Region:Middle East

Author(s):Dev

Product Code:KRAD7777

Pages:82

Published On:December 2025

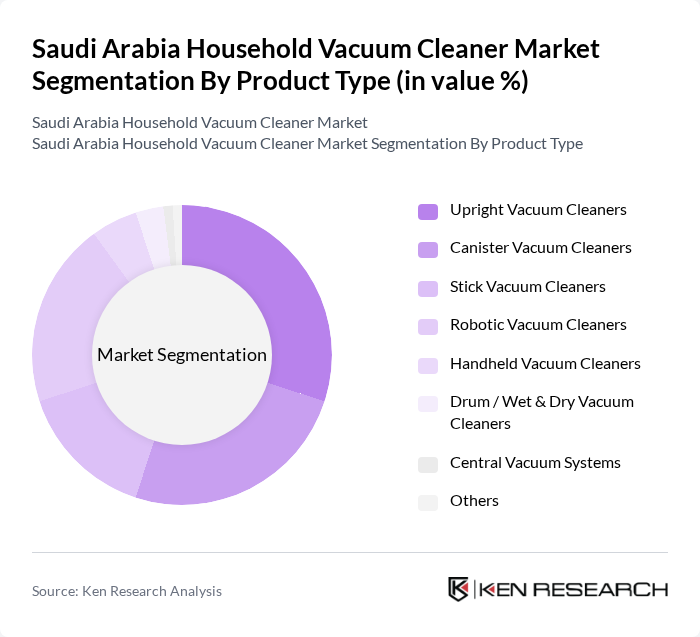

By Product Type:The product type segmentation includes various categories of vacuum cleaners, each catering to different consumer needs and preferences. The primary subsegments are Upright Vacuum Cleaners, Canister Vacuum Cleaners, Stick Vacuum Cleaners, Robotic Vacuum Cleaners, Handheld Vacuum Cleaners, Drum/Wet & Dry Vacuum Cleaners, Central Vacuum Systems, and Others. Among these, Upright Vacuum Cleaners are particularly popular in carpeted and larger homes due to their ease of use and effectiveness in cleaning carpets and large areas, while canister models remain important for versatile hard-floor and multi-surface cleaning. The growing trend towards convenience and smart-home integration has also led to an increase in the adoption of Robotic and cordless Stick Vacuum Cleaners, which offer automated or lightweight cleaning solutions for busy and tech?savvy households, supported by rising online sales and wider availability of smart models.

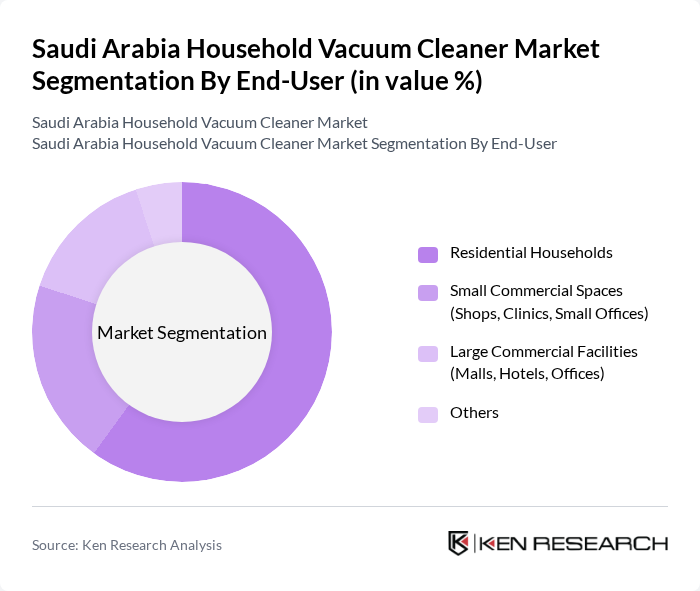

By End-User:The end-user segmentation encompasses various categories, including Residential Households, Small Commercial Spaces (Shops, Clinics, Small Offices), Large Commercial Facilities (Malls, Hotels, Offices), and Others. Residential Households represent the largest segment, driven by the increasing number of households, higher female labor-force participation, and the growing awareness of cleanliness and hygiene, which has been reinforced since the pandemic. Small Commercial Spaces also contribute significantly to the market, as retailers, clinics, and small offices seek efficient and compact cleaning solutions to maintain their premises, often favoring canister, stick, and wet & dry models. The demand from Large Commercial Facilities is rising as well, with a focus on high-capacity, durable, and sometimes contract-based cleaning solutions, particularly in malls, hotels, and corporate offices that increasingly prioritize hygiene standards and professional-grade vacuum technologies.

The Saudi Arabia Household Vacuum Cleaner Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Dyson Ltd., Koninklijke Philips N.V., Electrolux AB, Panasonic Corporation, Miele & Cie. KG, iRobot Corporation, Xiaomi Corporation, SharkNinja Operating LLC, Bissell Inc., Black+Decker (Stanley Black & Decker, Inc.), Tineco Intelligent Technology Co., Ltd., Eureka Forbes Limited, Geepas (Western International Group) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia household vacuum cleaner market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of smart technologies, such as AI and IoT, is expected to enhance product functionality and user experience. Additionally, the growing trend towards eco-friendly products will likely shape future offerings, as consumers increasingly seek sustainable options. As e-commerce continues to expand, brands will have new avenues to reach consumers, further influencing market dynamics and growth potential.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Upright Vacuum Cleaners Canister Vacuum Cleaners Stick Vacuum Cleaners Robotic Vacuum Cleaners Handheld Vacuum Cleaners Drum / Wet & Dry Vacuum Cleaners Central Vacuum Systems Others |

| By End-User | Residential Households Small Commercial Spaces (Shops, Clinics, Small Offices) Large Commercial Facilities (Malls, Hotels, Offices) Others |

| By Region | Central Region (Including Riyadh) Western Region (Including Jeddah, Makkah, Madinah) Eastern Region (Including Dammam, Dhahran, Al Khobar) Southern Region Northern Region |

| By Technology / Features | Bagged Vacuum Cleaners Bagless Vacuum Cleaners Corded Vacuum Cleaners Cordless / Battery-operated Vacuum Cleaners Smart & Connected (App / Wi-Fi / Voice Control) Others |

| By Application Area | Hard Floor Cleaning (Tiles, Marble, Hardwood) Carpet & Rug Cleaning Upholstery & Mattress Cleaning Automotive & Garage Cleaning Pet Hair & Allergen-focused Cleaning Others |

| By Distribution Channel | Offline – Electronics & Appliance Retailers Offline – Hypermarkets & Supermarkets Online – E-commerce Marketplaces Online – Direct-to-Consumer Brand Webstores Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Vacuum Cleaner Purchases | 150 | Homeowners, Renters |

| Consumer Preferences and Brand Loyalty | 120 | Frequent Buyers, Brand Advocates |

| Usage Patterns and Satisfaction Levels | 90 | Regular Users, Cleaning Service Providers |

| Market Trends and Future Expectations | 70 | Industry Experts, Retail Managers |

| Impact of E-commerce on Vacuum Cleaner Sales | 80 | Online Shoppers, E-commerce Managers |

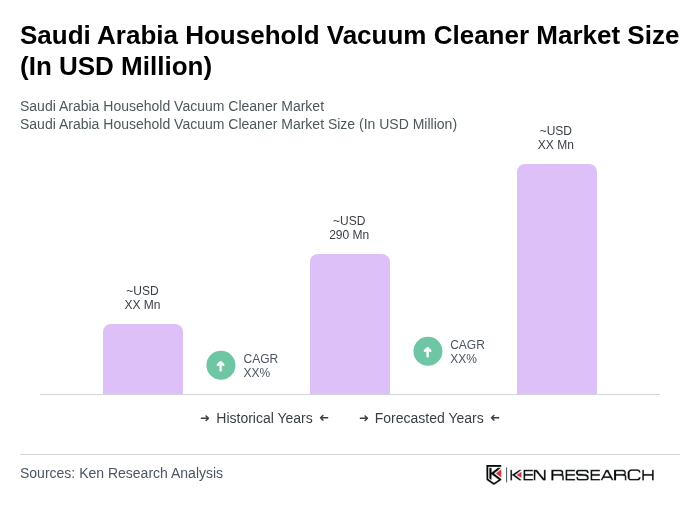

The Saudi Arabia Household Vacuum Cleaner Market is valued at approximately USD 290 million, reflecting a significant increase driven by urbanization, rising disposable incomes, and a growing preference for automated cleaning solutions among consumers.