Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7923

Pages:98

Published On:December 2025

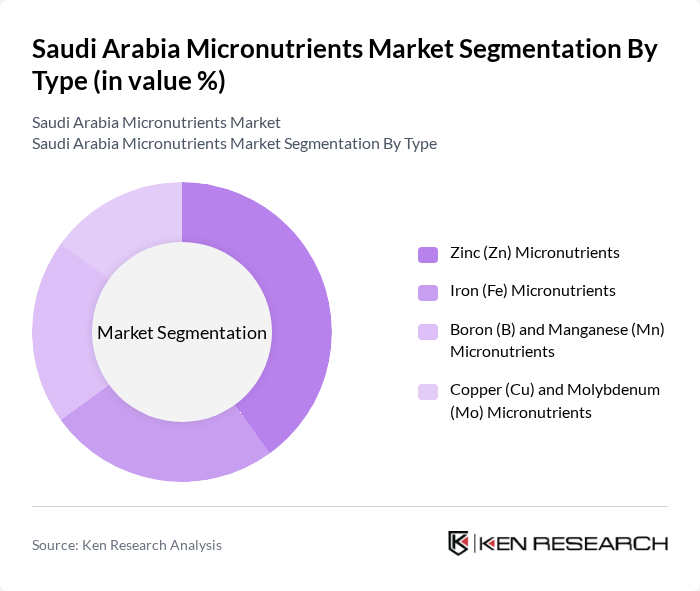

By Type:The micronutrients market in Saudi Arabia is segmented into four main types: Zinc (Zn) Micronutrients, Iron (Fe) Micronutrients, Boron (B) and Manganese (Mn) Micronutrients, and Copper (Cu) and Molybdenum (Mo) Micronutrients. Among these, Zinc micronutrients are the most widely used due to their critical role in plant growth and development. The increasing awareness of soil health and crop nutrition has led to a surge in demand for zinc-based products, making it a dominant segment in the market.

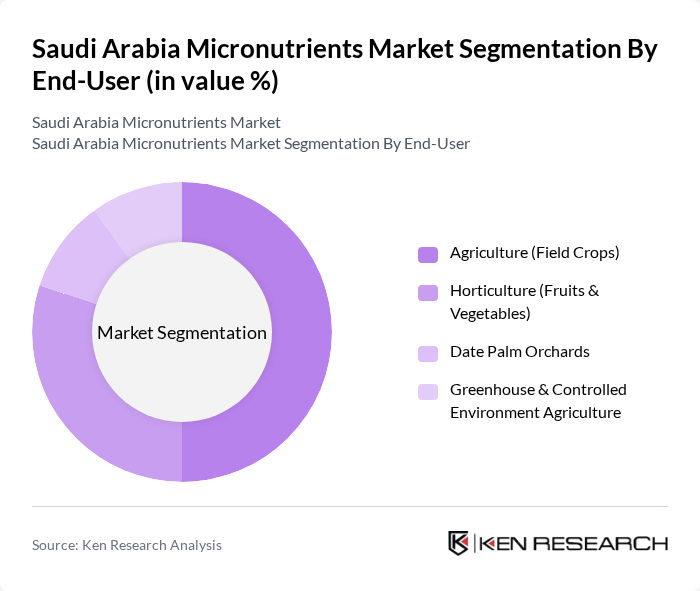

By End-User:The end-user segmentation of the micronutrients market includes Agriculture (Field Crops), Horticulture (Fruits & Vegetables), Date Palm Orchards, and Greenhouse & Controlled Environment Agriculture. The Agriculture segment, particularly field crops, dominates the market due to the extensive cultivation of staple crops in Saudi Arabia. The increasing focus on enhancing crop yield and quality in the agricultural sector drives the demand for micronutrients among farmers.

The Saudi Arabia Micronutrients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, Nutrien Ltd., Haifa Group, The Mosaic Company, BASF SE, Corteva Agriscience, ICL Group Ltd., Coromandel International Ltd., Nufarm Limited, ATP Nutrition, Balchem Corporation, OCP Group (Groupe OCP S.A.), UPL Limited, Adama Agricultural Solutions Ltd., Sumitomo Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia micronutrients market appears promising, driven by increasing agricultural productivity and government support for sustainable practices. As farmers become more aware of the benefits of micronutrients, demand is expected to rise. Additionally, technological advancements in nutrient delivery systems will enhance efficiency. The market is likely to see innovations in product formulations, catering to the growing trend of organic farming, which will further stimulate growth and investment in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Zinc (Zn) Micronutrients Iron (Fe) Micronutrients Boron (B) and Manganese (Mn) Micronutrients Copper (Cu) and Molybdenum (Mo) Micronutrients |

| By End-User | Agriculture (Field Crops) Horticulture (Fruits & Vegetables) Date Palm Orchards Greenhouse & Controlled Environment Agriculture |

| By Application Method | Soil Application Foliar Application Fertigation (Drip Irrigation) Hydroponic Systems |

| By Crop Type | Cereals and Grains (38% market share in 2024) Fruits and Vegetables Oilseeds and Pulses (10.2% CAGR through 2030) Date Palms and Specialty Crops |

| By Distribution Channel | Direct Sales to Farmers Agricultural Input Retailers Online Sales Platforms Cooperative Societies |

| By Region | Northern Region (Al-Jouf, Tabuk, Hail - 65% of fresh produce output) Central Region (Riyadh, Al-Kharj) Eastern Region (Al-Ahsa) Southern Region (Najran, Asir) |

| By Product Form | Granular Liquid Formulations (7.4% CAGR through 2030) Powder Chelated Complexes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Nutritionists, Dietitians, General Practitioners |

| Micronutrient Manufacturers | 50 | Product Managers, R&D Directors |

| Retailers of Dietary Supplements | 40 | Store Managers, Purchasing Agents |

| Consumers of Micronutrient Products | 100 | Health-conscious Individuals, Parents, Elderly Consumers |

| Public Health Officials | 40 | Policy Makers, Health Program Coordinators |

The Saudi Arabia Micronutrients Market is valued at approximately USD 85 million, reflecting a significant growth trend driven by increasing agricultural productivity and government initiatives aimed at enhancing food security under Vision 2030.