Region:Middle East

Author(s):Shubham

Product Code:KRAD3547

Pages:97

Published On:November 2025

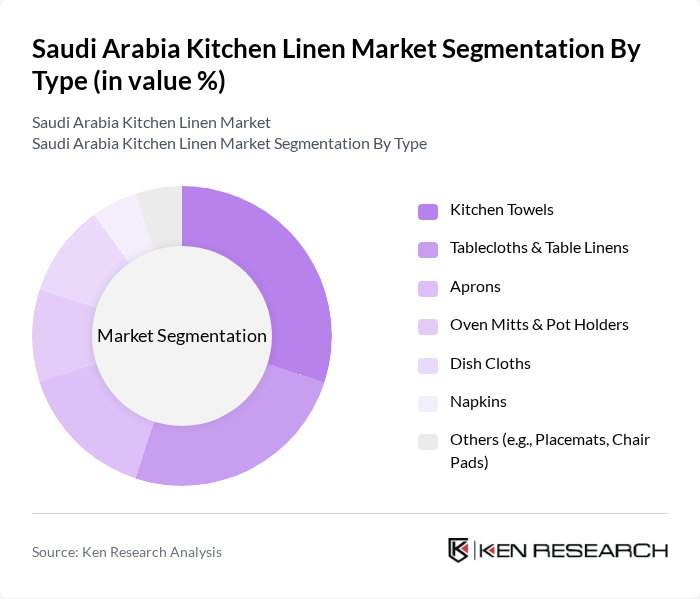

By Type:The kitchen linen market can be segmented into various types, including kitchen towels, tablecloths & table linens, aprons, oven mitts & pot holders, dish cloths, napkins, and others such as placemats and chair pads. Among these, kitchen towels and tablecloths are the most popular due to their essential roles in daily kitchen activities and dining experiences. The demand for these products is driven by consumer preferences for functionality, durability, and aesthetics, with a growing trend towards personalized and designer options, as well as eco-friendly materials .

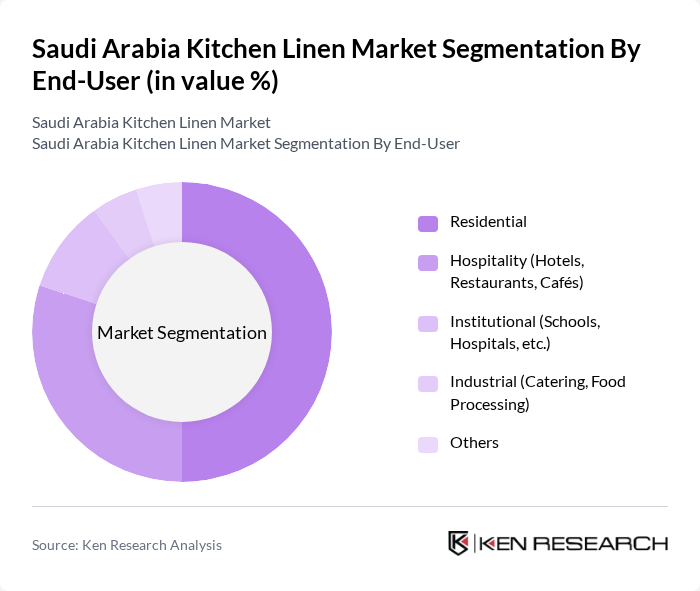

By End-User:The kitchen linen market is segmented by end-user into residential, hospitality (hotels, restaurants, cafés), institutional (schools, hospitals, etc.), industrial (catering, food processing), and others. The residential segment dominates the market, driven by the increasing number of households, the growing trend of home cooking, and the influence of modern home décor trends. The hospitality sector also plays a significant role, as hotels and restaurants require high-quality linens to enhance their dining experiences and comply with hygiene standards .

The Saudi Arabia Kitchen Linen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bed Quarter (Al Mazro Group), Omar Kassem Alesayi Group, Satex, Tawreed, Watheer International, Al Sorayai Group, Al Abdullatif Industrial Investment Company, Almutlaq Group, Al Hokair Group, Al Othaim Holding, Al Rugaib Furniture, IKEA Saudi Arabia (Ghassan Ahmed Al Sulaiman Group), Home Centre (Landmark Group), Danube Home, Carrefour Saudi Arabia (Majid Al Futtaim Retail) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia kitchen linen market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The shift towards online shopping is expected to reshape retail dynamics, with e-commerce sales projected to exceed SAR 19 billion in future. Additionally, the increasing focus on eco-friendly materials will likely lead to a rise in sustainable product offerings, catering to environmentally conscious consumers and enhancing brand loyalty in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Kitchen Towels Tablecloths & Table Linens Aprons Oven Mitts & Pot Holders Dish Cloths Napkins Others (e.g., Placemats, Chair Pads) |

| By End-User | Residential Hospitality (Hotels, Restaurants, Cafés) Institutional (Schools, Hospitals, etc.) Industrial (Catering, Food Processing) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Direct Sales (B2B) Others (e.g., Department Stores) |

| By Material | Cotton Linen Polyester & Synthetics Blends (Cotton/Polyester, Cotton/Linen, etc.) Bamboo & Other Sustainable Fibers Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Type | National Brands Private Labels International Brands Others |

| By Usage | Everyday Use Occasional Use Professional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Household Decision Makers, Kitchen Enthusiasts |

| Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trend Analysis | 100 | Market Analysts, Retail Strategists |

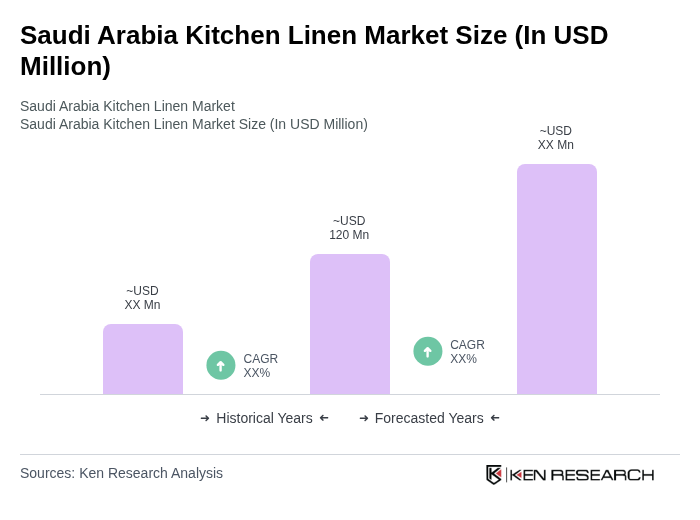

The Saudi Arabia Kitchen Linen Market is valued at approximately USD 120 million, driven by increasing demand for home textiles, rising disposable incomes, and a growing interest in home decor among consumers.