Region:Middle East

Author(s):Geetanshi

Product Code:KRAE4685

Pages:116

Published On:December 2025

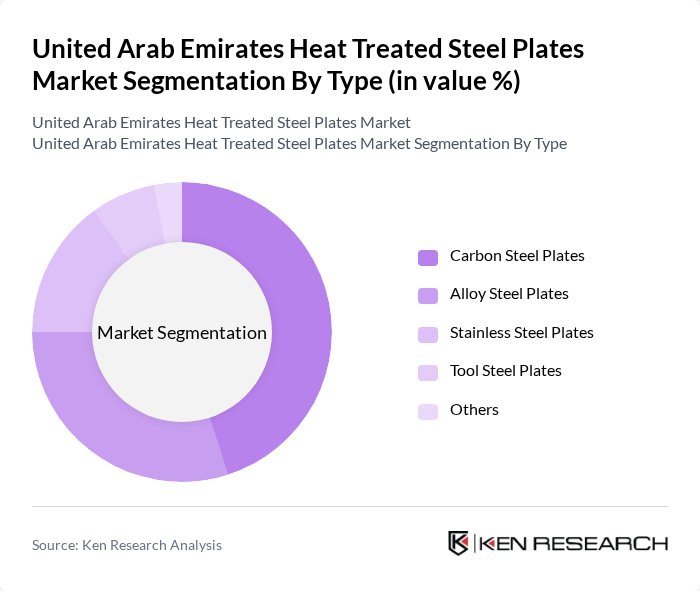

By Type:The market is segmented into various types of heat treated steel plates, including Carbon Steel Plates, Alloy Steel Plates, Stainless Steel Plates, Tool Steel Plates, and Others. Each type serves different applications and industries, with specific characteristics that cater to diverse customer needs.

The Carbon Steel Plates segment is the leading sub-segment in the market, primarily due to its widespread use in construction and heavy machinery applications. The durability and cost-effectiveness of carbon steel make it a preferred choice among manufacturers and builders. Additionally, the growing trend towards infrastructure development in the UAE has further solidified its dominance, as carbon steel plates are essential for structural integrity in various projects.

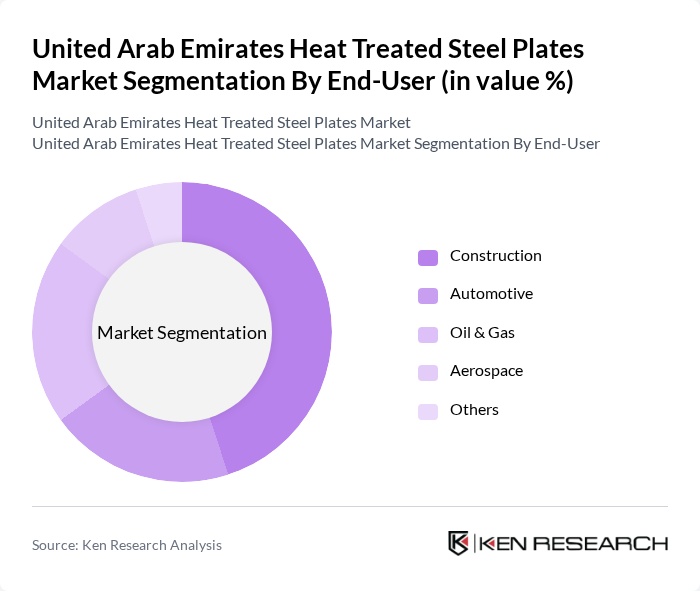

By End-User:The market is segmented based on end-users, including Construction, Automotive, Oil & Gas, Aerospace, and Others. Each end-user category has distinct requirements and applications for heat treated steel plates, influencing market dynamics.

The Construction sector is the dominant end-user of heat treated steel plates, accounting for a significant portion of the market. This is largely due to the ongoing infrastructure projects and urban development initiatives in the UAE, which require high-strength materials for structural applications. The automotive and oil & gas sectors also contribute to the demand, but the construction industry remains the primary driver of growth in this segment.

The United Arab Emirates Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Steel, Al Ghurair Iron & Steel, Conares, AISC Steel, AECOM, Jindal Steel & Power, Qatar Steel, Al-Futtaim Engineering, Gulf Steel Works, National Steel Industry, Abu Dhabi Steel, Al Jazeera Steel Products, United Steel Industries, Sharjah Steel, Al Ain Steel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE heat treated steel plates market appears promising, driven by ongoing investments in infrastructure and industrial growth. As the government continues to prioritize sustainable development, manufacturers are likely to adopt eco-friendly practices and advanced technologies. Additionally, the integration of automation and digitalization in production processes will enhance efficiency and reduce costs. These trends indicate a robust market environment, fostering innovation and competitiveness among local players while addressing emerging consumer demands for high-quality, sustainable products.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbon Steel Plates Alloy Steel Plates Stainless Steel Plates Tool Steel Plates Others |

| By End-User | Construction Automotive Oil & Gas Aerospace Others |

| By Application | Structural Applications Pressure Vessels Heavy Machinery Marine Applications Others |

| By Thickness | Thin Plates Medium Plates Thick Plates Others |

| By Treatment Type | Quenching Tempering Annealing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Demand | 120 | Project Managers, Procurement Officers |

| Manufacturing Applications | 100 | Operations Managers, Quality Control Engineers |

| Oil & Gas Industry Usage | 80 | Supply Chain Managers, Engineering Leads |

| Distribution Channels Analysis | 70 | Sales Managers, Logistics Coordinators |

| Market Trends and Insights | 90 | Industry Analysts, Market Researchers |

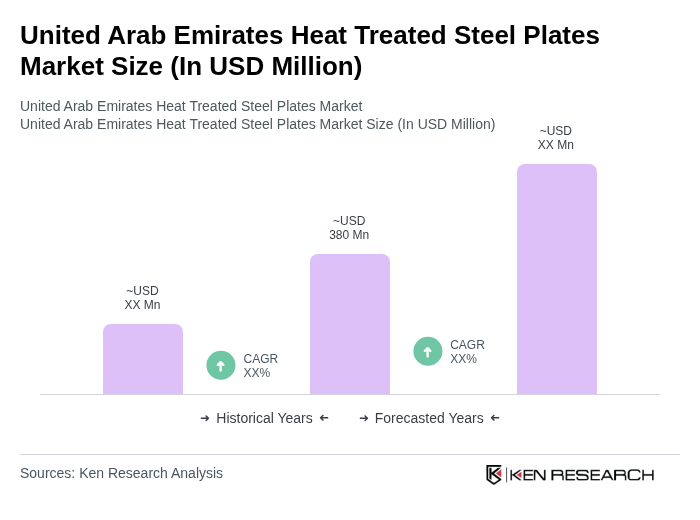

The United Arab Emirates Heat Treated Steel Plates market is valued at approximately USD 380 million, reflecting a robust growth trajectory driven by increasing demand across construction, automotive, and oil & gas sectors, alongside significant infrastructure investments.