Region:Middle East

Author(s):Dev

Product Code:KRAB7067

Pages:86

Published On:October 2025

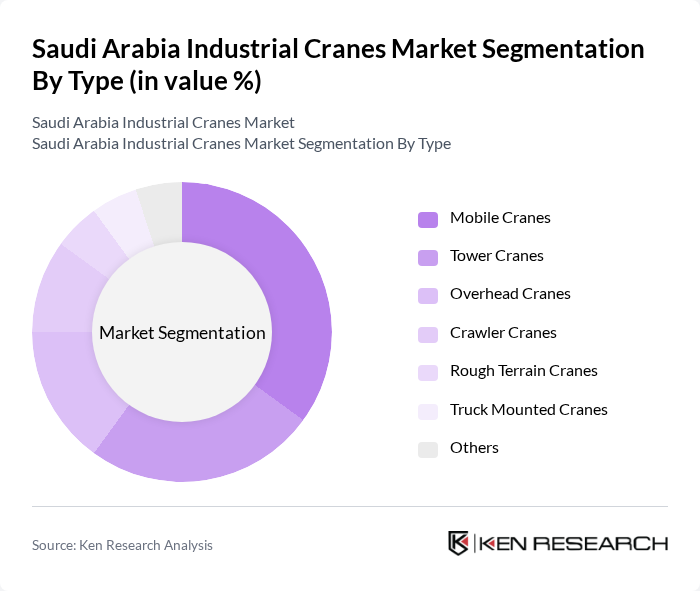

By Type:The market is segmented into various types of cranes, including Mobile Cranes, Tower Cranes, Overhead Cranes, Crawler Cranes, Rough Terrain Cranes, Truck Mounted Cranes, and Others. Among these, Mobile Cranes are particularly popular due to their versatility and ease of transport, making them suitable for a wide range of applications in construction and logistics.

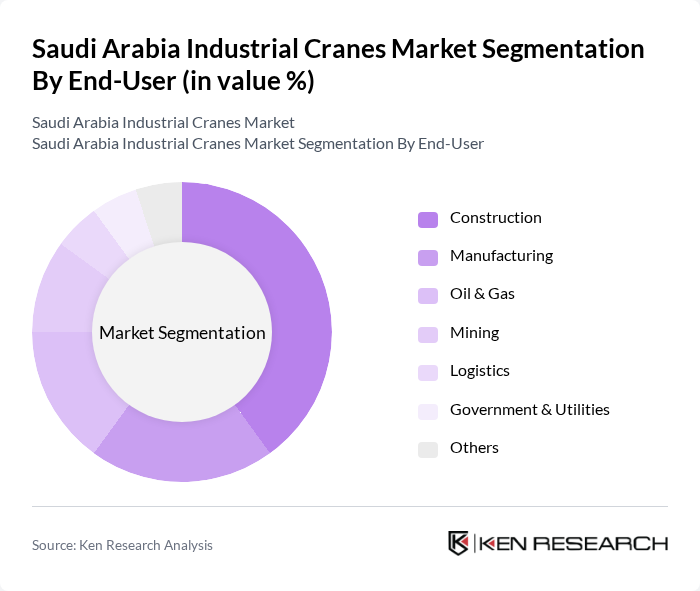

By End-User:The industrial cranes market serves various end-users, including Construction, Manufacturing, Oil & Gas, Mining, Logistics, Government & Utilities, and Others. The construction sector is the largest end-user, driven by ongoing infrastructure projects and urban development initiatives across the country.

The Saudi Arabia Industrial Cranes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alimak Group, Terex Corporation, Liebherr Group, Manitowoc Company, Inc., Konecranes, JLG Industries, Inc., Tadano Ltd., XCMG Group, Zoomlion Heavy Industry Science & Technology Co., Ltd., SANY Group, Doosan Infracore, Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd., Fassi Gru S.p.A., P&H Crane, Manitou Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial cranes market in Saudi Arabia appears promising, driven by ongoing infrastructure projects and technological advancements. As the government continues to invest heavily in construction and logistics, the demand for cranes is expected to rise significantly. Additionally, the integration of automation and IoT technologies will enhance operational efficiency, making cranes more versatile and appealing to various industries. This evolving landscape presents a unique opportunity for market players to innovate and expand their offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Cranes Tower Cranes Overhead Cranes Crawler Cranes Rough Terrain Cranes Truck Mounted Cranes Others |

| By End-User | Construction Manufacturing Oil & Gas Mining Logistics Government & Utilities Others |

| By Application | Heavy Lifting Material Handling Construction Projects Maintenance Services Others |

| By Sales Channel | Direct Sales Distributors Online Sales Rental Services Others |

| By Distribution Mode | Domestic Distribution International Distribution E-commerce Platforms Others |

| By Price Range | Low-End Cranes Mid-Range Cranes High-End Cranes Others |

| By Brand | Established Brands Emerging Brands Local Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Crane Usage | 100 | Project Managers, Site Engineers |

| Manufacturing Industry Crane Applications | 80 | Operations Managers, Production Supervisors |

| Logistics and Warehousing Crane Operations | 70 | Warehouse Managers, Logistics Coordinators |

| Oil & Gas Sector Crane Requirements | 60 | Procurement Officers, Safety Managers |

| Renewable Energy Projects Crane Needs | 50 | Project Developers, Engineering Consultants |

The Saudi Arabia Industrial Cranes Market is valued at approximately USD 1.2 billion, driven by significant growth in the construction and infrastructure sectors, as well as investments in oil and gas projects.