Region:Middle East

Author(s):Shubham

Product Code:KRAD5398

Pages:90

Published On:December 2025

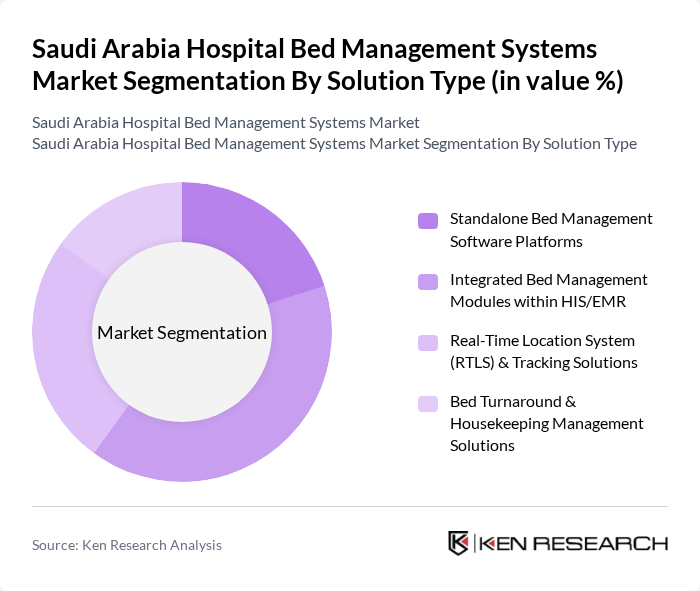

By Solution Type:The market is segmented into various solution types, including standalone bed management software platforms, integrated bed management modules within HIS/EMR, real-time location systems (RTLS) & tracking solutions, and bed turnaround & housekeeping management solutions. Among these, integrated bed management modules within HIS/EMR are leading the market due to their ability to streamline operations and enhance interoperability within healthcare systems.

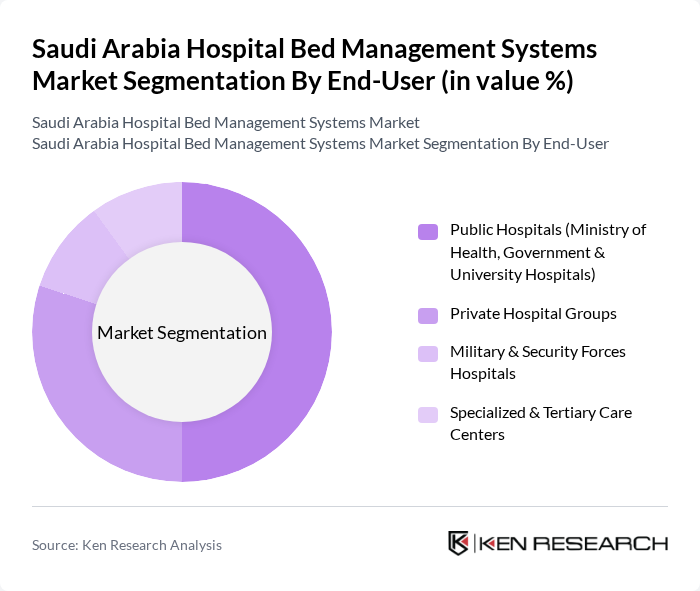

By End-User:The end-user segmentation includes public hospitals (Ministry of Health, government & university hospitals), private hospital groups, military & security forces hospitals, and specialized & tertiary care centers. Public hospitals are the dominant segment, driven by government initiatives to enhance healthcare services, the increasing patient load in public facilities, and their large-scale operations with higher patient volumes.

The Saudi Arabia Hospital Bed Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Cerner (Cerner Middle East Limited), Epic Systems Corporation, InterSystems Corporation, Philips Healthcare (Philips Middle East & Turkey), GE HealthCare Technologies Inc., Agfa HealthCare, Dedalus Group, Tamer Healthcare (Tamer Group), Al Faisaliah Medical Systems (FMS), Saudi German Health (Provider Use-Case & In?House Digital Platforms), Dr. Sulaiman Al Habib Medical Group (Provider Use-Case & In?House Digital Platforms), Vezeeta, Lean Business Services, Cloud Solutions Company (e.g., STC Cloud / National Cloud Providers Supporting Deployments), Local Health IT System Integrators & Channel Partners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hospital bed management systems market in Saudi Arabia appears promising, driven by ongoing technological advancements and government support. As healthcare facilities increasingly adopt AI and machine learning, operational efficiencies are expected to improve significantly. Additionally, the integration of telemedicine solutions will enhance patient care and streamline hospital operations. The focus on patient-centered care will further drive the demand for innovative management systems, ensuring that hospitals can meet the evolving needs of their patient populations effectively.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Standalone Bed Management Software Platforms Integrated Bed Management Modules within HIS/EMR Real-Time Location System (RTLS) & Tracking Solutions Bed Turnaround & Housekeeping Management Solutions |

| By End-User | Public Hospitals (Ministry of Health, Government & University Hospitals) Private Hospital Groups Military & Security Forces Hospitals Specialized & Tertiary Care Centers |

| By Deployment Model | On-Premise Solutions Cloud & Web-Based Solutions Hybrid Deployment Managed Services |

| By Region | Central Region (Riyadh & Surrounding Clusters) Western Region (Jeddah, Makkah & Madinah Clusters) Eastern Region (Dammam, Al Khobar & Dhahran Clusters) Southern & Northern Regions |

| By Functional Module | Bed Allocation & Admission/Discharge/Transfer (ADT) Management Patient Flow & Waiting List Management Capacity Planning, Forecasting & Command Center Dashboards Analytics & Regulatory Reporting |

| By Technology | RFID-Enabled Bed & Patient Tracking IoT-Enabled Smart Bed Management Solutions Software-Only (Non-RFID/IoT) Solutions AI-Enabled & Predictive Analytics Solutions |

| By Procurement & Policy Driver | Vision 2030 & Healthcare Transformation Program Initiatives Public-Private Partnership (PPP) & Privatization Projects Digital Health & Interoperability Mandates (NPHIES, Seha etc.) Infection Control, ICU & Emergency Preparedness Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Bed Management | 110 | Hospital Administrators, IT Managers |

| Private Hospital Bed Management | 90 | Procurement Officers, Operations Managers |

| Healthcare IT Solutions | 80 | Healthcare IT Directors, System Analysts |

| Bed Management Software Providers | 70 | Product Managers, Sales Executives |

| Regulatory Bodies and Healthcare Policy Makers | 60 | Policy Analysts, Healthcare Consultants |

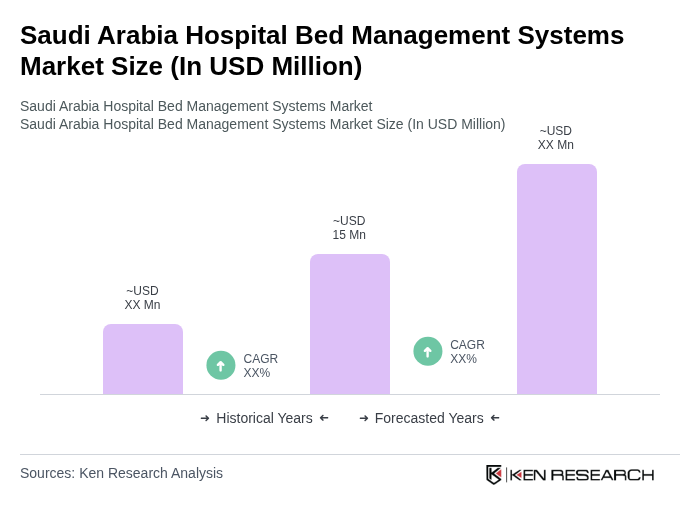

The Saudi Arabia Hospital Bed Management Systems Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient hospital operations and improved patient care.