Region:Middle East

Author(s):Dev

Product Code:KRAC2699

Pages:96

Published On:October 2025

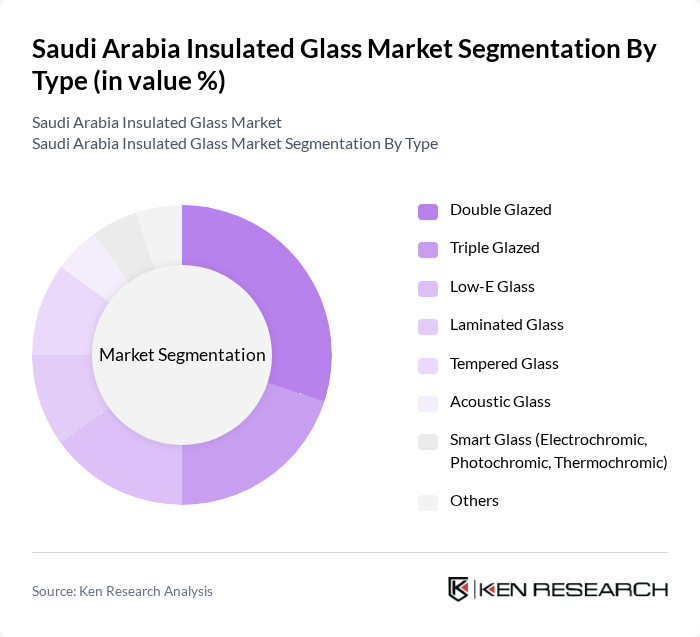

By Type:The market can be segmented into various types of insulated glass products, including Double Glazed, Triple Glazed, Low-E Glass, Laminated Glass, Tempered Glass, Acoustic Glass, Smart Glass (Electrochromic, Photochromic, Thermochromic), and Others. Each type serves specific consumer needs and preferences, contributing to the overall market dynamics .

TheDouble Glazedsegment is currently dominating the market due to its widespread application in residential and commercial buildings. This type of insulated glass is favored for its cost-effectiveness and energy efficiency, making it a popular choice among consumers. The increasing focus on energy conservation and the rising costs of energy have further propelled the demand for double glazed products. Additionally, the growing trend of green building certifications has led to a higher adoption rate of double glazed windows and facades, solidifying its position as the leading subsegment .

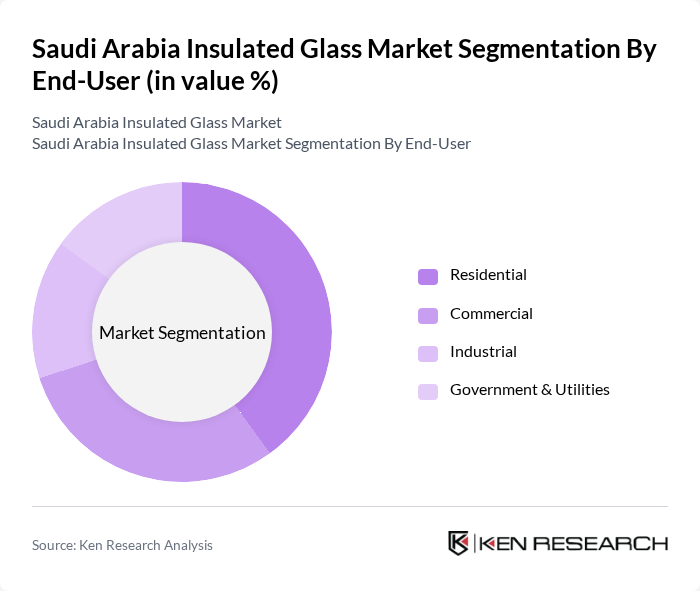

By End-User:The market can be segmented based on end-users into Residential, Commercial, Industrial, and Government & Utilities. Each end-user category has distinct requirements and preferences, influencing the demand for insulated glass products .

TheResidentialsegment is the largest end-user category, accounting for a significant portion of the market. This dominance is attributed to the increasing number of housing projects and the growing trend of energy-efficient homes. Homeowners are increasingly opting for insulated glass to enhance energy efficiency and comfort, driving the demand in this segment. Additionally, government incentives for energy-efficient home improvements have further boosted the residential market, making it a key player in the overall insulated glass landscape .

The Saudi Arabia Insulated Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Guardian International Float Glass Co. Ltd. (Guardian Glass Saudi Arabia), Saudi Glass Industries (SGI), Al-Jazeera Factory for Glass & Plastic Products, Al-Muhaidib Group, Saudi Arabian Glass Company Ltd., Al-Babtain Group, Al-Hokair Group, Al-Rajhi Group, Al-Suwaidi Industrial Services Co., Al-Tamimi Group, Saudi International Glass Co. Ltd., Al-Mansour Group, Al-Saad Group, Saint-Gobain Sekurit Saudi Arabia, AGC Obeikan Glass contribute to innovation, geographic expansion, and service delivery in this space .

The future of the insulated glass market in Saudi Arabia appears promising, driven by increasing government support for sustainable construction and rising urbanization. As the Kingdom continues to invest in infrastructure and energy-efficient buildings, the demand for insulated glass is expected to grow significantly. Additionally, advancements in smart glass technologies and a shift towards triple-glazed options will likely enhance product offerings, catering to the evolving preferences of consumers and architects alike, thereby fostering a competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Double Glazed Triple Glazed Low-E Glass Laminated Glass Tempered Glass Acoustic Glass Smart Glass (Electrochromic, Photochromic, Thermochromic) Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Facades Windows Doors Skylights Curtain Walls Partitions Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Price Range | Economy Mid-Range Premium |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region (Abha) |

| By Policy Support | Subsidies Tax Exemptions Grants Green Building Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Architects, Builders, Homeowners |

| Commercial Building Developments | 80 | Project Managers, Real Estate Developers |

| Industrial Facility Installations | 50 | Facility Managers, Procurement Officers |

| Energy Efficiency Initiatives | 60 | Sustainability Consultants, Policy Makers |

| Architectural Design Firms | 70 | Design Architects, Structural Engineers |

The Saudi Arabia Insulated Glass Market is valued at approximately USD 1.5 billion, driven by the booming construction sector and increasing demand for energy-efficient building materials. This growth reflects a significant trend towards sustainability and energy conservation in the region.