Region:Middle East

Author(s):Dev

Product Code:KRAC3283

Pages:80

Published On:January 2026

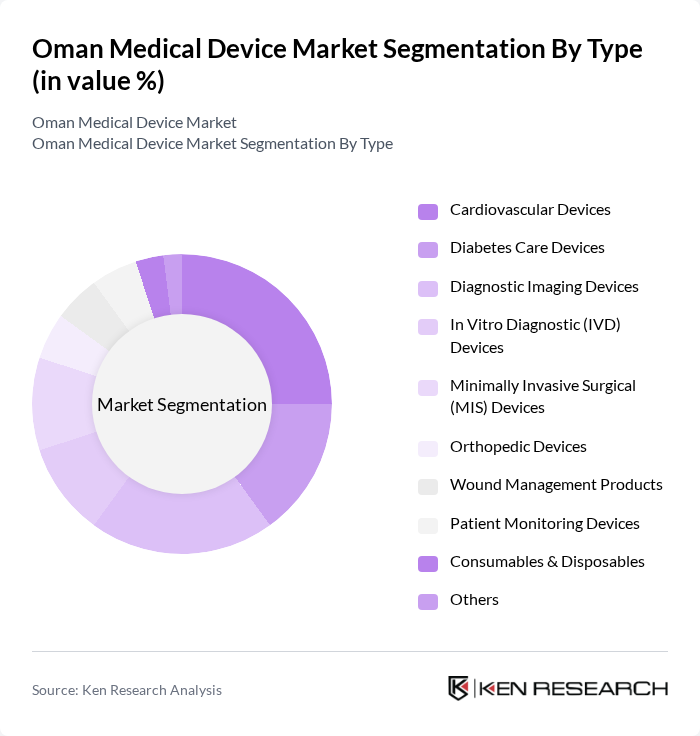

By Type:The medical device market can be segmented into various types, including cardiovascular devices, diabetes care devices, diagnostic imaging devices, in vitro diagnostic (IVD) devices, minimally invasive surgical (MIS) devices, orthopedic devices, wound management products, patient monitoring devices, consumables & disposables, and others. This classification is consistent with recognized segmentation of the Oman medical devices market by type. Each of these segments plays a crucial role in addressing specific healthcare needs and improving patient outcomes, with strong demand particularly in diagnostic imaging, cardiovascular, diabetes care, and IVD categories to support the management of non?communicable diseases and critical care.

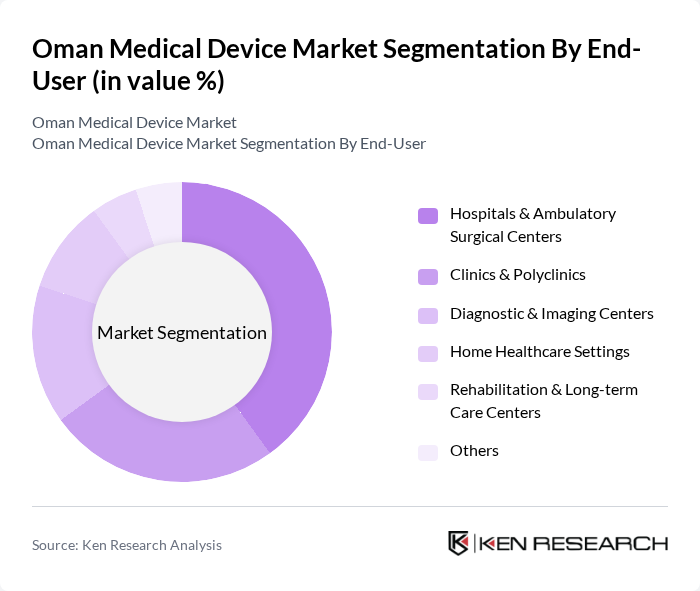

By End-User:The end-user segmentation includes hospitals & ambulatory surgical centers, clinics & polyclinics, diagnostic & imaging centers, home healthcare settings, rehabilitation & long-term care centers, and others. This aligns with common application-based segmentation of the Oman medical devices market, where hospitals and ambulatory surgical centers account for the largest share, followed by clinics and other outpatient facilities. Each segment reflects the diverse settings in which medical devices are utilized, catering to various patient needs and healthcare delivery models, with growing utilization in home healthcare settings for chronic disease monitoring and in rehabilitation and long-term care centers for mobility aids and monitoring devices.

The Oman Medical Device Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE HealthCare, Philips, Medtronic plc, Abbott Laboratories, Johnson & Johnson (including Ethicon & DePuy Synthes), Stryker Corporation, Boston Scientific Corporation, B. Braun Melsungen AG, Olympus Corporation, Terumo Corporation, Smith & Nephew plc, Zimmer Biomet Holdings, Inc., 3M Health Care, Hologic, Inc. contribute to innovation, geographic expansion, and service delivery in this space, primarily through imaging systems, cardiovascular and orthopedic implants, surgical equipment, diagnostics, and infection prevention products.

The Oman medical device market is poised for significant growth, driven by increasing healthcare investments and a rising demand for innovative medical technologies. As the government continues to enhance healthcare infrastructure, the market is expected to see a surge in the adoption of advanced medical devices. Additionally, the integration of digital health solutions and telemedicine will likely reshape patient care, making healthcare more accessible and efficient. This evolving landscape presents numerous opportunities for both local and international players in the medical device sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Cardiovascular Devices Diabetes Care Devices Diagnostic Imaging Devices In Vitro Diagnostic (IVD) Devices Minimally Invasive Surgical (MIS) Devices Orthopedic Devices Wound Management Products Patient Monitoring Devices Consumables & Disposables Others |

| By End-User | Hospitals & Ambulatory Surgical Centers Clinics & Polyclinics Diagnostic & Imaging Centers Home Healthcare Settings Rehabilitation & Long-term Care Centers Others |

| By Application | Cardiology Orthopedics & Trauma Neurology Respiratory & Anesthesia Diabetes & Endocrinology General Surgery & Critical Care Others |

| By Distribution Channel | Direct Sales to Providers Local Distributors/Importers Tender-based & Institutional Procurement Online B2B Platforms Retail Pharmacies & Medical Stores Others |

| By Technology | Wearable & Connected Devices Implantable Devices Robotic & Computer-assisted Surgery Systems D Printed Medical Devices AI-enabled & Digital Health Devices Others |

| By Region | Muscat Salalah Sohar Nizwa Other Governorates |

| By Policy Support | Government Healthcare Infrastructure Programs Public–Private Partnership (PPP) Initiatives Local Manufacturing & Localization Incentives R&D and Innovation Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Medical Device Manufacturers | 50 | Sales Directors, Product Managers |

| Healthcare Facility Administrators | 40 | Facility Managers, Operations Directors |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Healthcare Professionals | 70 | Doctors, Nurses, Medical Technologists |

The Oman Medical Device Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increased healthcare expenditure, rising chronic disease prevalence, and advancements in medical technology.