Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0173

Pages:96

Published On:August 2025

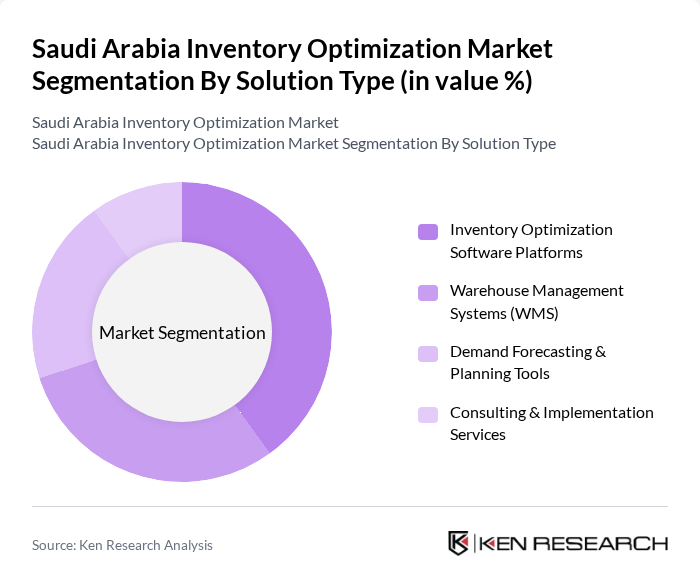

By Solution Type:The solution type segmentation includes Inventory Optimization Software Platforms, Warehouse Management Systems (WMS), Demand Forecasting & Planning Tools, and Consulting & Implementation Services. Among these, Inventory Optimization Software Platforms are leading the market due to their ability to provide real-time data analytics, automate replenishment, and improve decision-making processes. The increasing reliance on data-driven and AI-powered strategies in inventory management is propelling the demand for these software solutions .

By End-User:The end-user segmentation encompasses Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics & Transportation Providers, Food & Beverage, Oil & Gas, and Others. The Retail & E-commerce sector is the dominant segment, driven by the rapid growth of online shopping, omnichannel retail expansion, and the need for efficient inventory management to meet evolving consumer demands. The increasing competition in the retail space necessitates advanced inventory optimization solutions to enhance customer satisfaction and operational efficiency .

The Saudi Arabia Inventory Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Blue Yonder (formerly JDA Software), Manhattan Associates, Infor, Microsoft Corporation, Kinaxis, Epicor Software Corporation, Zoho Corporation, Fishbowl Inventory, NetSuite (Oracle NetSuite), SkuVault, TradeGecko (now QuickBooks Commerce), FourKites, Aramex, Saudi Logistics Services (SAL), Kuehne + Nagel, Agility Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory optimization market in Saudi Arabia appears promising, driven by technological advancements and government support. As businesses increasingly adopt automation and AI technologies, the efficiency of inventory management is expected to improve significantly. Furthermore, the rise of e-commerce will necessitate more sophisticated inventory solutions, leading to greater investments in smart warehousing and real-time tracking systems. These trends will likely enhance operational efficiency and customer satisfaction across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Inventory Optimization Software Platforms Warehouse Management Systems (WMS) Demand Forecasting & Planning Tools Consulting & Implementation Services |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics & Transportation Providers Food & Beverage Oil & Gas Others |

| By Industry Vertical | Consumer Goods Automotive Electronics & Electricals Pharmaceuticals & Healthcare Food & Beverage Oil & Gas Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Artificial Intelligence (AI) & Machine Learning Internet of Things (IoT) Blockchain Robotics & Automation Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Supply Chain Managers, Inventory Analysts |

| Manufacturing Supply Chain Optimization | 80 | Operations Managers, Production Planners |

| E-commerce Inventory Solutions | 90 | eCommerce Directors, Logistics Coordinators |

| Technology Adoption in Inventory Management | 60 | IT Managers, Digital Transformation Leads |

| Logistics and Distribution Strategies | 50 | Logistics Directors, Warehouse Managers |

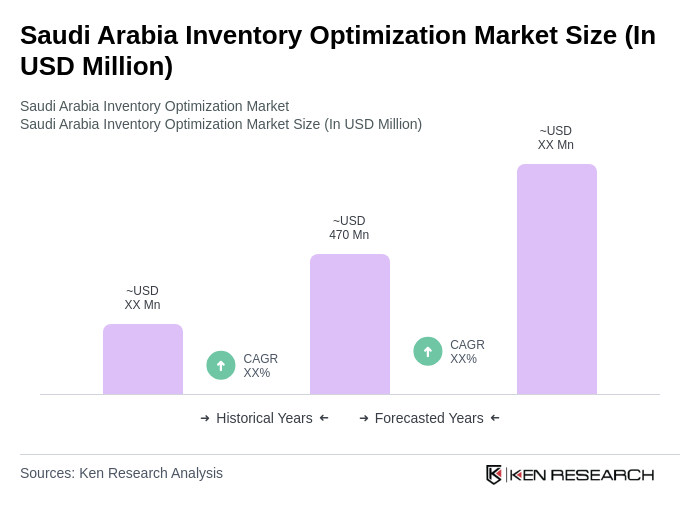

The Saudi Arabia Inventory Optimization Market is valued at approximately USD 470 million, driven by the increasing demand for efficient supply chain management solutions and the need for cost reduction in inventory management practices.