Region:Middle East

Author(s):Shubham

Product Code:KRAD6708

Pages:88

Published On:December 2025

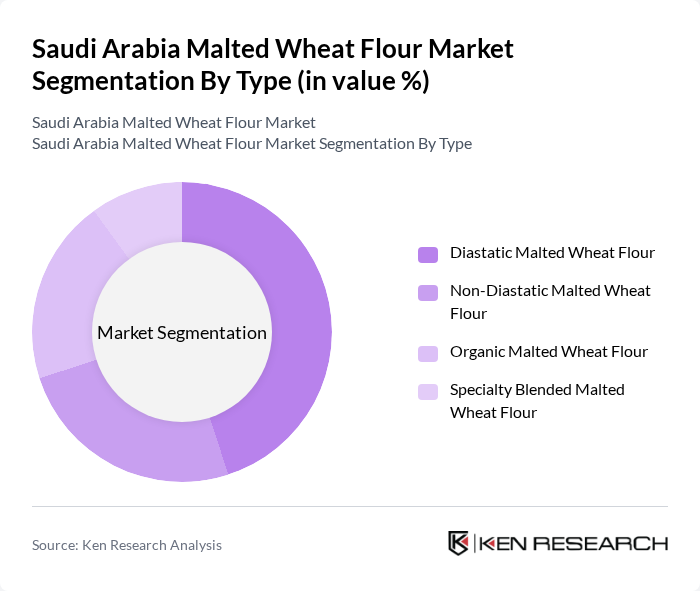

By Type:The market is segmented into various types of malted wheat flour, including Diastatic Malted Wheat Flour, Non-Diastatic Malted Wheat Flour, Organic Malted Wheat Flour, and Specialty Blended Malted Wheat Flour. Among these, Diastatic Malted Wheat Flour is leading due to its essential role in baking and brewing processes, where it acts as a natural enzyme source, enhancing fermentation and flavor. The increasing trend towards organic products is also driving the growth of Organic Malted Wheat Flour, as consumers become more health-conscious and seek natural ingredients.

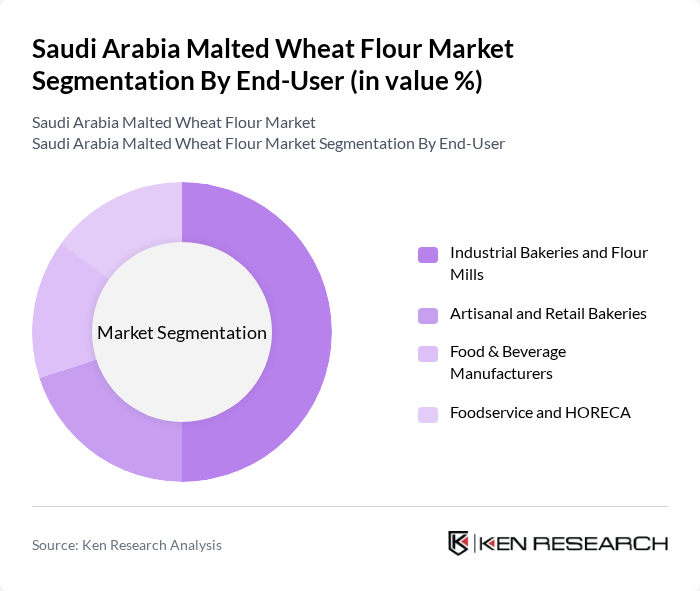

By End-User:The end-user segmentation includes Industrial Bakeries and Flour Mills, Artisanal and Retail Bakeries, Food & Beverage Manufacturers, and Foodservice and HORECA. Industrial Bakeries and Flour Mills dominate the market due to their high-volume production capabilities and the increasing demand for baked goods. The rise in artisanal baking and the growth of the foodservice sector are also contributing to the demand for malted wheat flour, as these segments seek quality ingredients to enhance their product offerings.

The Saudi Arabia Malted Wheat Flour Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Milling Company (formerly First Flour Mills Co.), Second Milling Company, Third Milling Company, Fourth Milling Company, Arabian Agricultural Services Company (ARASCO), National Grain Company, Almarai Company, Saudia Dairy & Foodstuff Company (SADAFCO), Savola Group, Al Othaim Markets Company, Al Islami Foods, Agthia Group PJSC, Al Ghurair Foods, IFFCO Group, Archer Daniels Midland Company (ADM) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the malted wheat flour market in Saudi Arabia appears promising, driven by increasing health consciousness and a growing food processing sector. As consumers continue to seek healthier alternatives, the demand for malted products is expected to rise. Additionally, advancements in production technology will likely enhance product quality and availability, making malted wheat flour more accessible. The market is poised for growth, with potential collaborations between manufacturers and health-focused brands further expanding its reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Diastatic Malted Wheat Flour Non?Diastatic Malted Wheat Flour Organic Malted Wheat Flour Specialty Blended Malted Wheat Flour |

| By End-User | Industrial Bakeries and Flour Mills Artisanal and Retail Bakeries Food & Beverage Manufacturers (Snacks, Cereals, Beverages) Foodservice and HORECA |

| By Packaging Type | Bulk Bags (?25 kg) Intermediate Bulk Containers / Silos Retail Packs (<5 kg) Customized Industrial Packaging |

| By Distribution Channel | Direct Institutional Sales Distributors and Wholesalers Modern Retail (Supermarkets/Hypermarkets) Online and B2B E?commerce Platforms |

| By Region | Central Region (Riyadh and Surrounding) Eastern Region Western Region (Makkah, Madinah, Jeddah) Southern & Northern Regions |

| By Application | Bread and Flatbreads Bakery Products (Cakes, Biscuits, Pastries) Breakfast Cereals & Nutritional Foods Malted Beverages and Syrups |

| By Product Form | Fine Powder Coarse / Granulated Liquid / Extract Form |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bakery Sector Flour Usage | 120 | Bakery Owners, Production Managers |

| Food Manufacturing Flour Requirements | 100 | Food Product Developers, Procurement Managers |

| Retail Flour Sales Insights | 80 | Retail Managers, Category Buyers |

| Export Market Flour Demand | 60 | Export Managers, Trade Analysts |

| Consumer Preferences in Flour Products | 110 | Household Consumers, Nutritionists |

The Saudi Arabia Malted Wheat Flour Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by increasing demand for malted products in the food and beverage sector and a shift towards healthier eating habits among consumers.