Saudi Arabia Medical Device Testing Services Market Overview

- The Saudi Arabia Medical Device Testing Services Market is valued at USD 60 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for high-quality medical devices, stringent regulatory requirements, and the rising focus on patient safety and product efficacy. The market is also supported by advancements in technology and the growing healthcare sector in the region, with significant investments under Vision 2030 accelerating the adoption of advanced testing protocols and local manufacturing capabilities .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their robust healthcare infrastructure, presence of major hospitals, and medical device manufacturers. Riyadh, being the capital, serves as a central hub for regulatory bodies and healthcare services, while Jeddah and Dammam are critical for their strategic locations and access to international trade routes. The expansion of specialized healthcare cities and manufacturing zones under Vision 2030 further strengthens the regional testing ecosystem .

- In 2023, the Saudi Food and Drug Authority (SFDA) implemented new regulations mandating that all medical devices undergo rigorous testing and certification before market entry. This regulation, including the MDS-G010 guidance for AI- and machine learning-enabled devices, aims to enhance the safety and effectiveness of medical devices, ensuring compliance with international standards and protecting public health. The regulatory framework is aligned with global best practices, increasing the demand for accredited testing services within the country .

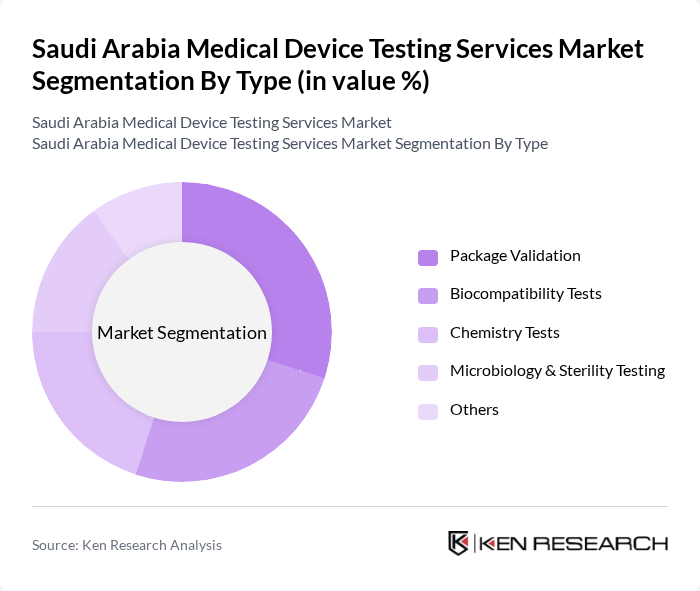

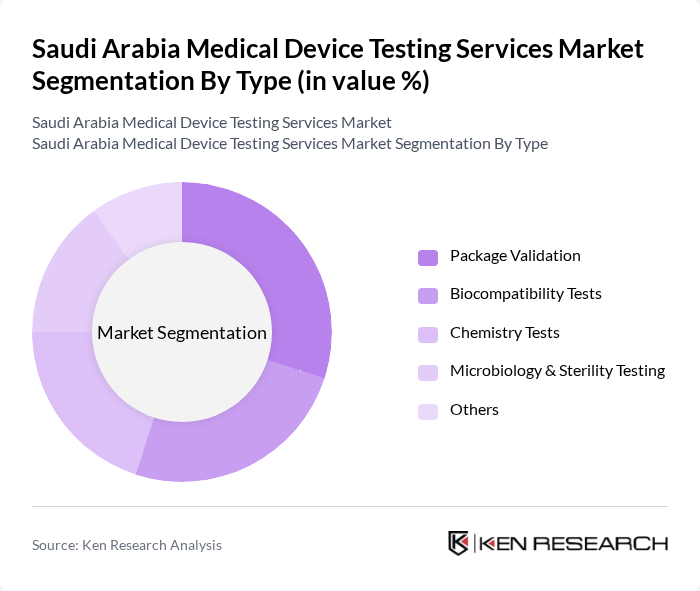

Saudi Arabia Medical Device Testing Services Market Segmentation

By Type:The market is segmented into various types of testing services, including Package Validation, Biocompatibility Tests, Chemistry Tests, Microbiology & Sterility Testing, and Others. Each of these segments plays a crucial role in ensuring the safety and efficacy of medical devices. Among these, Biocompatibility Tests is the largest segment, reflecting the critical importance of biological safety in medical device development. Chemistry Tests is the fastest-growing segment, driven by the increasing complexity of device materials and regulatory scrutiny .

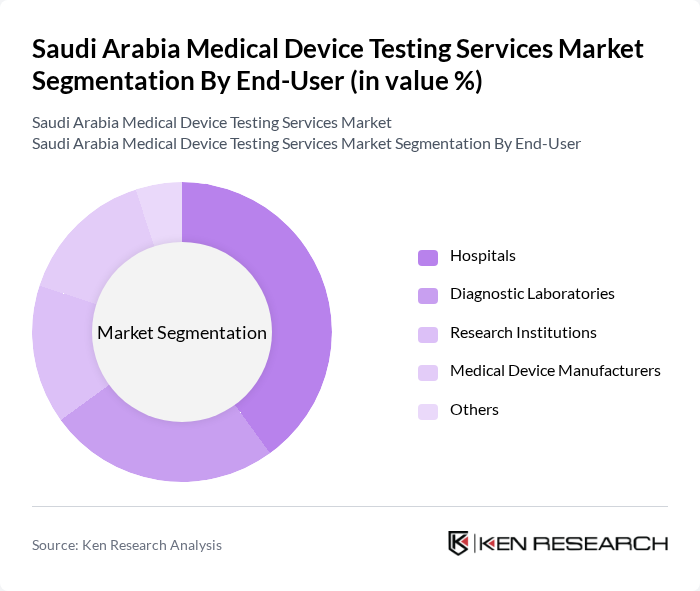

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, Medical Device Manufacturers, and Others. Hospitals are the leading end-users due to their high demand for testing services to ensure the safety and effectiveness of medical devices used in patient care. The increasing number of hospitals and healthcare facilities in Saudi Arabia further drives this segment, with diagnostic laboratories and research institutions also playing a growing role in supporting innovation and regulatory compliance .

Saudi Arabia Medical Device Testing Services Market Competitive Landscape

The Saudi Arabia Medical Device Testing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS S.A., Intertek Group plc, TÜV SÜD AG, Bureau Veritas S.A., UL LLC, Eurofins Scientific SE, DNV GL, Medpace Holdings, Inc., Charles Lawrence International, Qserve Group, BSI Group, KPMG, PPD, Inc., Labcorp, MDSAP, Saudi Food and Drug Authority (SFDA) Testing Labs, King Faisal Specialist Hospital & Research Centre (KFSH&RC) Medical Device Testing Unit, King Saud University Medical Device Testing Center, King Abdulaziz City for Science and Technology (KACST) Medical Device Testing Facility, Saudi Central Laboratory (SCL) contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Medical Device Testing Services Market Industry Analysis

Growth Drivers

- Increasing Healthcare Expenditure:Saudi Arabia's healthcare expenditure is projected to reach approximately SAR 200 billion (USD 53.3 billion) in future, reflecting a significant increase from previous years. This rise is driven by the government's commitment to enhancing healthcare services and infrastructure, as outlined in Vision 2030. The increased funding facilitates investments in medical device testing services, ensuring compliance with international standards and improving patient outcomes, thereby fostering market growth.

- Rising Demand for Advanced Medical Technologies:The demand for advanced medical technologies in Saudi Arabia is expected to surge, with the market for medical devices anticipated to exceed SAR 30 billion (USD 8 billion) in future. This growth is fueled by an aging population and a higher prevalence of chronic diseases, necessitating innovative medical solutions. Consequently, the need for rigorous testing services to validate these technologies becomes paramount, driving the market for medical device testing services.

- Stringent Regulatory Requirements:The Saudi Food and Drug Authority (SFDA) has implemented stringent regulations for medical devices, mandating compliance with international testing standards. In future, the SFDA is expected to enhance its regulatory framework, requiring all medical devices to undergo comprehensive testing before market entry. This regulatory environment not only ensures patient safety but also stimulates demand for local testing services, thereby propelling market growth in the medical device testing sector.

Market Challenges

- High Costs of Testing Services:The costs associated with medical device testing services in Saudi Arabia can be prohibitively high, often exceeding SAR 1 million (USD 266,000) for comprehensive evaluations. This financial burden can deter smaller manufacturers from seeking necessary testing, potentially leading to non-compliance with regulatory standards. As a result, the high costs present a significant challenge to the growth of the medical device testing services market in the region.

- Limited Availability of Skilled Professionals:The medical device testing sector in Saudi Arabia faces a shortage of skilled professionals, with estimates indicating a gap of over 5,000 qualified personnel in future. This shortage hampers the ability of testing facilities to meet increasing demand and maintain high-quality standards. The lack of trained experts poses a challenge to the market, as it limits the capacity for efficient and effective testing services.

Saudi Arabia Medical Device Testing Services Market Future Outlook

The future of the medical device testing services market in Saudi Arabia appears promising, driven by ongoing investments in healthcare infrastructure and advancements in technology. As the government continues to prioritize healthcare improvements, the demand for testing services is expected to rise. Additionally, the integration of digital health solutions and artificial intelligence in testing processes will enhance efficiency and accuracy, positioning the market for significant growth in the coming years.

Market Opportunities

- Expansion of Healthcare Infrastructure:The Saudi government is investing heavily in healthcare infrastructure, with plans to establish over 100 new hospitals in future. This expansion will create a substantial demand for medical device testing services, as new facilities will require compliance with stringent testing standards to ensure patient safety and quality of care.

- Adoption of Digital Health Solutions:The increasing adoption of digital health solutions, projected to reach SAR 5 billion (USD 1.3 billion) in future, presents a significant opportunity for the medical device testing services market. As telemedicine and remote monitoring technologies gain traction, the need for rigorous testing and validation of these devices will grow, driving demand for specialized testing services.