Region:Middle East

Author(s):Shubham

Product Code:KRAC4235

Pages:99

Published On:October 2025

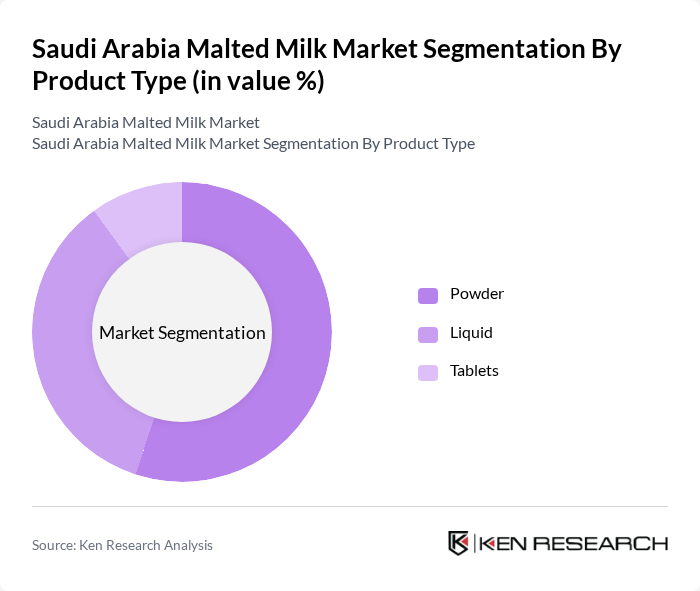

By Product Type:The market is segmented into three main product types: Powder, Liquid, and Tablets. Among these, the Powder segment is the most dominant due to its versatility and ease of use in various applications, including beverages, bakery, and nutritional supplements. The Liquid segment is also gaining traction, particularly among health-conscious consumers seeking convenient ready-to-drink options. Tablets, while less common, cater to specific consumer preferences for portable nutrition .

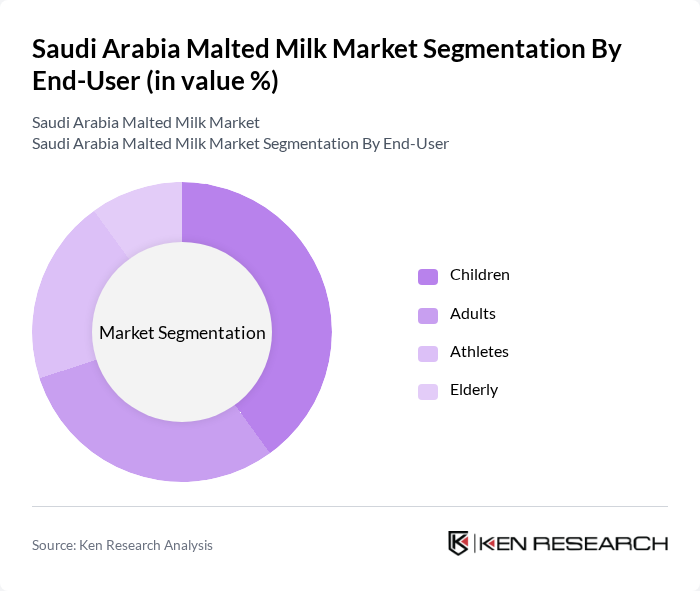

By End-User:The end-user segmentation includes Children, Adults, Athletes, and the Elderly. The Children segment leads the market, driven by parents' increasing focus on providing nutritious options for their kids. Adults are also a significant consumer group, often seeking malted milk for its health benefits. Athletes and the Elderly segments are growing as well, as these groups look for convenient sources of energy and nutrition .

The Saudi Arabia Malted Milk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Nestlé Saudi Arabia, FrieslandCampina, SADAFCO (Saudi Dairy and Foodstuff Company), Al Ain Dairy, Al Safi Danone, Nadec (National Agricultural Development Company), Panda Dairy, Lactel, GlaxoSmithKline (Horlicks), Mondelez International, Ferrero Group, Unilever Saudi Arabia, Arla Foods, and Emborg contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian malted milk market is poised for significant growth, driven by evolving consumer preferences towards healthier and convenient beverage options. As the population becomes more health-conscious, brands are likely to focus on product innovation, including organic and fortified variants. Additionally, the rise of e-commerce platforms will facilitate easier access to malted milk products, enhancing market penetration. Strategic partnerships with retailers will further bolster distribution, ensuring that brands can effectively meet the increasing demand across diverse consumer segments.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Powder Liquid Tablets |

| By End-User | Children Adults Athletes Elderly |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

| By Application | Beverages Bakery Products Confectionery Nutritional Supplements |

| By Packaging Type | Carton Packs Jars Tins Pouches |

| By Price Range | Economy Mid-Range Premium |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Makkah) Southern Region (Abha, Jizan) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Outlets for Malted Milk | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Urban Areas | 120 | Household Decision Makers, Health-Conscious Consumers |

| Distribution Channels Analysis | 80 | Distributors, Wholesalers |

| Market Trends and Innovations | 60 | Product Development Managers, Marketing Executives |

| Health and Nutrition Insights | 50 | Nutritionists, Health Coaches |

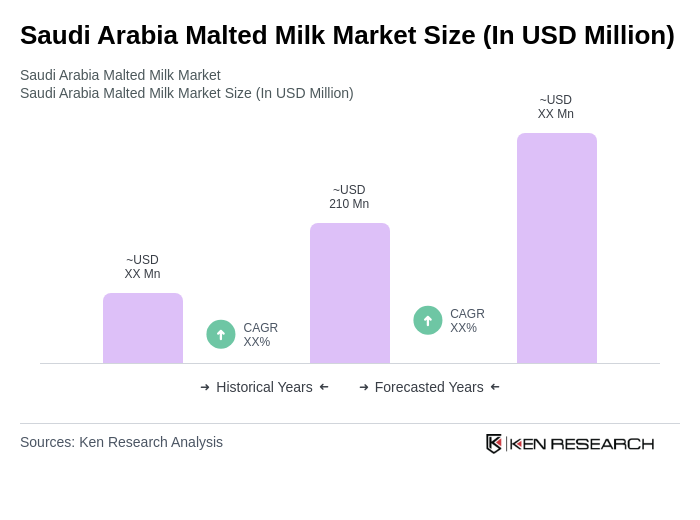

The Saudi Arabia Malted Milk Market is valued at approximately USD 210 million, reflecting a significant growth trend driven by increasing consumer awareness of its health benefits and rising demand for fortified food products.