Region:North America

Author(s):Dev

Product Code:KRAC8844

Pages:91

Published On:November 2025

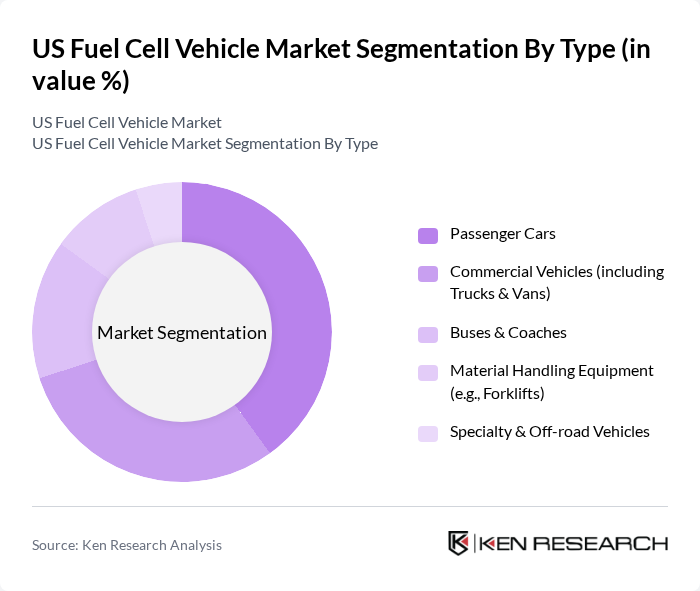

By Type:The market is segmented into various types of fuel cell vehicles, including passenger cars, commercial vehicles, buses, material handling equipment, and specialty vehicles. Among these, passenger cars and commercial vehicles are the most prominent segments, driven by consumer demand for eco-friendly transportation options and the need for efficient logistics solutions. The increasing focus on reducing greenhouse gas emissions and improving air quality further propels the growth of these segments.

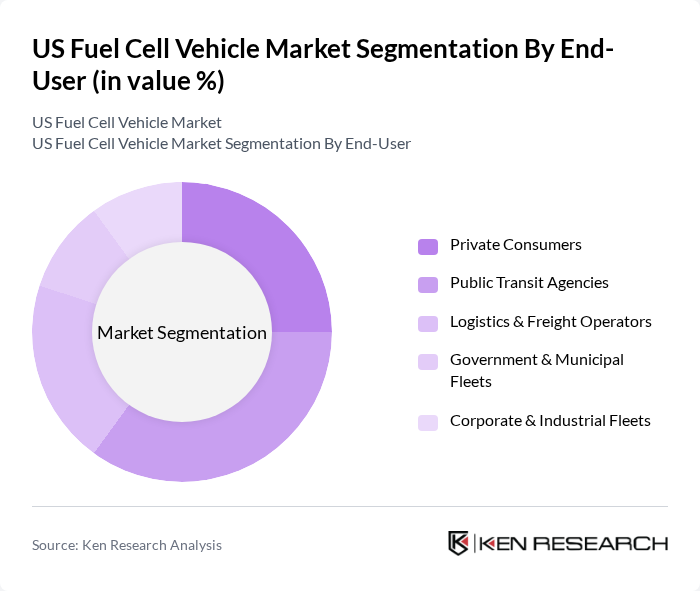

By End-User:The end-user segmentation includes private consumers, public transit agencies, logistics and freight operators, government and municipal fleets, and corporate and industrial fleets. Public transit agencies and logistics operators are leading segments, as they are increasingly adopting fuel cell vehicles to enhance operational efficiency and reduce emissions. The growing emphasis on sustainable transportation solutions is driving the demand for fuel cell vehicles in these sectors.

The US Fuel Cell Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Hyundai Motor Company, Ballard Power Systems Inc., Plug Power Inc., Nikola Corporation, FuelCell Energy, Inc., General Motors Company, Daimler Truck AG, BMW AG, Mercedes-Benz Group AG, Ford Motor Company, Hyzon Motors Inc., Cummins Inc., Bloom Energy Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US fuel cell vehicle market appears promising, driven by increasing investments in hydrogen production and infrastructure development. By future, the US Department of Energy plans to allocate $100 million to enhance hydrogen production technologies. Additionally, the integration of renewable energy sources into hydrogen production is expected to lower costs and improve sustainability. As consumer awareness grows and technology advances, the market is likely to see a gradual increase in fuel cell vehicle adoption, particularly in commercial applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Cars Commercial Vehicles (including Trucks & Vans) Buses & Coaches Material Handling Equipment (e.g., Forklifts) Specialty & Off-road Vehicles |

| By End-User | Private Consumers Public Transit Agencies Logistics & Freight Operators Government & Municipal Fleets Corporate & Industrial Fleets |

| By Application | Urban Mobility Long-Haul & Regional Transport Industrial & Warehouse Operations Backup & Auxiliary Power Other Niche Applications |

| By Fuel Cell Technology | Proton Exchange Membrane Fuel Cells (PEMFC) Solid Oxide Fuel Cells (SOFC) Alkaline Fuel Cells (AFC) Phosphoric Acid Fuel Cells (PAFC) Other Technologies |

| By Hydrogen Source | Steam Methane Reforming (Natural Gas) Electrolysis (Renewable & Grid Power) Biomass Gasification Byproduct Hydrogen & Other Sources |

| By Market Segment | Original Equipment Manufacturers (OEMs) Aftermarket & Service Providers Fleet Operators Infrastructure & Energy Providers |

| By Policy Support | Federal Incentives & Grants State-Level Programs (e.g., California ZEV Mandate) Local Government Initiatives Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Market | 100 | Automotive Engineers, Product Managers |

| Commercial Fleet Operators | 60 | Fleet Managers, Logistics Coordinators |

| Public Transportation Sector | 40 | Transit Authority Officials, Operations Directors |

| Consumer Insights | 80 | Potential Fuel Cell Vehicle Buyers, Environmental Advocates |

| Government and Regulatory Bodies | 40 | Policy Makers, Energy Analysts |

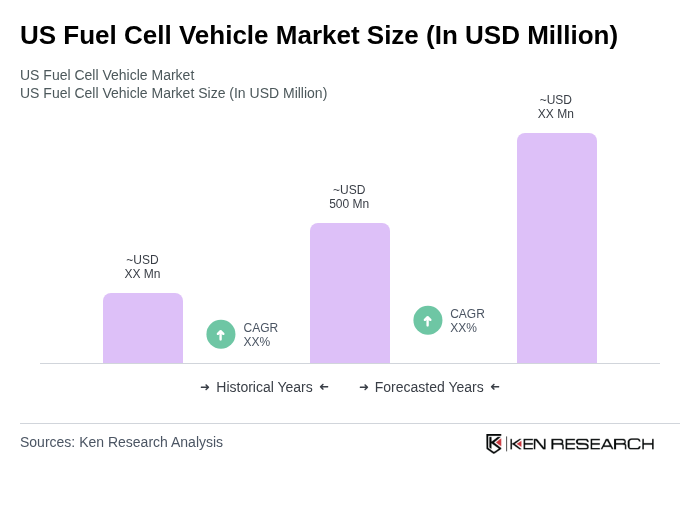

The US Fuel Cell Vehicle Market is valued at approximately USD 500 million, driven by investments in hydrogen infrastructure, government incentives for clean energy technologies, and advancements in fuel cell technology that enhance vehicle performance and reduce costs.