Region:Asia

Author(s):Geetanshi

Product Code:KRAE4686

Pages:83

Published On:December 2025

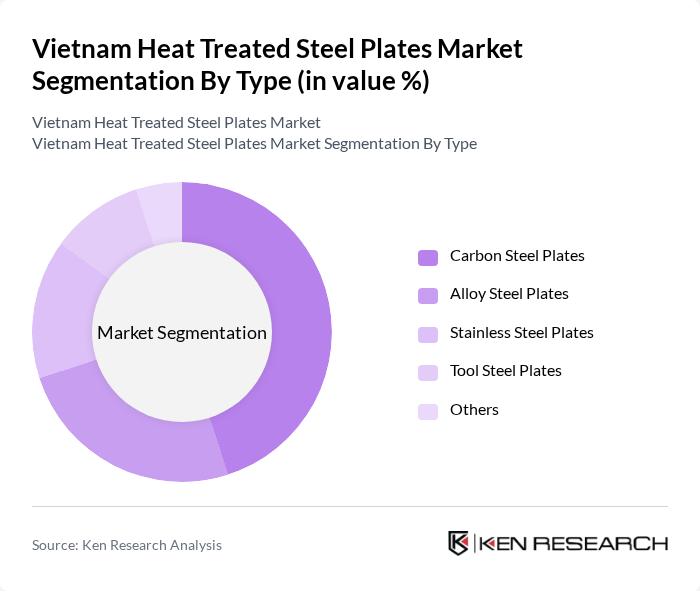

By Type:The market is segmented into various types of heat-treated steel plates, including Carbon Steel Plates, Alloy Steel Plates, Stainless Steel Plates, Tool Steel Plates, and Others. Among these, Carbon Steel Plates are the most widely used due to their versatility and cost-effectiveness, making them a preferred choice in construction and manufacturing sectors. Alloy Steel Plates are also gaining traction due to their enhanced properties, which are essential for high-stress applications in heavy machinery and renewable energy structures.

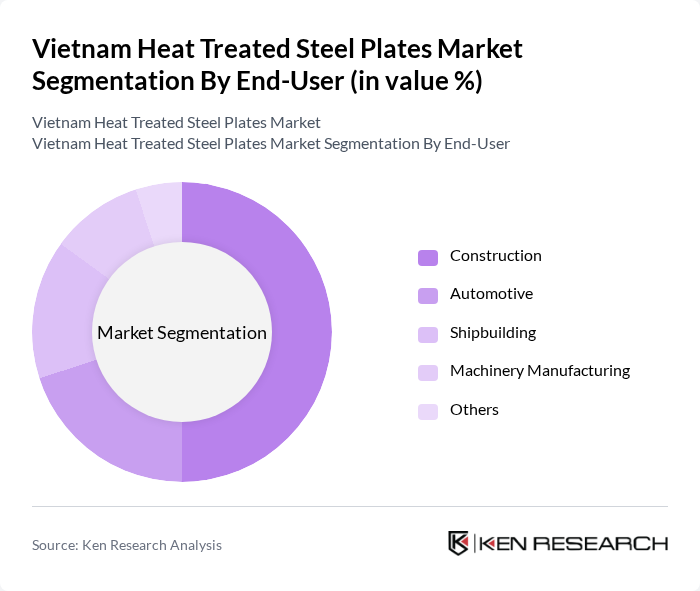

By End-User:The end-user segmentation includes Construction, Automotive, Shipbuilding, Machinery Manufacturing, and Others. The construction sector is the leading end-user, driven by ongoing infrastructure projects and urban development. The automotive industry also plays a significant role, as heat-treated steel plates are essential for manufacturing durable vehicle components. Shipbuilding is another critical sector, particularly in coastal regions where demand for marine vessels is high, alongside growing energy and power applications in offshore wind and heavy machinery.

The Vietnam Heat Treated Steel Plates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hoa Phat Group, Formosa Ha Tinh Steel Corporation, Vietnam Steel Corporation, POSCO Vietnam, Thang Long Steel, Nam Kim Steel, Tisco Steel, Dai Duong Steel, VNSteel, Southern Steel Corporation, Hoa Sen Group, SMC Investment Trading Company, Viet Han Steel, An Phat Holdings, Tien Len Steel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam heat-treated steel plates market appears promising, driven by ongoing infrastructure projects and a robust automotive sector. As the government continues to invest in modernization, demand for high-strength steel plates is expected to rise. Additionally, technological advancements will likely enhance production efficiency, allowing manufacturers to offer customized solutions. Sustainability initiatives will also play a crucial role, as companies increasingly adopt eco-friendly practices to meet regulatory requirements and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbon Steel Plates Alloy Steel Plates Stainless Steel Plates Tool Steel Plates Others |

| By End-User | Construction Automotive Shipbuilding Machinery Manufacturing Others |

| By Application | Structural Applications Pressure Vessels Heavy Equipment Oil & Gas Industry Others |

| By Thickness | Thin Plates Medium Plates Thick Plates Others |

| By Surface Treatment | Hot Rolled Cold Rolled Coated Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Demand | 100 | Project Managers, Procurement Officers |

| Automotive Manufacturing Needs | 80 | Production Supervisors, Quality Control Managers |

| Machinery and Equipment Applications | 70 | Design Engineers, Operations Managers |

| Export Market Insights | 60 | Export Managers, Trade Analysts |

| Research and Development Perspectives | 50 | R&D Directors, Process Engineers |

The Vietnam Heat Treated Steel Plates market is valued at approximately USD 150 million, driven by increasing demand from sectors such as construction, automotive, and shipbuilding, alongside rapid industrialization and urbanization in the country.