Region:Middle East

Author(s):Rebecca

Product Code:KRAC2553

Pages:94

Published On:October 2025

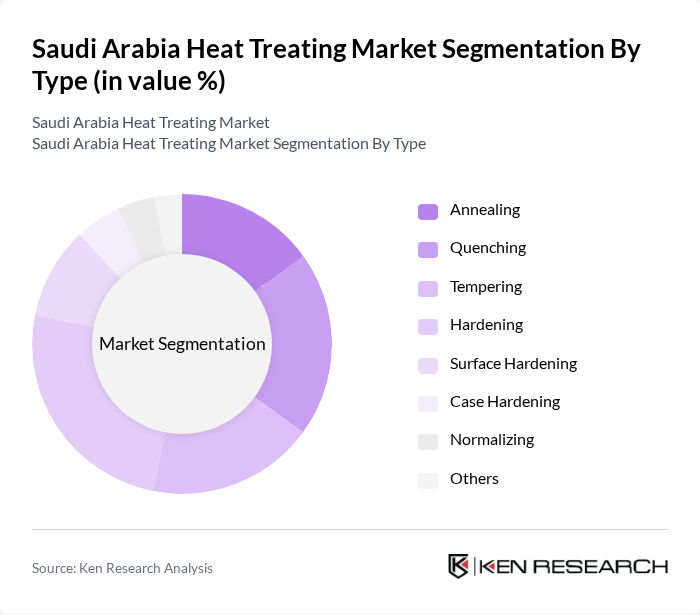

By Type:The heat treating market is segmented into annealing, quenching, tempering, hardening, surface hardening, case hardening, normalizing, and others. Each process is designed to modify specific mechanical properties—such as hardness, ductility, and toughness—tailoring materials for diverse industrial applications. Annealing improves ductility and relieves internal stresses; quenching increases hardness; tempering balances hardness and toughness; hardening maximizes strength; surface and case hardening enhance wear resistance; normalizing refines grain structure; and other specialized treatments address unique requirements in niche sectors .

The hardening process remains the dominant segment in the Saudi Arabia heat treating market, reflecting its essential role in boosting material strength and durability for demanding applications. Automotive and aerospace manufacturers are major consumers of hardened components, leveraging these processes to meet stringent safety and performance standards. The ongoing shift toward lightweight and high-strength alloys in vehicle and aircraft production further amplifies demand for advanced hardening techniques .

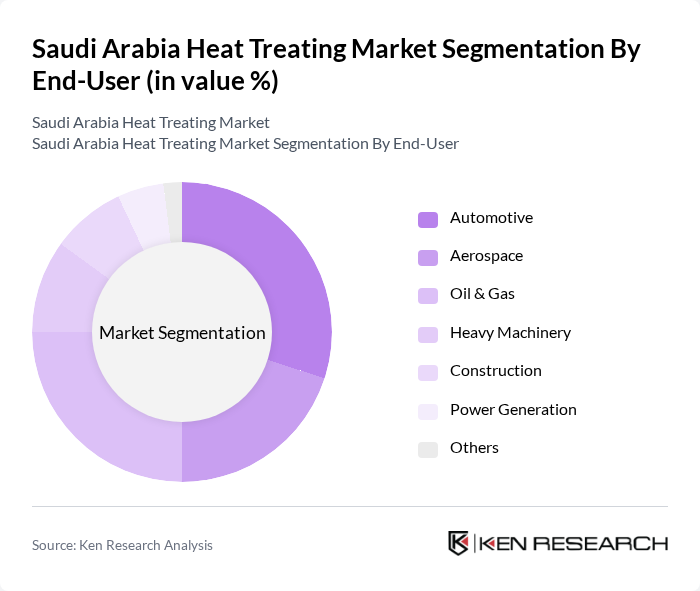

By End-User:The heat treating market is segmented by end-user industries, including automotive, aerospace, oil & gas, heavy machinery, construction, power generation, and others. Each sector requires tailored heat treatment solutions to optimize material performance under specific operational conditions. Automotive manufacturers prioritize fatigue resistance and lightweight construction; aerospace companies demand precision and reliability; the oil & gas sector focuses on corrosion resistance and high-pressure tolerance; heavy machinery and construction require robust, wear-resistant parts; and power generation emphasizes thermal stability and longevity .

The automotive sector leads the Saudi Arabia heat treating market, driven by rising vehicle production and the need for high-strength, lightweight components. The sector’s focus on advanced alloys and precision engineering has increased demand for specialized heat treatment services. Aerospace and oil & gas industries also play significant roles, requiring heat-treated materials that meet rigorous safety and efficiency standards, particularly for critical infrastructure and exploration equipment .

The Saudi Arabia Heat Treating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Heat Treatment Co. (SHTCO), Bodycote plc, Al-Falak Heat Treating, Gulf Heat Treatment, Nabertherm GmbH, Carbolite Gero Ltd., Al-Jazira Heat Treatment, National Industrialization Company (Tasnee), Saudi Arabian Oil Company (Saudi Aramco), Al-Rajhi Steel, Al-Suwaidi Industrial Services Co. Ltd., Zamil Industrial Investment Co., Al-Babtain Group, Arabian International Company for Steel Structures (AIC Steel), Al-Khodari & Sons contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia heat treating market is poised for significant growth, driven by increasing demand from the automotive sector and advancements in manufacturing capabilities. As companies invest in energy-efficient technologies and automation, the market is expected to evolve, focusing on sustainability and operational efficiency. Additionally, the integration of Industry 4.0 technologies will enhance process optimization, leading to improved product quality and reduced costs. Overall, the market is set to adapt to emerging trends while addressing existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Annealing Quenching Tempering Hardening Surface Hardening Case Hardening Normalizing Others |

| By End-User | Automotive Aerospace Oil & Gas Heavy Machinery Construction Power Generation Others |

| By Application | Tool Manufacturing Component Production Repair & Maintenance Services Metalworking Others |

| By Material Type | Steel Cast Iron Aluminum Titanium Others |

| By Service Type | Contract Heat Treating In-House Heat Treating Others |

| By Equipment Type | Electrically Heated Furnaces Gas-Fired Furnaces Induction Heating Systems Ovens & Kilns Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Heat Treatment Processes | 100 | Manufacturing Engineers, Quality Control Managers |

| Aerospace Component Treatment | 80 | Production Managers, Aerospace Engineers |

| Construction Material Heat Treatment | 70 | Procurement Managers, Operations Supervisors |

| Industrial Equipment Heat Treatment | 90 | Plant Managers, Technical Directors |

| Research & Development in Heat Treatment | 40 | R&D Managers, Process Engineers |

The Saudi Arabia Heat Treating Market is valued at approximately USD 290 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for heat-treated components across various industries, including automotive, aerospace, and oil & gas.