Region:Middle East

Author(s):Dev

Product Code:KRAA9556

Pages:84

Published On:November 2025

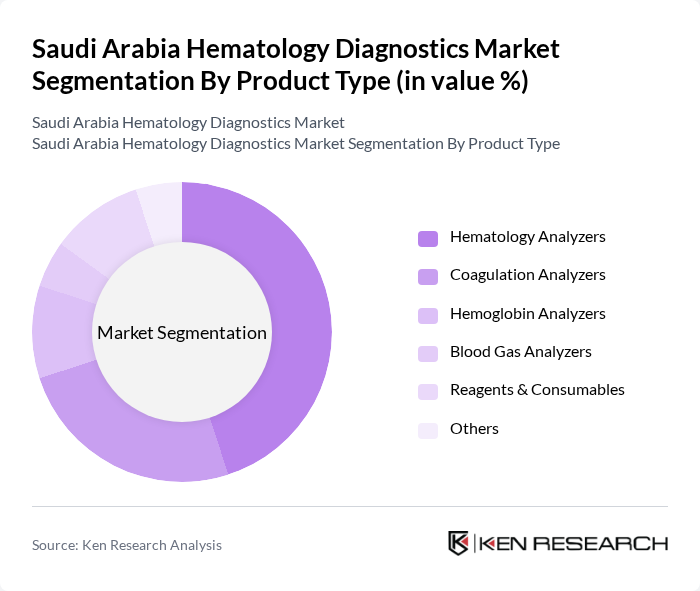

By Product Type:The product type segmentation includes various categories such as Hematology Analyzers, Coagulation Analyzers, Hemoglobin Analyzers, Blood Gas Analyzers, Reagents & Consumables, and Others. Among these,Hematology Analyzersdominate the market due to their essential role in performing complete blood counts and other critical tests. The increasing demand for automated and efficient diagnostic solutions drives the growth of this segment, as healthcare providers seek to enhance operational efficiency and patient care. Modern hematology analyzers now incorporate multi-parameter testing, digital imaging, and automated data reporting, further strengthening their market position.

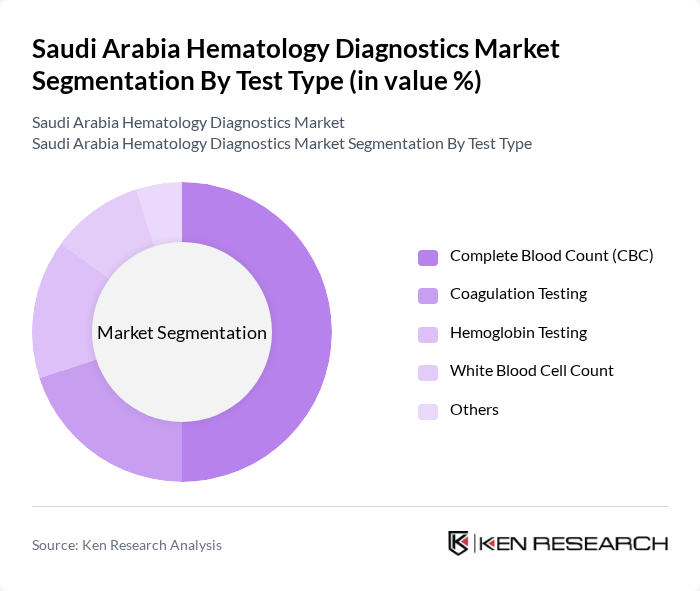

By Test Type:The test type segmentation encompasses Complete Blood Count (CBC), Coagulation Testing, Hemoglobin Testing, White Blood Cell Count, and Others. TheComplete Blood Count (CBC)test is the most widely performed hematology test, driving significant demand in the market. Its ability to provide comprehensive information about a patient's blood health makes it indispensable in clinical settings, leading to its dominance in the overall test type segmentation. CBC and coagulation testing are increasingly utilized in both inpatient and outpatient settings, supported by automation and digital integration in laboratory workflows.

The Saudi Arabia Hematology Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Beckman Coulter, Sysmex Corporation, Ortho Clinical Diagnostics, Mindray Medical International, HORIBA Medical, Bio-Rad Laboratories, Thermo Fisher Scientific, Becton, Dickinson and Company, Agilent Technologies, Grifols S.A., DiaSorin S.p.A., QIAGEN N.V., Al-Farabi Medical Laboratories, Alfa Medical Laboratories, MDLAB (Medical Diagnostic Laboratories), Ro’ya Specialized Medical Laboratories contribute to innovation, geographic expansion, and service delivery in this space. Strategic partnerships among diagnostic companies, hospitals, and research institutes are accelerating product innovation and adoption in hematology diagnostics.

The future of the hematology diagnostics market in Saudi Arabia appears promising, driven by ongoing advancements in technology and increased healthcare investments. The integration of artificial intelligence and telemedicine is expected to enhance diagnostic accuracy and accessibility, particularly in underserved areas. Furthermore, the government's commitment to improving healthcare infrastructure will likely facilitate the expansion of diagnostic services, ensuring that more patients receive timely and effective care for blood disorders, ultimately fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hematology Analyzers Coagulation Analyzers Hemoglobin Analyzers Blood Gas Analyzers Reagents & Consumables Others |

| By Test Type | Complete Blood Count (CBC) Coagulation Testing Hemoglobin Testing White Blood Cell Count Others |

| By Technology | Flow Cytometry Spectrophotometry Microscopy Immunoassays Molecular Diagnostics Others |

| By Application | Disease Diagnosis Blood Screening Transfusion Medicine Oncology Clinical Research Others |

| By End-User | Hospitals Diagnostic Laboratories Blood Banks Research & Academic Institutes Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region (Riyadh, Qassim, Hail) Eastern Region (Dammam, Al Khobar) Western Region (Jeddah, Mecca, Medina, Taif) Southern Region (Abha, Najran, Jizan) Northern Region (Tabuk, Arar, Sakaka) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Hematology Departments | 60 | Hematologists, Laboratory Technicians |

| Diagnostic Laboratories | 50 | Laboratory Managers, Quality Control Officers |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Managers |

| Patient Advocacy Groups | 40 | Patient Representatives, Community Health Workers |

The Saudi Arabia Hematology Diagnostics Market is valued at approximately USD 18 million, driven by the increasing prevalence of blood disorders and advancements in diagnostic technologies, including AI-based blood analysis and automated hematology systems.