Region:Middle East

Author(s):Shubham

Product Code:KRAA8726

Pages:80

Published On:November 2025

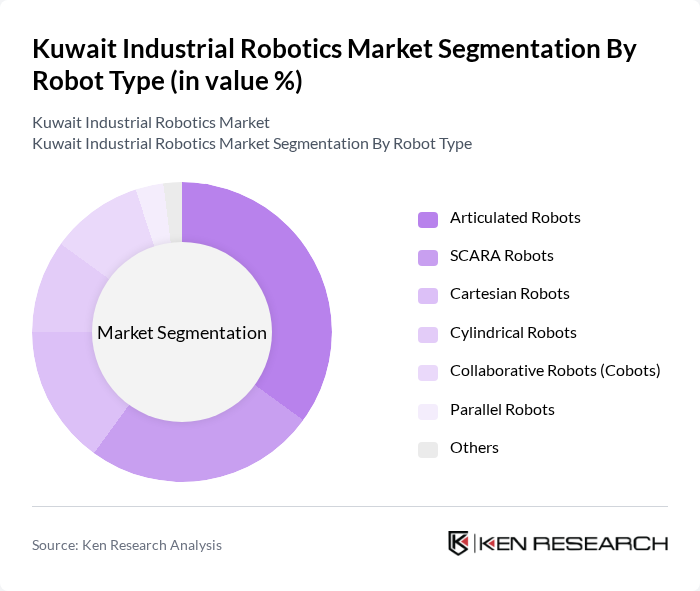

By Robot Type:The industrial robotics market in Kuwait is segmented into articulated robots, SCARA robots, Cartesian robots, cylindrical robots, collaborative robots (cobots), parallel robots, and others. Articulated robots are widely adopted for their versatility and ability to perform complex tasks in manufacturing and assembly lines. SCARA robots are preferred for high-speed, precise assembly and packaging operations. Collaborative robots are increasingly utilized for their ability to safely work alongside human operators, enhancing productivity and workplace safety. These trends reflect the global shift toward flexible automation and human-robot collaboration .

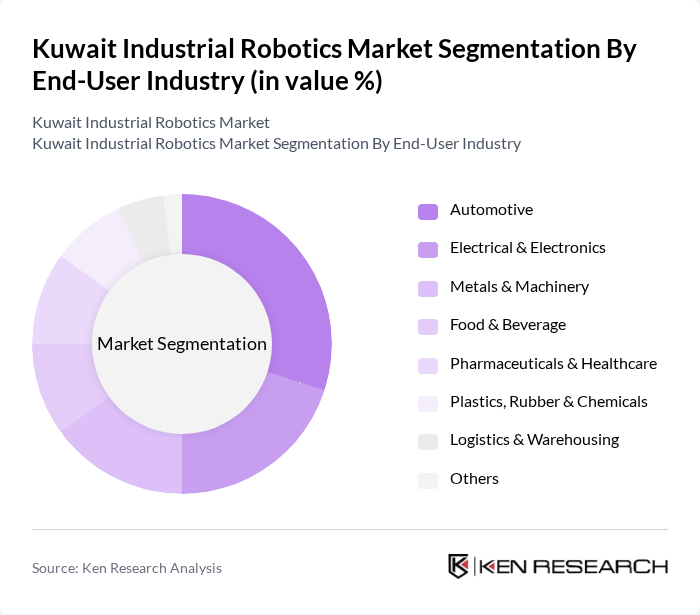

By End-User Industry:The end-user industries for industrial robotics in Kuwait include automotive, electrical & electronics, metals & machinery, food & beverage, pharmaceuticals & healthcare, plastics, rubber & chemicals, logistics & warehousing, and others. The automotive sector is a leading adopter, driven by the need for automation in assembly and welding lines. The electrical & electronics industry leverages robotics for precision manufacturing and quality control. The healthcare sector is increasingly integrating robotics for laboratory automation and surgical assistance, mirroring global trends toward automation in diverse sectors .

The Kuwait Industrial Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as KUKA Robotics, ABB Robotics, FANUC Corporation, Yaskawa Electric Corporation, Mitsubishi Electric, Universal Robots, Omron Adept Technologies, Siemens AG, Kawasaki Heavy Industries, Epson Robots, Denso Robotics, Stäubli Robotics, Comau S.p.A., AUBO Robotics, Techman Robot, Hyundai Robotics, Siasun Robot & Automation, Nachi-Fujikoshi Corp., Doosan Robotics, ABB Kuwait (local subsidiary) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait industrial robotics market appears promising, driven by ongoing technological advancements and government support for automation. As industries increasingly recognize the benefits of robotics, the integration of IoT and AI technologies is expected to enhance operational capabilities. Furthermore, the focus on sustainability will likely lead to the development of energy-efficient robotic solutions, positioning Kuwait as a competitive player in the regional robotics landscape. Continued investment in workforce training will also be crucial for overcoming existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Robot Type | Articulated Robots SCARA Robots Cartesian Robots Cylindrical Robots Collaborative Robots (Cobots) Parallel Robots Others |

| By End-User Industry | Automotive Electrical & Electronics Metals & Machinery Food & Beverage Pharmaceuticals & Healthcare Plastics, Rubber & Chemicals Logistics & Warehousing Others |

| By Application | Welding & Soldering Material Handling Assembly & Disassembly Packaging & Palletizing Painting & Coating Quality Inspection Others |

| By Payload Capacity | Up to 16 kg –60 kg –225 kg Above 225 kg |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Eastern Kuwait |

| By Investment Source | Private Investments Government Funding International Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Robotics Adoption | 80 | Production Managers, Automation Engineers |

| Oil & Gas Industry Automation | 70 | Operations Managers, Safety Managers |

| Logistics and Warehousing Robotics | 60 | Logistics Coordinators, Warehouse Supervisors |

| Healthcare Robotics Integration | 50 | Healthcare Administrators, Biomedical Engineers |

| Education and Training in Robotics | 40 | Academic Researchers, Vocational Training Coordinators |

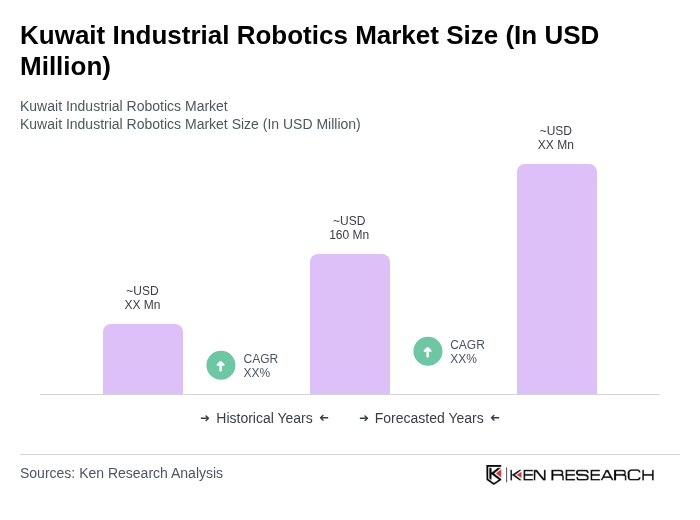

The Kuwait Industrial Robotics Market is valued at approximately USD 160 million, reflecting a significant growth trend driven by the adoption of automation technologies across various sectors, including manufacturing, logistics, and oil & gas.