Region:Middle East

Author(s):Rebecca

Product Code:KRAB6868

Pages:97

Published On:October 2025

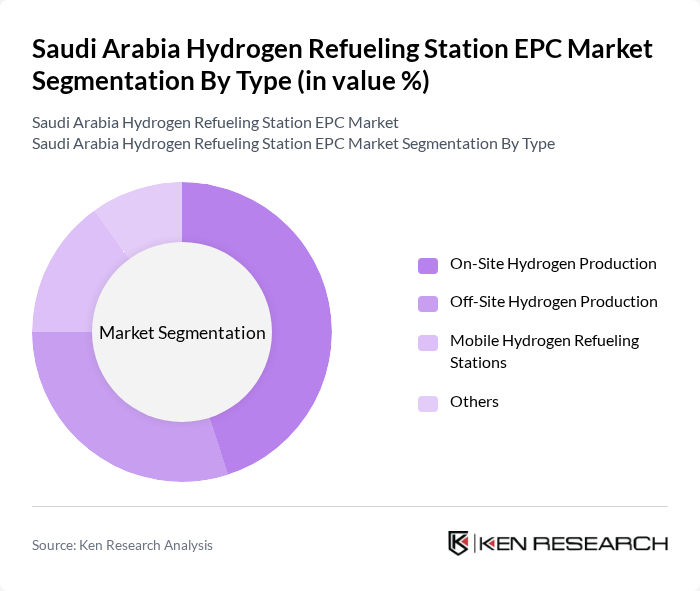

By Type:The market is segmented into On-Site Hydrogen Production, Off-Site Hydrogen Production, Mobile Hydrogen Refueling Stations, and Others. Among these, On-Site Hydrogen Production is gaining traction due to its efficiency and reduced transportation costs. Off-Site Hydrogen Production is also significant, particularly for large-scale applications. Mobile Hydrogen Refueling Stations are emerging as a flexible solution for various end-users, while the "Others" category includes innovative solutions that cater to niche markets.

By End-User:The end-user segmentation includes Automotive, Public Transportation, Industrial Applications, and Others. The Automotive sector is the leading segment, driven by the increasing adoption of hydrogen fuel cell vehicles. Public Transportation is also significant, with cities investing in hydrogen buses and taxis. Industrial Applications are growing as industries seek cleaner alternatives, while the "Others" category encompasses various emerging applications.

The Saudi Arabia Hydrogen Refueling Station EPC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde AG, Plug Power Inc., Nel ASA, ITM Power PLC, Ballard Power Systems Inc., Hydrogenics Corporation, McPhy Energy S.A., Siemens AG, Shell Hydrogen, TotalEnergies SE, Air Liquide S.A., Kawasaki Heavy Industries, Ltd., Hyundai Motor Company, Toyota Motor Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrogen refueling station market in Saudi Arabia appears promising, driven by increasing government support and technological advancements. By future, the government aims to establish at least 20 hydrogen refueling stations across major cities, enhancing accessibility for consumers. Additionally, the growing collaboration between public and private sectors is expected to foster innovation and investment in hydrogen technologies, further solidifying hydrogen's role as a key energy carrier in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Site Hydrogen Production Off-Site Hydrogen Production Mobile Hydrogen Refueling Stations Others |

| By End-User | Automotive Public Transportation Industrial Applications Others |

| By Application | Transportation Energy Storage Power Generation Others |

| By Investment Source | Government Funding Private Investments International Grants Others |

| By Policy Support | Subsidies Tax Incentives Regulatory Support Others |

| By Distribution Mode | Direct Sales Partnerships with Fuel Providers Online Platforms Others |

| By Component | Compressors Storage Tanks Dispensing Units Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Production Companies | 100 | CEOs, Operations Managers |

| Infrastructure Development Firms | 80 | Project Managers, Engineers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Automotive Manufacturers | 70 | Product Development Managers, Sustainability Officers |

| Energy Sector Analysts | 60 | Market Analysts, Research Directors |

The Saudi Arabia Hydrogen Refueling Station EPC Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by government initiatives and the rising demand for hydrogen fuel cell vehicles.