Region:Middle East

Author(s):Rebecca

Product Code:KRAA5745

Pages:87

Published On:January 2026

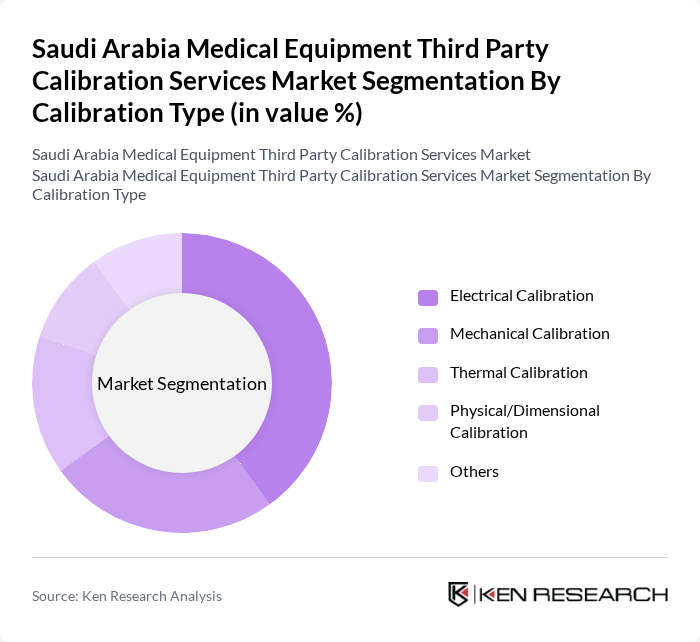

By Calibration Type:The calibration services market is segmented into various types, including Electrical Calibration, Mechanical Calibration, Thermal Calibration, Physical/Dimensional Calibration, and Others. Among these, Electrical Calibration is the most dominant segment due to the extensive use of electrical medical devices in hospitals and clinics. The increasing complexity of medical equipment necessitates precise electrical calibration to ensure optimal performance and safety.

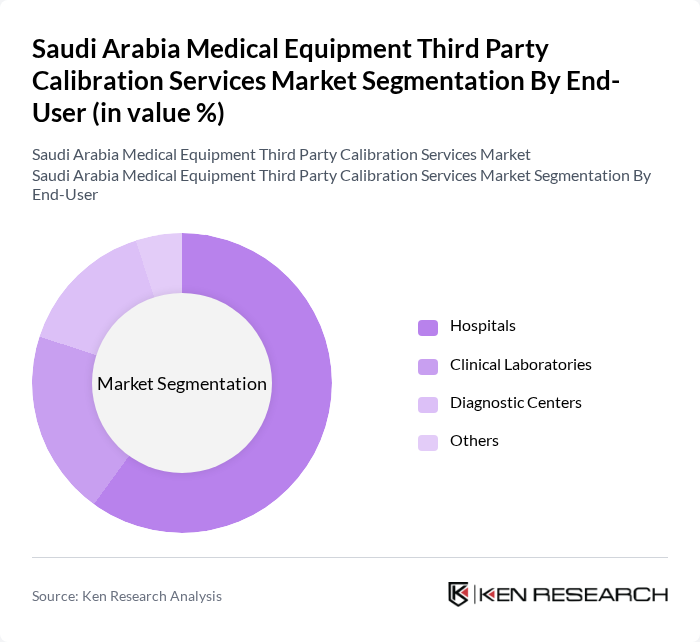

By End-User:The end-user segmentation includes Hospitals, Clinical Laboratories, Diagnostic Centers, and Others. Hospitals represent the largest segment, driven by the high volume of medical equipment requiring regular calibration to maintain safety and compliance. The increasing number of hospitals and healthcare facilities in Saudi Arabia further fuels the demand for calibration services.

The Saudi Arabia Medical Equipment Third Party Calibration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Falak Electronic Equipment & Supplies Co., Saudi Calibration Company, Al-Muhaidib Group, Aries Calibration LAB, Al Borg Calibration Laboratory, Gulf Calibration Services, MT Enterprises, AIM Inspection & Calibration Service, TÜV SÜD Calibration Laboratory, Testo SE & Co. KGaA, Fugro Suhaimi Limited, Al-Jazira Equipment Co., Al-Mansour Medical Equipment, Al-Salam Calibration Services, Al-Bilad Calibration Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia medical equipment third-party calibration services market appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. In future, the integration of IoT in calibration processes is expected to enhance service efficiency and accuracy. Additionally, the increasing focus on preventive maintenance will likely lead to a greater reliance on third-party services, as healthcare providers seek to minimize equipment downtime and ensure compliance with evolving regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Calibration Type | Electrical Calibration Mechanical Calibration Thermal Calibration Physical/Dimensional Calibration Others |

| By End-User | Hospitals Clinical Laboratories Diagnostic Centers Others |

| By Service Provider Type | Third-Party Calibration Services OEM Calibration Services In-House Calibration Services |

| By Service Delivery Mode | On-Site Calibration Off-Site Calibration Hybrid Calibration Services |

| By Accreditation Type | ISO 17025 Accredited Services Non-Accredited Services Others |

| By Geographic Region | Riyadh (Central Region) Jeddah (Western Region) Dammam (Eastern Region) Southern Region Others |

| By Ownership Type | Public Sector Private Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Calibration Services for Hospitals | 45 | Biomedical Engineers, Hospital Administrators |

| Calibration for Diagnostic Equipment | 38 | Laboratory Managers, Quality Assurance Officers |

| Calibration for Surgical Instruments | 32 | Surgeons, Operating Room Managers |

| Calibration for Imaging Equipment | 42 | Radiologists, Imaging Technologists |

| Calibration for Patient Monitoring Devices | 35 | Nursing Supervisors, Clinical Engineers |

The Saudi Arabia Medical Equipment Third Party Calibration Services Market is valued at approximately USD 600 million, reflecting a significant demand for accurate calibration services essential for patient safety and compliance with international standards.