Region:Middle East

Author(s):Dev

Product Code:KRAD5315

Pages:98

Published On:December 2025

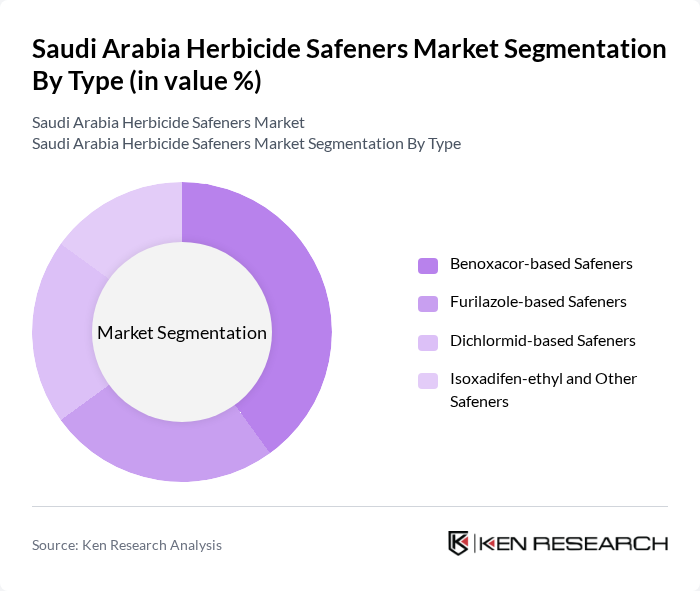

By Type:The market is segmented into four main types of herbicide safeners: Benoxacor-based Safeners, Furilazole-based Safeners, Dichlormid-based Safeners, and Isoxadifen-ethyl and Other Safeners. These active ingredients are widely recognized in global herbicide safener use, particularly in maize, sorghum, and cereal crops, where they are co-formulated with chloroacetanilide and sulfonylurea herbicides to reduce crop phytotoxicity. Among these, Benoxacor-based Safeners are typically prominent in global usage because they are frequently combined with S-metolachlor and atrazine, providing effective crop protection while maintaining weed control efficacy. The increasing use of these safeners in cereal and forage crops is driven by their compatibility with a wide range of pre-emergence and early post-emergence herbicides, making them a preferred choice for farmers seeking to balance yield protection and weed management.

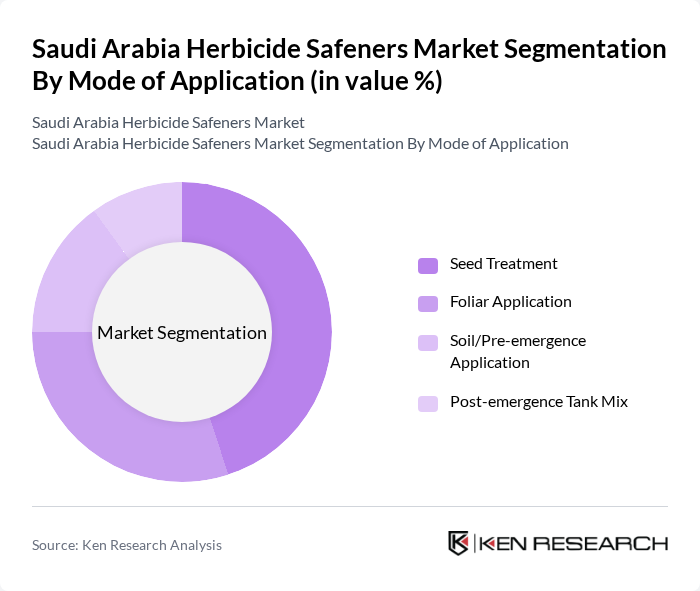

By Mode of Application:The market is segmented based on the mode of application into Seed Treatment, Foliar Application, Soil/Pre-emergence Application, and Post-emergence Tank Mix. Seed Treatment is a major mode of application globally for safeners because treating seed with safener–herbicide combinations can protect emerging seedlings from early-season herbicide injury and support uniform establishment. This method is increasingly favored by farmers in intensively managed cereal and forage systems due to its operational convenience, precise dosing, and ability to support higher herbicide efficacy while safeguarding crop vigor and yield potential.

The Saudi Arabia Herbicide Safeners Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation (UPL Corporation Limited), Helm AG, Albaugh, LLC, Saudi Arabian Fertilizer Company (SAFCO), Saudi Agricultural and Livestock Investment Company (SALIC), Saudi Agricultural Bank (Saudi Agricultural Development Fund) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia herbicide safeners market is poised for significant transformation as it adapts to evolving agricultural practices and consumer preferences. With the increasing adoption of precision agriculture and integrated pest management, the demand for innovative herbicide safeners is expected to rise. Additionally, the government's commitment to sustainable farming will likely drive investments in research and development, fostering a more resilient agricultural sector that prioritizes environmental safety and productivity.

| Segment | Sub-Segments |

|---|---|

| By Type | Benoxacor-based Safeners Furilazole-based Safeners Dichlormid-based Safeners Isoxadifen-ethyl and Other Safeners |

| By Mode of Application | Seed Treatment Foliar Application Soil/Pre-emergence Application Post-emergence Tank Mix |

| By Crop Type | Cereals & Grains (Wheat, Barley, Maize) Fruits & Vegetables Forage & Fodder Crops Other Field Crops |

| By Herbicide Selectivity | Selective Herbicides Non-selective Herbicides |

| By Formulation Type | Emulsifiable Concentrates (EC) Suspension Concentrates (SC) Water-Dispersible Granules (WDG) Other Formulations |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Farm Size | Large-Scale Commercial Farms Medium Farms Smallholder Farms Government & Institutional Farms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Producers | 120 | Farm Owners, Crop Managers |

| Agrochemical Distributors | 80 | Sales Managers, Distribution Coordinators |

| Research Institutions | 60 | Agricultural Researchers, Policy Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

| Retailers of Herbicides | 50 | Store Managers, Product Buyers |

The Saudi Arabia Herbicide Safeners Market is valued at approximately USD 12 million, reflecting its share within the global herbicide safeners market, which is estimated to be between USD 1.3 billion and USD 1.5 billion.