Region:Middle East

Author(s):Shubham

Product Code:KRAD6703

Pages:80

Published On:December 2025

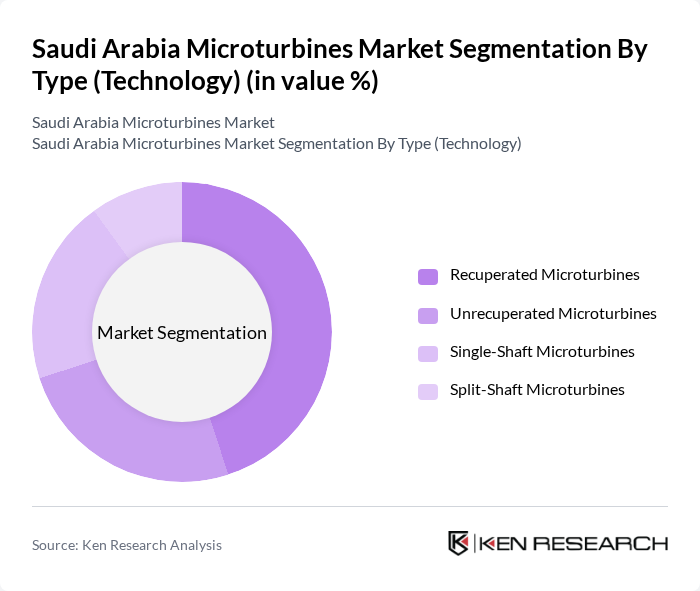

By Type (Technology):The microturbines market can be segmented into four main types: Recuperated Microturbines, Unrecuperated Microturbines, Single-Shaft Microturbines, and Split-Shaft Microturbines, which is consistent with global technology segmentation. Among these, Recuperated Microturbines are leading the market due to their higher electrical efficiency, better fuel utilization, and lower emissions compared to simple-cycle designs, making them especially suitable for combined heat and power (CHP) and continuous-duty distributed generation applications in commercial and industrial facilities.

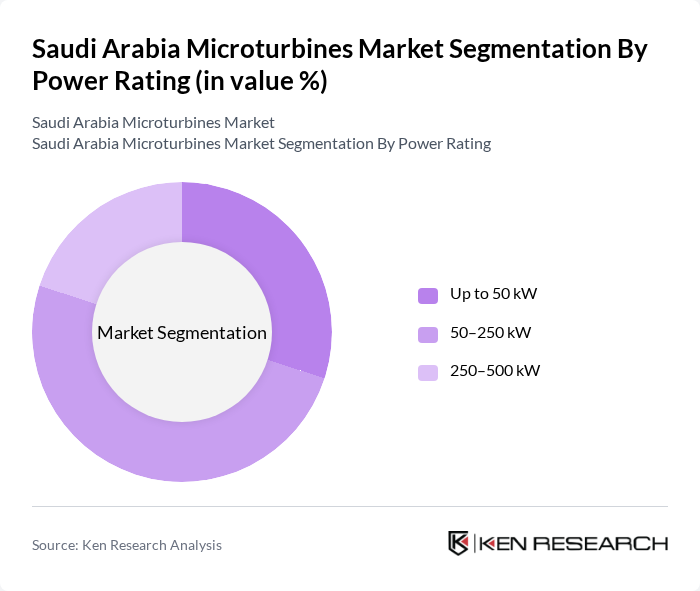

By Power Rating:The market is also segmented based on power ratings, including Up to 50 kW, 50–250 kW, and 250–500 kW, in line with common global classifications for microturbine systems. The segment of 50–250 kW is currently dominating the market, as it caters to a wide range of applications, from commercial buildings, hospitals, hotels, and data centers to small and medium industrial facilities, providing a balance between power output, modularity, and efficiency and aligning well with micro?CHP and onsite generation needs identified in the Kingdom.

The Saudi Arabia Microturbines Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capstone Green Energy Corporation (formerly Capstone Turbine), FlexEnergy Inc., Bladon Micro Turbine (Bladon Jets), Ansaldo Energia S.p.A., Siemens Energy AG, General Electric Company (GE Vernova – Distributed Power), Mitsubishi Power, Ltd., Caterpillar Inc. (CAT Distributed Generation & Microgrid Solutions), Rolls-Royce plc (Rolls-Royce Power Systems / MTU), Solar Turbines Incorporated (a Caterpillar company), Ingersoll Rand Inc., Eneftech Innovation SA, Turbine Technologies, Ltd., Micro Turbine Technology B.V., Local & Regional Partners (e.g., Saudi EPCs, distributors and O&M providers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microturbines market in Saudi Arabia appears promising, driven by increasing investments in renewable energy and technological advancements. As the government continues to implement supportive policies, the market is expected to witness a surge in microturbine adoption, particularly in remote areas. Additionally, the integration of smart technologies and energy management systems will enhance operational efficiency, making microturbines a viable alternative to traditional energy sources in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Technology) | Recuperated Microturbines Unrecuperated Microturbines Single-Shaft Microturbines Split-Shaft Microturbines |

| By Power Rating | Up to 50 kW –250 kW –500 kW |

| By Application | Combined Heat and Power (CHP) Standby / Backup Power Primary Power for Remote & Off-Grid Sites Oil & Gas and Flare Gas Utilization |

| By Fuel Source | Natural Gas Associated Gas / Flare Gas Biogas & Landfill Gas Liquid Fuels (Diesel, Kerosene, Others) |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Industrial & Manufacturing Commercial Buildings & Hospitality Utilities & Public Infrastructure Residential & Small Commercial |

| By Installation Type | Standalone Systems Grid-Connected Systems Microgrid & Hybrid Systems |

| By Region | Northern & Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Jubail) Western Region (incl. Jeddah, Makkah, Madinah, Red Sea projects) Southern Region |

| By Policy & Procurement Environment | Utility-Scale & Government Tenders Private Sector & IPP Contracts Industrial Energy Efficiency Programs Vision 2030 & Localization-Linked Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Microturbine Applications | 90 | Plant Managers, Energy Efficiency Consultants |

| Commercial Microturbine Installations | 75 | Facility Managers, Sustainability Officers |

| Residential Microturbine Users | 55 | Homeowners, Renewable Energy Advocates |

| Government and Regulatory Bodies | 45 | Policy Makers, Energy Regulators |

| Microturbine Manufacturers and Suppliers | 65 | Sales Managers, Product Development Engineers |

The Saudi Arabia Microturbines Market is valued at approximately USD 15 million, reflecting a growing interest in clean and efficient energy solutions, particularly in industrial and commercial sectors, as part of the country's broader energy strategy.