Region:Global

Author(s):Shubham

Product Code:KRAE0298

Pages:80

Published On:December 2025

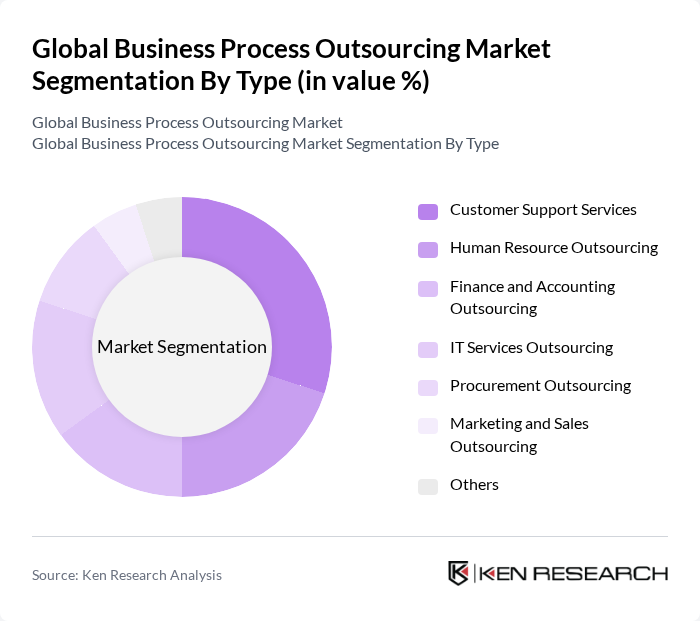

By Type:The BPO market is segmented into various types, including Customer Support Services, Human Resource Outsourcing, Finance and Accounting Outsourcing, IT Services Outsourcing, Procurement Outsourcing, Marketing and Sales Outsourcing, and Others. Among these, Customer Support Services is the leading segment, driven by the increasing demand for enhanced customer engagement and satisfaction. Companies are increasingly outsourcing their customer service functions to improve efficiency and focus on core business areas.

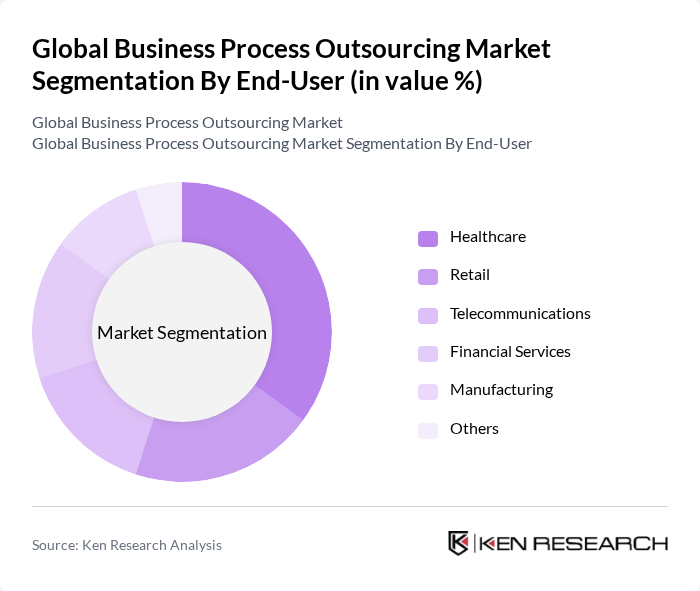

By End-User:The end-user segmentation includes Healthcare, Retail, Telecommunications, Financial Services, Manufacturing, and Others. The Healthcare sector is currently the dominant end-user, as organizations seek to improve patient care and operational efficiency through outsourcing. The increasing complexity of healthcare regulations and the need for cost management are driving healthcare providers to adopt BPO services.

The Global Business Process Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, IBM, TCS (Tata Consultancy Services), Infosys, Wipro, Genpact, Cognizant, Capgemini, HCL Technologies, Teleperformance, Sitel Group, Concentrix, Alorica, Sykes Enterprises, Atento contribute to innovation, geographic expansion, and service delivery in this space.

The future of the BPO market is poised for transformation, driven by technological innovations and evolving business needs. As companies increasingly adopt cloud-based solutions and remote work models, the demand for flexible outsourcing options will rise. Additionally, the emphasis on customer experience will lead to the integration of analytics in BPO services, enabling providers to deliver personalized solutions. This dynamic environment presents opportunities for growth and adaptation in the BPO sector, fostering resilience and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Customer Support Services Human Resource Outsourcing Finance and Accounting Outsourcing IT Services Outsourcing Procurement Outsourcing Marketing and Sales Outsourcing Others |

| By End-User | Healthcare Retail Telecommunications Financial Services Manufacturing Others |

| By Service Delivery Model | Onshore Offshore Nearshore Hybrid Others |

| By Industry Vertical | BFSI (Banking, Financial Services, and Insurance) Healthcare and Life Sciences Travel and Hospitality Education Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Technology Utilization | Cloud Computing Artificial Intelligence Robotic Process Automation Big Data Analytics Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Outsourcing Services | 150 | IT Managers, CIOs, Procurement Officers |

| Customer Support BPO | 120 | Customer Service Managers, Operations Directors |

| HR Outsourcing Solutions | 100 | HR Managers, Talent Acquisition Specialists |

| Finance and Accounting BPO | 80 | Finance Directors, Accounting Managers |

| Marketing and Sales Outsourcing | 90 | Marketing Managers, Sales Directors |

The Global Business Process Outsourcing Market is valued at approximately USD 300 billion, driven by the demand for cost-effective solutions and technological advancements. This valuation is based on a comprehensive five-year historical analysis of the market.