Region:Middle East

Author(s):Shubham

Product Code:KRAD5331

Pages:99

Published On:December 2025

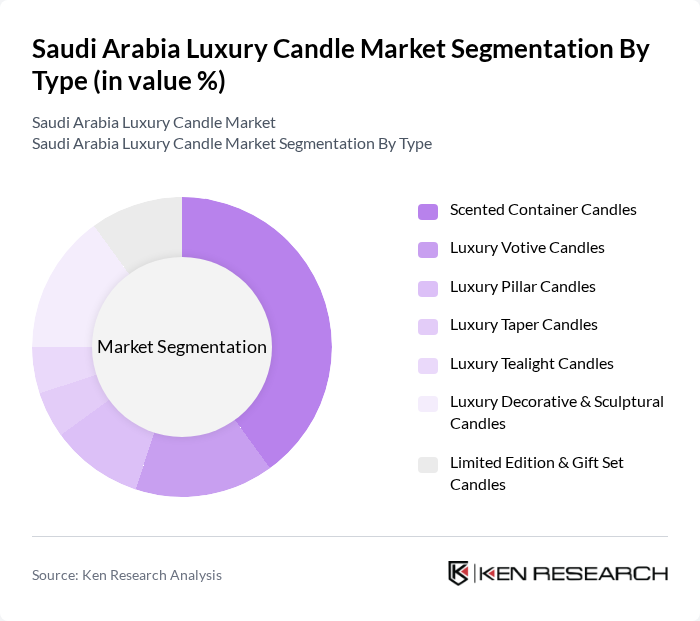

By Type:The luxury candle market can be segmented into various types, including scented container candles, luxury votive candles, luxury pillar candles, luxury taper candles, luxury tealight candles, luxury decorative & sculptural candles, and limited edition & gift set candles. Among these, scented container candles are particularly popular due to their versatility and ability to enhance home ambiance, consistent with the broader Saudi market where scented formats dominate overall candle demand. The trend towards personalization, aromatherapy-driven wellness, and unique scents has driven consumer preference towards this sub-segment, making it a dominant player in the market and a key driver of premiumization.

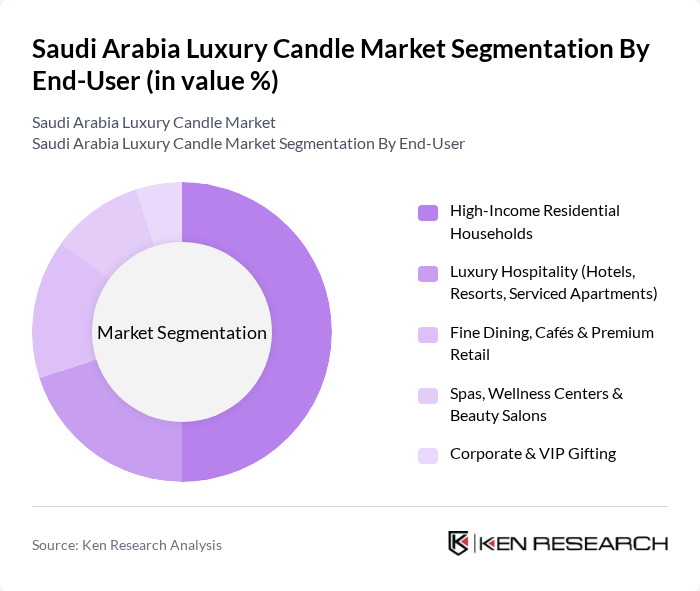

By End-User:The end-user segmentation includes high-income residential households, luxury hospitality (hotels, resorts, serviced apartments), fine dining, cafés & premium retail, spas, wellness centers & beauty salons, and corporate & VIP gifting. High-income residential households are the leading segment, driven by a growing trend of luxury home décor, increased focus on home ambiance, and the rising popularity of scented candles for personal use and gifting, mirroring the broader Saudi candles market where home décor and wellness are key demand drivers.

The Saudi Arabia Luxury Candle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diptyque, Jo Malone London, Yankee Candle, Cire Trudon, NEST New York (NEST Fragrances), VOLUSPA, Baobab Collection, Byredo, Rituals Cosmetics, Bath & Body Works, L'Occitane en Provence, Arabian Oud, Abdul Samad Al Qurashi, Al Musbah Group (House of Fragrance & Home Fragrance Lines), Niche Local Brands (e.g., Scent of Arabia, OHNUT & similar Saudi labels) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi luxury candle market is poised for significant growth, driven by evolving consumer preferences towards premium home products and sustainable practices. As disposable incomes rise and e-commerce continues to expand, brands that emphasize quality and unique experiences are likely to thrive. Additionally, the increasing popularity of wellness trends will further enhance the demand for scented candles, positioning the market for robust development in the coming years, particularly among younger consumers seeking personalized products.

| Segment | Sub-Segments |

|---|---|

| By Type | Scented Container Candles Luxury Votive Candles Luxury Pillar Candles Luxury Taper Candles Luxury Tealight Candles Luxury Decorative & Sculptural Candles Limited Edition & Gift Set Candles |

| By End-User | High-Income Residential Households Luxury Hospitality (Hotels, Resorts, Serviced Apartments) Fine Dining, Cafés & Premium Retail Spas, Wellness Centers & Beauty Salons Corporate & VIP Gifting |

| By Distribution Channel | Luxury Department Stores & Perfumeries Brand Boutiques & Concept Stores Lifestyle & Home Décor Stores E-commerce Marketplaces Direct-to-Consumer Online (Brand Websites & Social Commerce) |

| By Price Range | Ultra-Luxury (? SAR 400 per candle) Premium (SAR 200–399 per candle) Accessible Luxury (SAR 100–199 per candle) Gift Sets & Bundled Offers |

| By Occasion & Usage | Home Ambiance & Everyday Décor Religious & Cultural Occasions (Ramadan, Eid, Majlis) Weddings & Private Events Corporate Events & Hospitality Experiences Gifting & Souvenirs |

| By Wax & Material | Premium Paraffin Wax Blends Soy & Other Vegetable Wax Blends Beeswax & Natural Waxes Coconut & Palm Wax Blends Specialty & Sustainable Wax Blends |

| By Fragrance Profile | Oriental & Oud-Based Fragrances Floral & Rose-Based Fragrances Fresh, Citrus & Marine Fragrances Gourmand & Spicy Fragrances Custom & Limited-Edition Fragrances |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Candle Retailers | 60 | Store Managers, Brand Owners |

| Affluent Consumers | 120 | High-Income Households, Luxury Product Enthusiasts |

| Interior Designers | 50 | Design Consultants, Home Decor Specialists |

| Online Retail Platforms | 40 | E-commerce Managers, Digital Marketing Specialists |

| Market Analysts | 40 | Industry Analysts, Market Researchers |

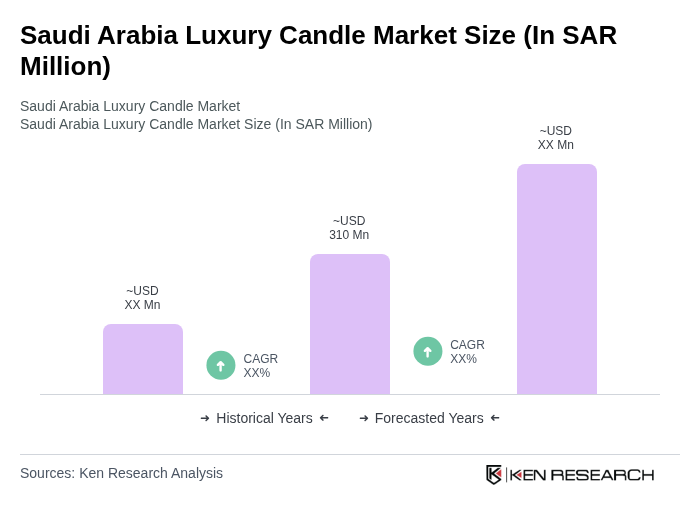

The Saudi Arabia Luxury Candle Market is valued at approximately SAR 310 million, reflecting a significant share within the broader Saudi Arabia candles market, which is estimated at about USD 9495 million.