Region:Middle East

Author(s):Shubham

Product Code:KRAA8625

Pages:89

Published On:November 2025

Market.png)

By Type:The market is segmented into various types of services that cater to different legal needs. The primary subsegments include Document Review, Legal Research, Contract Management, Compliance Services, Litigation Support, Intellectual Property Services, E-Discovery, Due Diligence, Legal Analytics, and Others. Among these, Document Review and Legal Research are particularly prominent due to their essential roles in legal proceedings and corporate compliance. E-Discovery and Contract Management are also experiencing rapid growth, driven by the increasing complexity and volume of electronically stored information and the need for streamlined contract lifecycle management .

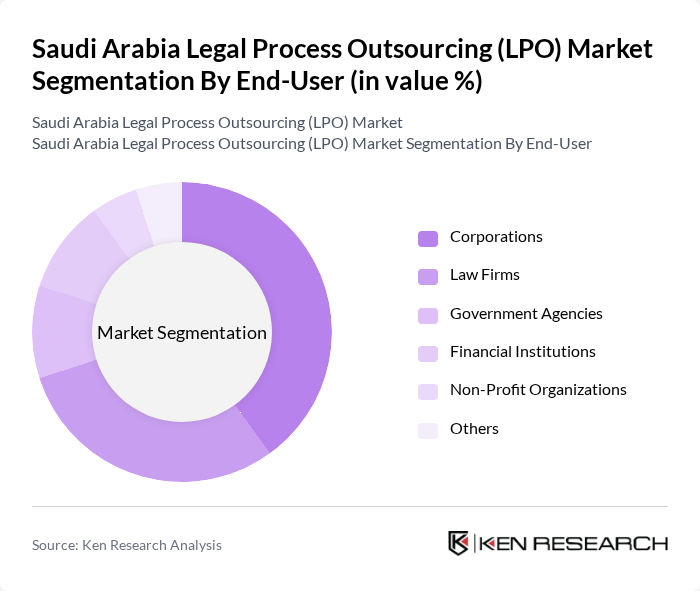

By End-User:The end-user segmentation includes Corporations, Law Firms, Government Agencies, Financial Institutions, Non-Profit Organizations, and Others. Corporations and Law Firms are the leading end-users, as they require extensive legal support for compliance, contract management, and litigation processes. Government agencies and financial institutions are also increasing their reliance on LPO services for regulatory compliance and risk management, while non-profit organizations utilize LPO solutions for cost-effective legal support .

The Saudi Arabia Legal Process Outsourcing (LPO) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Integreon, Elevate Services, UnitedLex, QuisLex, Pangea3, LegalBase, Thomson Reuters, LexisNexis, Epiq, Al Tamimi & Company, Hammad & Al-Mehdar Law Firm, Clyde & Co, Dentons, Baker McKenzie, DLA Piper contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia LPO market appears promising, driven by increasing demand for specialized legal services and technological advancements. As businesses continue to navigate complex regulatory environments, the reliance on LPO services is expected to grow. Additionally, the integration of AI and automation will enhance service delivery, making LPO more efficient. Companies are likely to seek partnerships with local firms to leverage expertise, further expanding the market's potential and fostering innovation in legal service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Document Review Legal Research Contract Management Compliance Services Litigation Support Intellectual Property Services E-Discovery Due Diligence Legal Analytics Others |

| By End-User | Corporations Law Firms Government Agencies Financial Institutions Non-Profit Organizations Others |

| By Industry | Financial Services Healthcare Technology Energy Real Estate Construction Retail & Consumer Goods Others |

| By Service Model | Onshore LPO Offshore LPO Hybrid LPO Nearshore LPO Others |

| By Delivery Method | Remote Services On-Site Services Cloud-Based Services Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| By Geographic Presence | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Legal Departments | 100 | General Counsels, Legal Operations Managers |

| LPO Service Providers | 80 | Business Development Managers, Service Delivery Heads |

| Legal Technology Firms | 50 | Product Managers, Technology Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Industry Experts and Consultants | 60 | Legal Consultants, Market Analysts |

The Saudi Arabia Legal Process Outsourcing (LPO) market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the demand for cost-effective legal services and technological advancements in legal practices.