Region:Middle East

Author(s):Geetanshi

Product Code:KRAE4683

Pages:80

Published On:December 2025

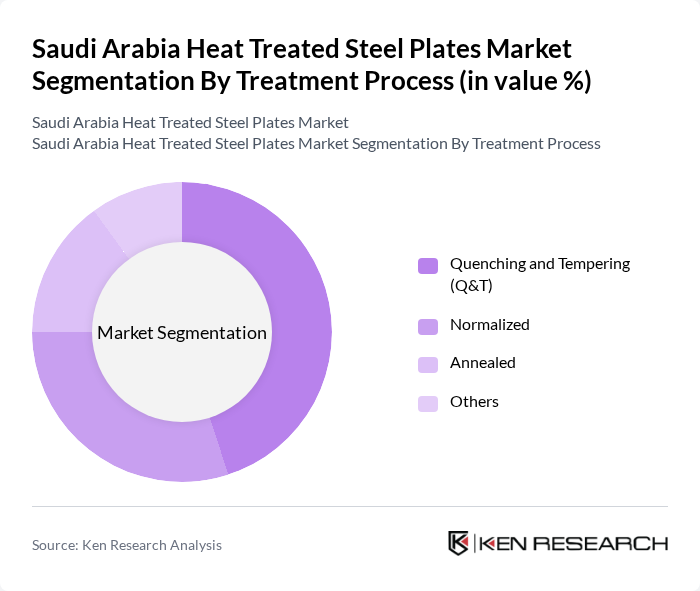

By Treatment Process:The treatment process of heat-treated steel plates is crucial as it determines the mechanical properties and performance of the steel. The primary treatment processes include Quenching and Tempering (Q&T), Normalized, Annealed, and Others. Among these, Quenching and Tempering (Q&T) is the most dominant due to its ability to enhance strength and toughness, making it suitable for various demanding applications.

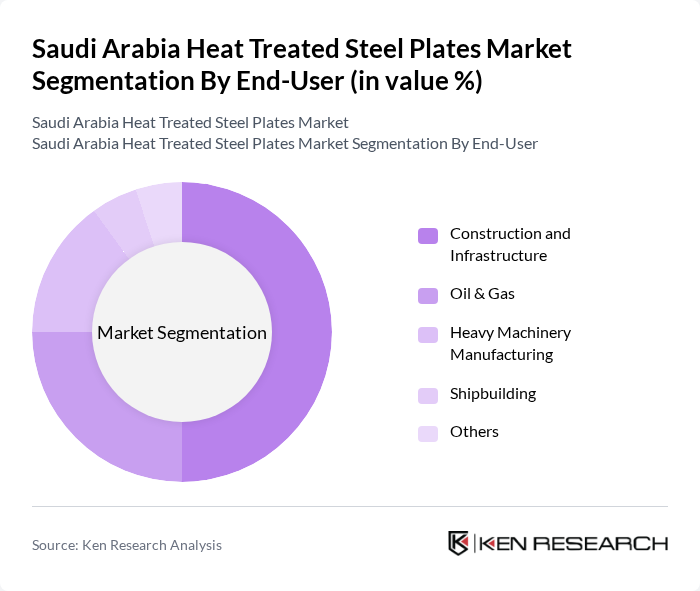

By End-User:The end-user segmentation highlights the various industries utilizing heat-treated steel plates, including Construction and Infrastructure, Oil & Gas, Heavy Machinery Manufacturing, Shipbuilding, and Others. The Construction and Infrastructure sector is the leading end-user, driven by ongoing large-scale projects and the need for robust materials that can withstand harsh conditions.

The Saudi Arabia Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Steel Pipe Company, Al-Rajhi Steel, Arabian Pipes Company, Hadeed (SABIC Affiliate), Al-Falak Steel, Zamil Steel, Al-Jazira Steel Products, United Gulf Steel Mill Company, Al-Muhaidib Group, Al-Babtain Group, Al-Khodari & Sons, Al-Mansoori Specialized Engineering, Al-Suwaidi Industrial Services, Al-Babtain Power & Telecommunication, Al-Faisal Holding contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia heat treated steel plates market appears promising, driven by ongoing investments in infrastructure and energy sectors. As the country continues to diversify its economy, the demand for high-quality steel products is expected to rise. Additionally, the integration of advanced manufacturing technologies and sustainable practices will likely enhance production efficiency. Companies that adapt to these trends and focus on innovation will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Treatment Process | Quenching and Tempering (Q&T) Normalized Annealed Others |

| By End-User | Construction and Infrastructure Oil & Gas Heavy Machinery Manufacturing Shipbuilding Others |

| By Application | Pressure Vessels Structural Components Heavy Equipment Others |

| By Thickness | <20mm 50mm >50mm Others |

| By Grade | High Strength Low Alloy (HSLA) Wear Resistant Armox/Quardian Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Procurement | 100 | Procurement Managers, Project Directors |

| Manufacturing Industry Usage | 80 | Operations Managers, Production Supervisors |

| Automotive Industry Applications | 70 | Design Engineers, Supply Chain Managers |

| Infrastructure Development Projects | 90 | Project Managers, Civil Engineers |

| Steel Distribution Channels | 60 | Sales Managers, Distribution Coordinators |

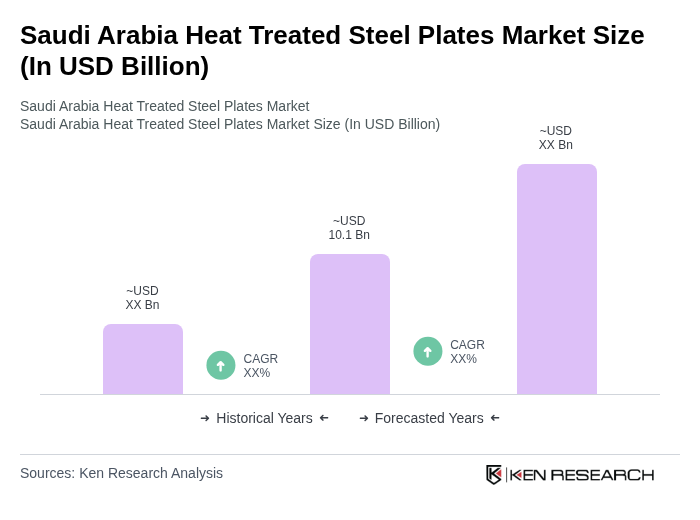

The Saudi Arabia Heat Treated Steel Plates Market is valued at approximately USD 10.1 billion, reflecting a robust growth trajectory driven by increasing demand in construction, oil and gas, and heavy machinery sectors.