Region:Middle East

Author(s):Shubham

Product Code:KRAA8494

Pages:95

Published On:November 2025

Market.png)

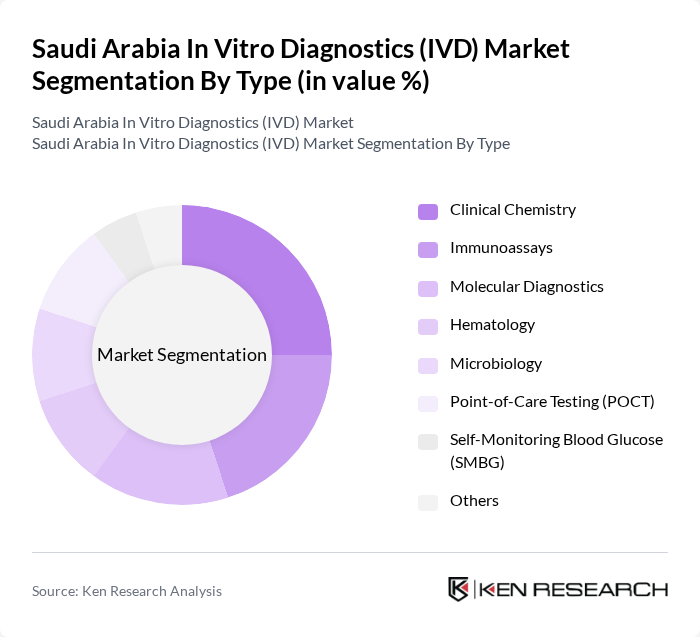

By Type:

The IVD market in Saudi Arabia is significantly influenced by the Clinical Chemistry segment, which is the largest due to its extensive application in routine diagnostics and monitoring of various health conditions. The increasing prevalence of metabolic disorders and the need for timely diagnosis have led to a surge in demand for clinical chemistry tests. Additionally, advancements in technology and the introduction of automated systems have enhanced the efficiency and accuracy of these tests, further solidifying their dominance in the market .

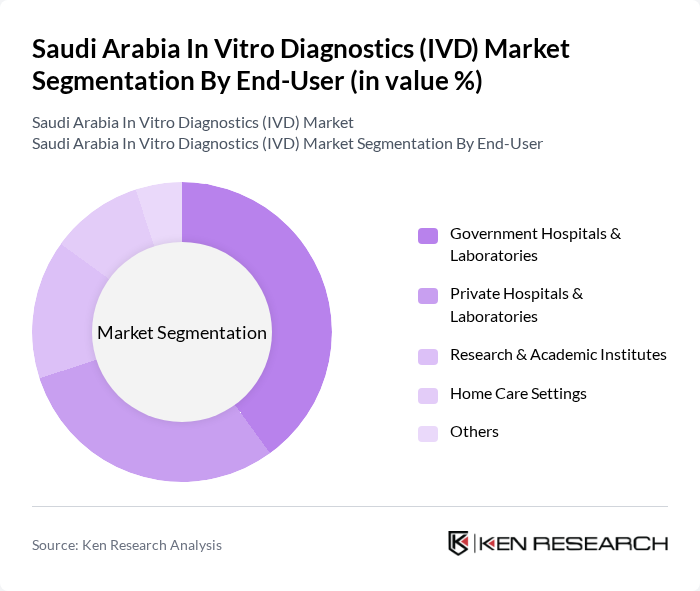

By End-User:

The Government Hospitals & Laboratories segment leads the market due to the substantial investments made by the Saudi government in healthcare infrastructure and services. These facilities are equipped with advanced diagnostic technologies and cater to a large patient population, driving the demand for IVD products. Additionally, the government's focus on improving healthcare access and quality, as part of Vision 2030, has further bolstered the growth of this segment, making it a key player in the IVD market .

The Saudi Arabia In Vitro Diagnostics (IVD) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Bio-Rad Laboratories, Beckman Coulter, Ortho Clinical Diagnostics, QIAGEN, Hologic, Becton, Dickinson and Company, Agilent Technologies, PerkinElmer, Sysmex Corporation, Mindray, DiaSorin, bioMérieux, Nihon Kohden, Al Borg Diagnostics, National Unified Procurement Company (NUPCO), Al Hayat Pharmaceuticals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IVD market in Saudi Arabia appears promising, driven by ongoing advancements in technology and increasing healthcare investments. The government’s commitment to enhancing healthcare infrastructure, alongside rising public awareness of health issues, is expected to foster a conducive environment for market growth. Additionally, the integration of artificial intelligence in diagnostics and the expansion of telemedicine services are likely to reshape the landscape, making diagnostics more accessible and efficient for patients across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical Chemistry Immunoassays Molecular Diagnostics Hematology Microbiology Point-of-Care Testing (POCT) Self-Monitoring Blood Glucose (SMBG) Others |

| By End-User | Government Hospitals & Laboratories Private Hospitals & Laboratories Research & Academic Institutes Home Care Settings Others |

| By Application | Infectious Diseases Diabetes Oncology (Cancer Diagnostics) Cardiovascular Diseases Autoimmune Diseases Nephrology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Technology | Immunoassay Clinical Chemistry Molecular Diagnostics (PCR, NGS, etc.) Hematology Analyzers Microbiology Testing Others |

| By Sample Type | Blood Samples Urine Samples Tissue Samples Saliva Samples Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Makkah, Medina) Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 80 | Laboratory Managers, Clinical Pathologists |

| Hospitals and Healthcare Facilities | 70 | Healthcare Administrators, Medical Directors |

| IVD Manufacturers | 40 | Product Managers, Sales Executives |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions | 50 | Research Scientists, Academic Professors |

The Saudi Arabia In Vitro Diagnostics (IVD) Market is valued at approximately USD 1.15 billion, reflecting significant growth driven by the rising prevalence of chronic diseases, advancements in diagnostic technologies, and government initiatives aimed at enhancing healthcare services.