Region:Middle East

Author(s):Dev

Product Code:KRAC4880

Pages:100

Published On:October 2025

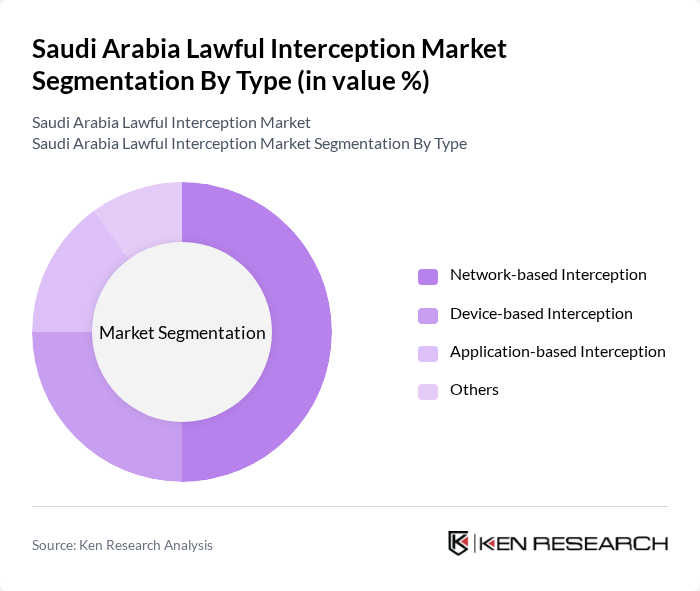

By Type:The market is segmented into Network-based Interception, Device-based Interception, Application-based Interception, and Others. Network-based Interception is the leading subsegment, accounting for the largest share due to its capacity for real-time monitoring and analysis of data traffic across diverse communication channels. The proliferation of encrypted communications, the expansion of 5G networks, and the increasing complexity of cyber threats are driving demand for comprehensive network-based interception technologies among government agencies and law enforcement.

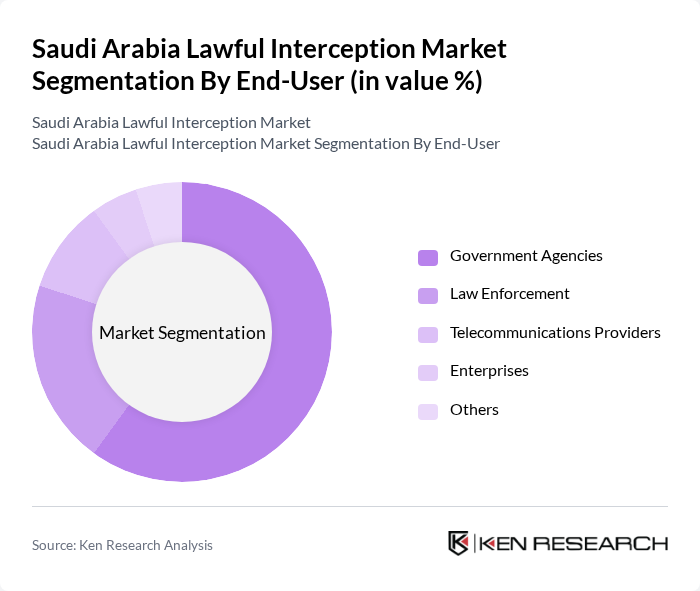

By End-User:The end-user segmentation includes Government Agencies, Law Enforcement, Telecommunications Providers, Enterprises, and Others. Government Agencies are the dominant end-users, driven by stringent national security requirements and public safety mandates. The ongoing focus on counter-terrorism, cybercrime prevention, and regulatory compliance has led to a surge in demand for lawful interception solutions among these agencies, making them the primary consumers in the market.

The Saudi Arabia Lawful Interception Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huawei Technologies Co., Ltd., Cisco Systems, Inc., Ericsson AB, Nokia Corporation, Thales Group, Verint Systems Inc., Amdocs Limited, BAE Systems plc, NEC Corporation, ZTE Corporation, Atos SE, Raytheon Technologies Corporation, L3Harris Technologies, Inc., Palantir Technologies Inc., Check Point Software Technologies Ltd., SS8 Networks, Inc., Utimaco GmbH, AQSACOM, Musarubra (McAfee Enterprise), Dreamlab Technologies AG, Incognito Software Systems Inc., Keysight Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lawful interception market in Saudi Arabia appears promising, driven by technological advancements and a strong focus on national security. As the government continues to invest in surveillance infrastructure, the integration of AI and cloud-based solutions will enhance operational efficiency. However, balancing security needs with privacy concerns will be crucial. The market is likely to evolve with increased collaboration between public and private sectors, fostering innovation while addressing regulatory compliance and public sentiment.

| Segment | Sub-Segments |

|---|---|

| By Type | Network-based Interception Device-based Interception Application-based Interception Others |

| By End-User | Government Agencies Law Enforcement Telecommunications Providers Enterprises Others |

| By Application | Criminal Investigation Cybersecurity Intelligence Gathering Counterterrorism Regulatory Compliance Others |

| By Component | Hardware (Mediation Devices, Gateways, Switches, Routers) Software (Interception Management, Data Analysis, Monitoring) Services (Integration, Maintenance, Managed Services) Others |

| By Network Technology | Mobile Data VoIP LTE WLAN DSL PSTN Others |

| By Communication Content | Voice Communication Video Text Messaging Data Downloads File Transfer Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Retail Wholesale E-commerce Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Regulatory Compliance | 50 | Regulatory Affairs Managers, Compliance Officers |

| Law Enforcement Interception Needs | 60 | Police Officials, Cybercrime Investigators |

| Telecom Service Provider Insights | 80 | Network Engineers, IT Security Managers |

| Legal Perspectives on Interception | 50 | Legal Advisors, Telecommunications Lawyers |

| Market Trends in Cybersecurity | 70 | Cybersecurity Analysts, Risk Management Professionals |

The Saudi Arabia Lawful Interception Market is valued at approximately USD 250 million, reflecting a robust growth trajectory driven by government regulations, national security needs, and the demand for advanced surveillance technologies among law enforcement agencies.