Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9478

Pages:84

Published On:November 2025

Market.png)

By Type:The market is segmented into various types, including Clinical Chemistry, Immunoassays, Molecular Diagnostics, Hematology, Microbiology, Self-Blood Glucose Testing, Coagulation, and Others. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and technologies driving their growth. The infectious diseases segment has emerged as a leading application area, driven by public health initiatives and increased demand for rapid diagnostic tests .

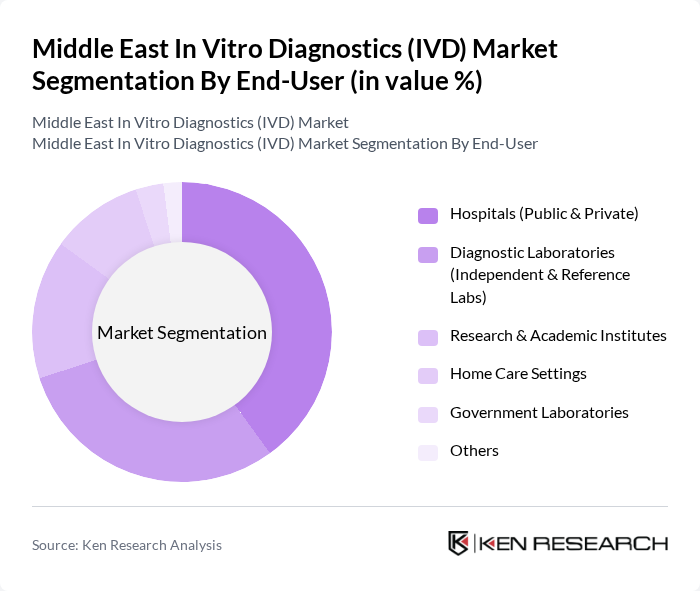

By End-User:The end-user segmentation includes Hospitals (Public & Private), Diagnostic Laboratories (Independent & Reference Labs), Research & Academic Institutes, Home Care Settings, Government Laboratories, and Others. Each segment reflects the diverse applications of IVD products across various healthcare settings. There is a notable shift towards independent diagnostic laboratories, driven by technological advancements and cost-effectiveness .

The Middle East In Vitro Diagnostics (IVD) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, Bio-Rad Laboratories, Becton, Dickinson and Company, QIAGEN, Hologic, Inc., Ortho Clinical Diagnostics, Agilent Technologies, PerkinElmer, Inc., Sysmex Corporation, Mindray Medical International Limited, DiaSorin S.p.A., Grifols S.A., bioMérieux SA, Danaher Corporation, Randox Laboratories, QuidelOrtho Corporation, Nihon Kohden Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East IVD market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As governments prioritize healthcare infrastructure, the integration of telemedicine and remote diagnostics is expected to enhance access to IVD solutions. Additionally, the rising awareness of personalized medicine will likely spur demand for tailored diagnostic tests, fostering innovation and collaboration between healthcare providers and technology firms to meet evolving patient needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical Chemistry Immunoassays Molecular Diagnostics Hematology Microbiology Self-Blood Glucose Testing Coagulation Others |

| By End-User | Hospitals (Public & Private) Diagnostic Laboratories (Independent & Reference Labs) Research & Academic Institutes Home Care Settings Government Laboratories Others |

| By Application | Infectious Diseases Diabetes Cancer Diagnostics Cardiovascular Diseases Autoimmune Diseases Nephrology Genetic Testing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Technology | PCR Technology Next-Generation Sequencing (NGS) Microarray Technology Immunoassay Technology Clinical Chemistry Analyzers Hematology Analyzers Point-of-Care Testing (POCT) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Others |

| By Product Type | Reagents Instruments Software & Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 100 | Laboratory Managers, Clinical Pathologists |

| Hospitals and Healthcare Facilities | 80 | Procurement Officers, Hospital Administrators |

| IVD Manufacturers | 50 | Product Managers, Sales Directors |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions | 60 | Research Scientists, Academic Professors |

The Middle East In Vitro Diagnostics (IVD) Market is valued at approximately USD 4.5 billion, driven by factors such as the increasing prevalence of chronic diseases, advancements in technology, and a growing emphasis on preventive healthcare.