Region:Global

Author(s):Shubham

Product Code:KRAA3189

Pages:96

Published On:August 2025

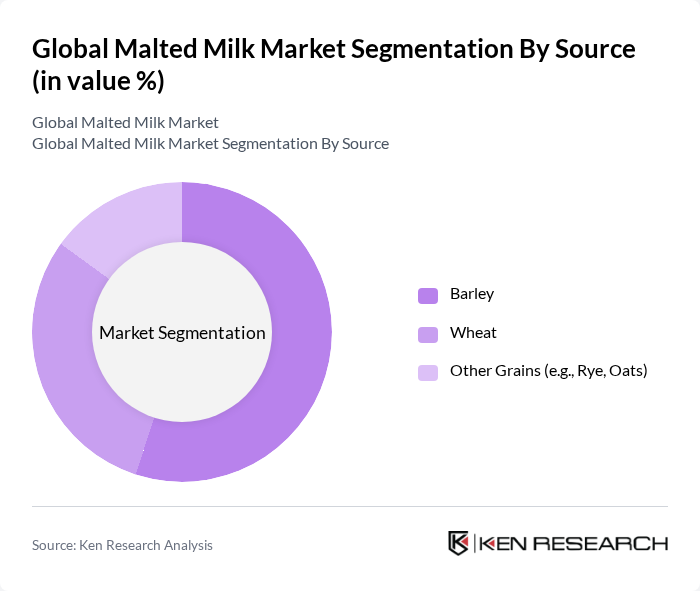

By Source:The market is segmented based on the source of grains used in malted milk production. The primary sources include barley, wheat, and other grains such as rye and oats. Barley remains the dominant source due to its high malt content, enzymatic activity, and favorable processing characteristics. Wheat is also widely used, offering a distinct flavor profile and nutritional benefits. Other grains—including rye and oats—are gaining traction as manufacturers respond to consumer demand for gluten-free and alternative grain options .

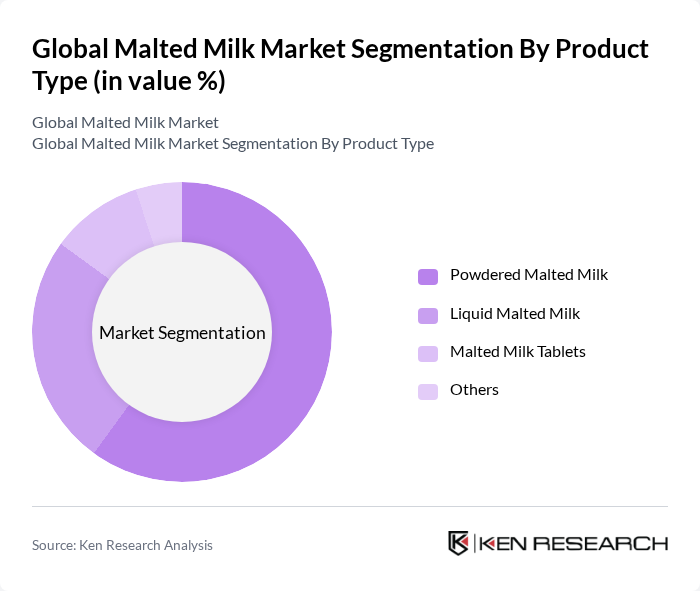

By Product Type:The product type segmentation includes powdered malted milk, liquid malted milk, malted milk tablets, and other forms. Powdered malted milk leads the segment, favored for its versatility, shelf stability, and ease of use in recipes and beverages. Liquid malted milk is popular for ready-to-drink applications, while malted milk tablets serve the on-the-go nutrition market. The "Others" category encompasses emerging niche products, such as plant-based and specialty formulations .

The Global Malted Milk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., The Kraft Heinz Company, Abbott Laboratories, GlaxoSmithKline plc, Royal FrieslandCampina N.V., Ovaltine (Associated British Foods plc), Horlicks (Haleon plc), Malt-O-Meal (Post Holdings, Inc.), Bournvita (Mondelez International, Inc.), Milo (Nestlé S.A.), Enfamil (Reckitt Benckiser Group plc), Ensure (Abbott Laboratories), Pediasure (Abbott Laboratories), Carnation (Nestlé S.A.), Complan (Hindustan Unilever Limited) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the malted milk market appears promising, driven by increasing health awareness and the demand for nutritious beverages. As consumers continue to prioritize health, the market is likely to see innovations in product formulations, including organic and plant-based options. Additionally, the expansion of online sales channels will facilitate greater accessibility, allowing brands to reach untapped markets and cater to diverse consumer preferences, ultimately enhancing market growth.

| Segment | Sub-Segments |

|---|---|

| By Source | Barley Wheat Other Grains (e.g., Rye, Oats) |

| By Product Type | Powdered Malted Milk Liquid Malted Milk Malted Milk Tablets Others |

| By End-User | Food Industry Retail (Household Consumption) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Direct Sales |

| By Packaging Type | Carton Packs Jars Tins Pouches Others |

| By Region | North America Latin America Western Europe Eastern Europe Asia-Pacific Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Health-Conscious Consumers, Parents |

| Food Service Sector | 80 | Restaurant Owners, Beverage Managers |

| Nutrition and Health Trends | 60 | Dietitians, Health Coaches |

| Market Distribution Channels | 90 | Wholesalers, Distributors |

The Global Malted Milk Market is valued at approximately USD 2 billion, reflecting a five-year historical analysis. This valuation highlights the growing consumer demand for nutritious and functional beverages, particularly malted milk, known for its rich nutritional profile.