Region:Middle East

Author(s):Dev

Product Code:KRAE0156

Pages:89

Published On:December 2025

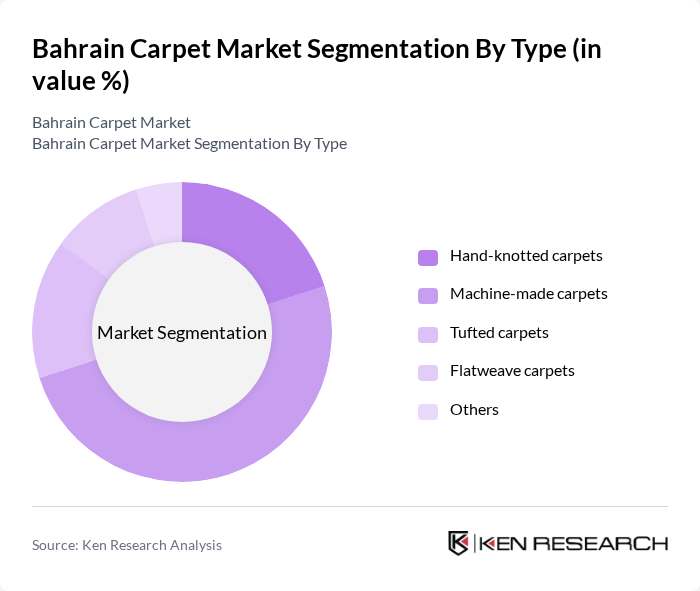

By Type:The carpet market in Bahrain is segmented into various types, including hand-knotted carpets, machine-made carpets, tufted carpets, flatweave carpets, and others. Among these, machine-made carpets dominate the market due to their affordability and mass production capabilities, catering to a broader consumer base. Hand-knotted carpets, while more expensive, appeal to niche markets seeking luxury and craftsmanship. The demand for tufted and flatweave carpets is also growing, driven by changing consumer preferences towards modern and versatile designs.

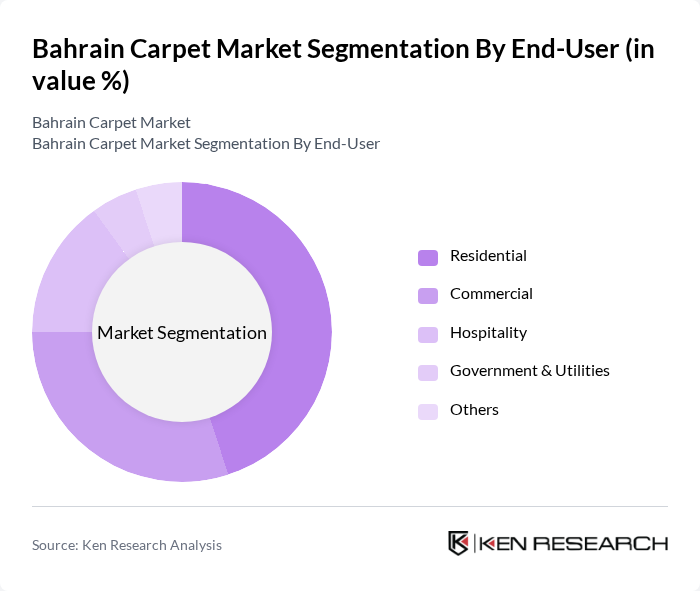

By End-User:The end-user segmentation of the carpet market includes residential, commercial, hospitality, government & utilities, and others. The residential segment holds the largest share, driven by increasing home renovations and interior design trends. The commercial sector is also significant, with businesses investing in carpets for aesthetic and functional purposes. The hospitality sector is growing, as hotels and restaurants seek to enhance their ambiance with quality carpets, while government and utility sectors contribute to steady demand through public projects.

The Bahrain Carpet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Carpet Company, Al Ameen Carpets, IKEA Bahrain, Oriental Weavers, and Mohawk Industries contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain carpet market is poised for growth, driven by increasing consumer interest in luxury and sustainable products. As the real estate sector expands, demand for carpets in new residential and commercial spaces will rise. Additionally, the integration of technology in carpet design and production processes is expected to enhance product offerings. E-commerce platforms will play a crucial role in reaching a broader audience, facilitating access to diverse carpet styles and customization options, thereby shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hand-knotted carpets Machine-made carpets Tufted carpets Flatweave carpets Others |

| By End-User | Residential Commercial Hospitality Government & Utilities Others |

| By Material | Wool Silk Synthetic fibers Cotton Others |

| By Design | Traditional designs Contemporary designs Custom designs Geometric patterns Others |

| By Distribution Channel | Online retail Brick-and-mortar stores Wholesale distributors Direct sales Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Carpet Buyers | 150 | Homeowners, Interior Designers |

| Commercial Carpet Installers | 100 | Contractors, Facility Managers |

| Retail Carpet Outlets | 80 | Store Managers, Sales Representatives |

| Carpet Exporters | 60 | Export Managers, Business Development Executives |

| Carpet Designers and Manufacturers | 70 | Product Designers, Production Managers |

The Bahrain Carpet Market is valued at approximately USD 20 million. This valuation reflects the growing consumer interest in home décor, urbanization, and a shift towards premium and sustainable products.