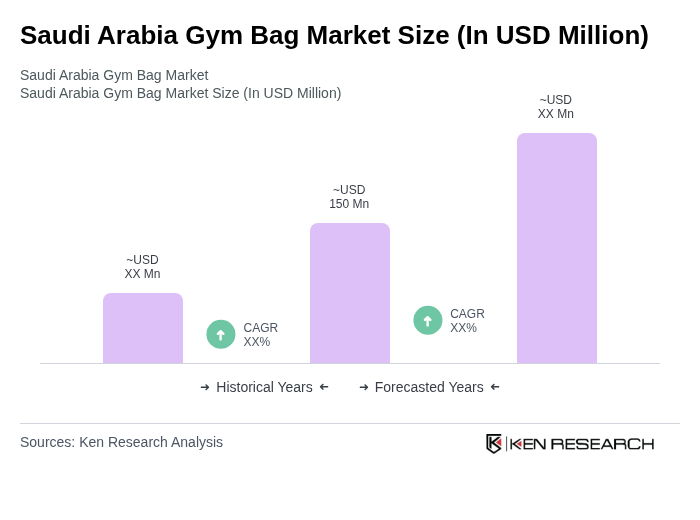

The Saudi Arabia Gym Bag Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing health consciousness and a rise in fitness activities among the population.