Region:Asia

Author(s):Geetanshi

Product Code:KRAD4184

Pages:96

Published On:December 2025

By Service Type:The service type segmentation includes various testing services essential for ensuring the safety and efficacy of medical devices. The subsegments include biocompatibility testing, microbiology & sterility testing, chemistry and material characterization testing, package validation and shelf-life testing, electrical safety and EMC testing, software and cybersecurity testing, and others. Among these, biocompatibility testing is currently the leading subsegment, in line with industry data that identifies biocompatibility tests as the largest revenue?generating service, driven by the increasing emphasis on patient safety, ISO 10993 compliance, and regulatory requirements for materials in contact with the body.

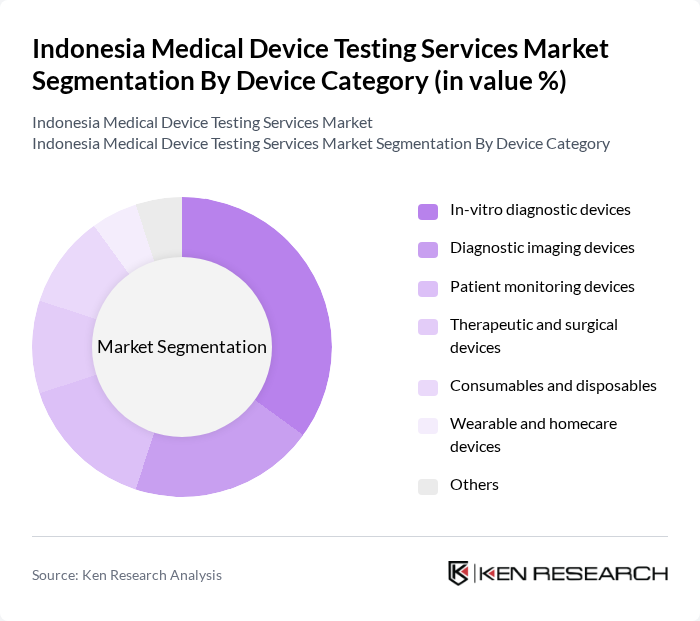

By Device Category:The device category segmentation encompasses various types of medical devices that require testing services. This includes in-vitro diagnostic devices, diagnostic imaging devices, patient monitoring devices, therapeutic and surgical devices, consumables and disposables, wearable and homecare devices, and others. The in-vitro diagnostic devices segment is currently the most significant, reflecting Indonesia’s high utilization of laboratory and rapid tests under BPJS coverage and the rising prevalence of chronic and infectious diseases that require reliable and rapid diagnostic solutions.

The Indonesia Medical Device Testing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT TÜV Rheinland Indonesia, PT SGS Indonesia, PT Intertek Utama Services, PT Sucofindo (Persero), PT Surveyor Indonesia, PT Qualis Indonesia (Qualis Indonesia Laboratory), PT Saraswanti Indo Genetech, PT Prodia Widyahusada Tbk (Prodia Diagnostic Laboratory), PT Bio Farma (Persero) – Biomedical & device testing facilities, Balai Besar Pengujian Alat Kesehatan (BBPOM / National Medical Device Testing Center), Badan Standardisasi Nasional (BSN) – SNI and conformity assessment bodies, PT Medivest Indonesia, PT Kalgen Innolab (Kalgen Laboratory), PT Kimia Farma Diagnostika, PT ITS Testing Services Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia medical device testing services market appears promising, driven by technological advancements and increasing regulatory scrutiny. As manufacturers adopt automation and AI in testing processes, efficiency and accuracy will improve, enhancing service delivery. Additionally, the focus on sustainability will encourage the development of eco-friendly testing methodologies. These trends, combined with a growing emphasis on personalized medicine, will shape the market landscape, fostering innovation and expanding opportunities for service providers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Biocompatibility testing Microbiology & sterility testing Chemistry and material characterization testing Package validation and shelf-life testing Electrical safety and EMC testing Software and cybersecurity testing Others |

| By Device Category | In-vitro diagnostic devices Diagnostic imaging devices Patient monitoring devices Therapeutic and surgical devices Consumables and disposables Wearable and homecare devices Others |

| By End-User | Medical device manufacturers Contract research organizations (CROs) Hospitals and diagnostic laboratories Academic and research institutes Others |

| By Regulatory Compliance Support | Indonesia local certification (MoH/BPOM, SNI) CE Marking (EU MDR/IVDR) U.S. FDA submissions Other international certifications |

| By Testing Phase | Preclinical testing Clinical performance and validation studies Post-market surveillance and vigilance testing Others |

| By Service Delivery Model | Outsourced / third-party testing services In-house testing services Hybrid / collaborative model Others |

| By Client Size | Multinational medical device companies Large domestic manufacturers Small & medium enterprises (SMEs) / start-ups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Testing Laboratories | 70 | Laboratory Directors, Compliance Officers |

| Healthcare Providers | 60 | Clinical Engineers, Procurement Managers |

| Regulatory Bodies | 40 | Policy Makers, Health Inspectors |

| Industry Associations | 50 | Executive Directors, Research Analysts |

The Indonesia Medical Device Testing Services Market is valued at approximately USD 140 million, reflecting a significant growth driven by increasing demand for high-quality medical devices and stringent regulatory requirements from the Ministry of Health and related agencies.