Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4798

Pages:97

Published On:December 2025

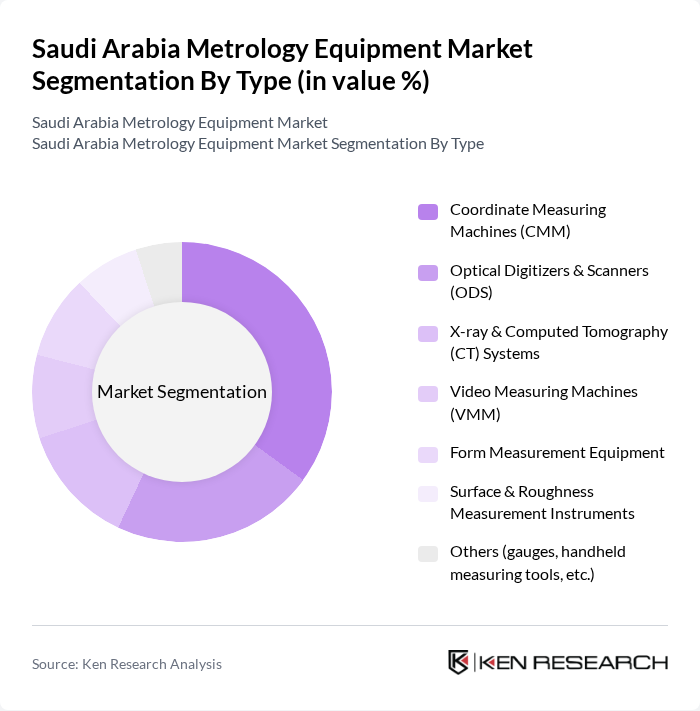

By Type:The market is segmented into various types of metrology equipment, including Coordinate Measuring Machines (CMM), Optical Digitizers & Scanners (ODS), X-ray & Computed Tomography (CT) Systems, Video Measuring Machines (VMM), Form Measurement Equipment, Surface & Roughness Measurement Instruments, and Others (gauges, handheld measuring tools, etc.). This structure is consistent with recent Saudi Arabia metrology and industrial metrology reports, where CMMs and optical digitizers and scanners are identified as key equipment categories, with CMM holding the largest share and ODS among the fastest-growing segments. Each of these subsegments plays a crucial role in ensuring precision and quality in manufacturing processes.

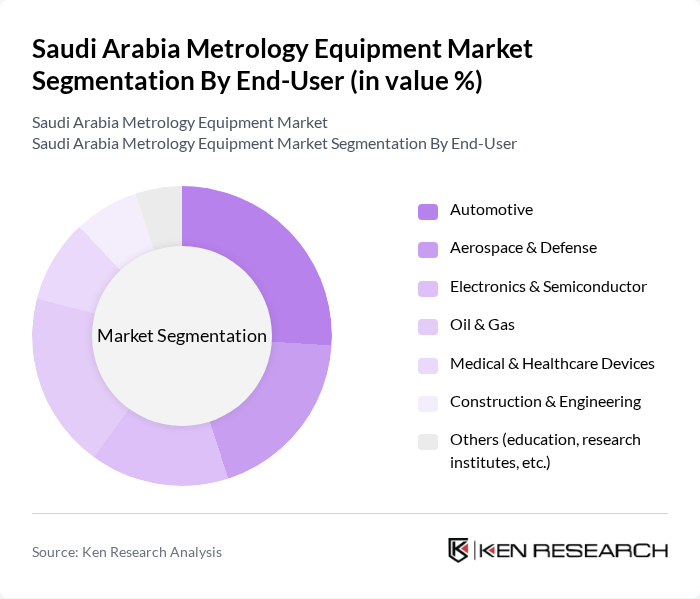

By End-User:The end-user segmentation includes Automotive, Aerospace & Defense, Electronics & Semiconductor, Oil & Gas, Medical & Healthcare Devices, Construction & Engineering, and Others (education, research institutes, etc.). This reflects the major industrial metrology and 3D metrology demand clusters in Saudi Arabia, where automotive, aerospace, electronics, and oil & gas are highlighted as leading adopters of metrology solutions for quality control, dimensional inspection, and process optimization. Each sector has unique requirements for metrology equipment, driven by the need for quality assurance and regulatory compliance.

The Saudi Arabia Metrology Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Standards, Metrology and Quality Organization (SASO), National Measurement and Calibration Center (NMCC) – KACST, Hexagon AB, Carl Zeiss AG (ZEISS Industrial Metrology), Mitutoyo Corporation, Renishaw plc, Nikon Metrology NV, FARO Technologies, Inc., Keysight Technologies, Inc., Fluke Corporation, Rohde & Schwarz GmbH & Co. KG, Mahr GmbH, KLA Corporation, Intertek Group plc, SGS SA contribute to innovation, geographic expansion, and service delivery in this space, providing solutions ranging from dimensional metrology and 3D scanning to electronic test and measurement, calibration, and conformity assessment services.

The future of the Saudi Arabia metrology equipment market appears promising, driven by ongoing technological innovations and government support. As industries increasingly prioritize quality assurance and compliance with international standards, the demand for advanced metrology solutions is expected to rise. Furthermore, the integration of IoT and automation technologies will likely enhance operational efficiency, positioning the market for significant growth. Companies that invest in training and development will be better equipped to navigate the evolving landscape and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Coordinate Measuring Machines (CMM) Optical Digitizers & Scanners (ODS) X-ray & Computed Tomography (CT) Systems Video Measuring Machines (VMM) Form Measurement Equipment Surface & Roughness Measurement Instruments Others (gauges, handheld measuring tools, etc.) |

| By End-User | Automotive Aerospace & Defense Electronics & Semiconductor Oil & Gas Medical & Healthcare Devices Construction & Engineering Others (education, research institutes, etc.) |

| By Industry | Discrete Manufacturing (metalworking, machinery, etc.) Process Industries (petrochemicals, refining, etc.) Power & Energy Infrastructure & Construction Food & Beverage Others |

| By Measurement Technique | Contact Measurement Non-Contact Optical Measurement Laser Scanning & Inline Metrology X-ray / CT-based Measurement Others |

| By Calibration Type | In-House Calibration (OEM / captive labs) Third-Party Accredited Calibration Services OEM Service Contracts Others |

| By Application | Quality Control & Inspection Research and Development Production Monitoring & Inline Inspection Reverse Engineering & Mapping Others |

| By Policy Support | Vision 2030 Industrial & Localization Programs Government Subsidies & Funding Schemes Tax Incentives & Customs Exemptions Regulatory Compliance & Accreditation Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Metrology Equipment | 120 | Quality Control Managers, Production Engineers |

| Calibration Services | 90 | Calibration Technicians, Laboratory Managers |

| Healthcare Measurement Devices | 80 | Biomedical Engineers, Hospital Procurement Officers |

| Research and Development Metrology | 70 | R&D Managers, Product Development Engineers |

| Environmental Monitoring Equipment | 60 | Environmental Scientists, Compliance Officers |

The Saudi Arabia Metrology Equipment Market is valued at approximately USD 170 million, reflecting a growing demand for precision measurement tools across various industries, including automotive, aerospace, and oil & gas.