Region:Middle East

Author(s):Rebecca

Product Code:KRAD7508

Pages:82

Published On:December 2025

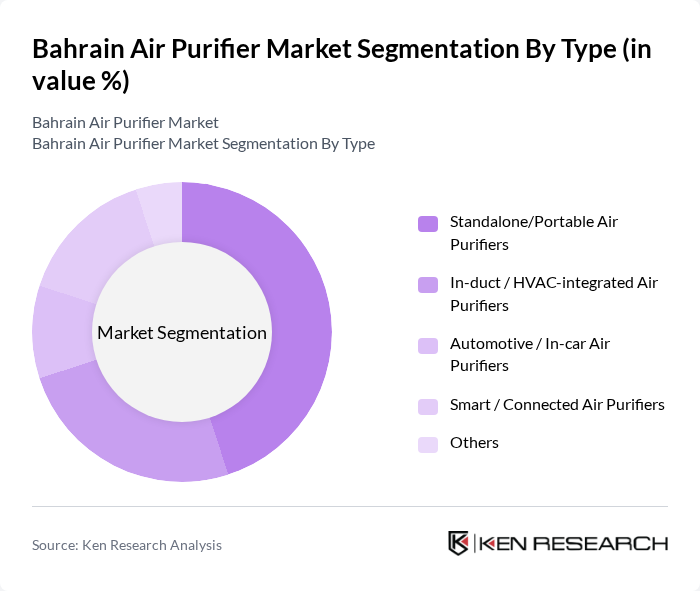

By Type:The market is segmented into various types of air purifiers, including standalone/portable air purifiers, in-duct/HVAC-integrated air purifiers, automotive/in-car air purifiers, smart/connected air purifiers, and others. Standalone/portable air purifiers dominate the market due to their affordability and ease of use, making them popular among residential consumers. The increasing trend towards smart home technology is also boosting the demand for smart/connected air purifiers.

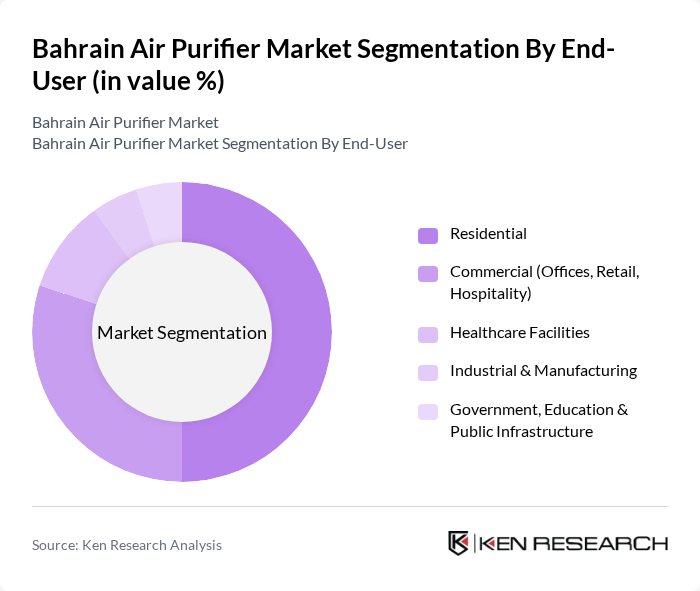

By End-User:The end-user segmentation includes residential, commercial (offices, retail, hospitality), healthcare facilities, industrial & manufacturing, and government, education & public infrastructure. The residential segment leads the market, driven by increasing consumer awareness of health issues related to air quality. The commercial sector is also growing, as businesses recognize the importance of providing a healthy environment for employees and customers.

The Bahrain Air Purifier Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Corporation, Koninklijke Philips N.V., Honeywell International Inc., Xiaomi Corporation, Sharp Corporation, Dyson Ltd, LG Electronics Inc., Blueair AB, Coway Co., Ltd., Levoit (VeSync Co., Ltd.), Winix Inc., Guardian Technologies LLC (GermGuardian), IQAir AG, Samsung Electronics Co., Ltd., Daikin Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain air purifier market is poised for significant growth, driven by increasing health consciousness and government support for clean air initiatives. As urbanization continues to rise, the demand for effective air purification solutions will likely escalate. Additionally, technological advancements in air purification, such as IoT integration, will enhance product appeal. Companies that focus on educating consumers about air quality benefits and offer affordable options will be well-positioned to capture market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Standalone/Portable Air Purifiers In-duct / HVAC-integrated Air Purifiers Automotive / In-car Air Purifiers Smart / Connected Air Purifiers Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Healthcare Facilities Industrial & Manufacturing Government, Education & Public Infrastructure |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Technology | HEPA & Mechanical Filtration Activated Carbon Filtration Electrostatic Precipitators & Ionizers UV-C & Photocatalytic Oxidation Hybrid / Multi-stage Purification Systems |

| By Application | Indoor Air Quality Improvement (PM2.5, Dust, Sand) Odor & VOCs Removal Allergens & Asthma Management Infection Control & Healthcare Use Others |

| By Sales Channel | Offline (Electronics & Appliance Stores, Hypermarkets) Online (E-commerce Marketplaces & Brand Webstores) Institutional / Project Sales |

| By Customer Type | Individual Retail Customers Corporate & SME Customers Government & Public Sector Entities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Purifier Users | 140 | Homeowners, Renters |

| Commercial Air Quality Managers | 100 | Facility Managers, Office Administrators |

| Health and Wellness Professionals | 80 | Doctors, Environmental Health Specialists |

| Retailers of Air Purifiers | 70 | Store Managers, Sales Representatives |

| Government Policy Makers | 50 | Environmental Policy Analysts, Health Officials |

The Bahrain Air Purifier Market is valued at approximately USD 42 million, reflecting a significant increase driven by rising awareness of air quality issues and health concerns among consumers, particularly in urban areas.