Region:Middle East

Author(s):Dev

Product Code:KRAB7260

Pages:89

Published On:October 2025

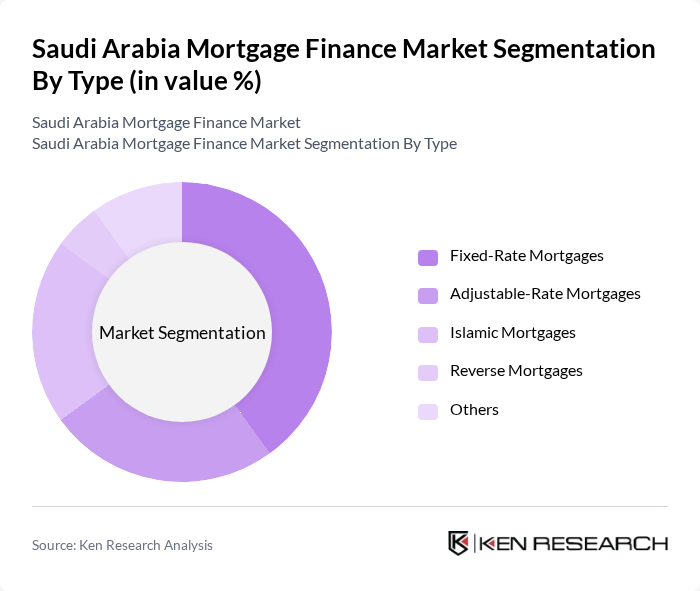

By Type:The mortgage finance market can be segmented into several types, including Fixed-Rate Mortgages, Adjustable-Rate Mortgages, Islamic Mortgages, Reverse Mortgages, and Others. Each type caters to different consumer needs and preferences, with Islamic Mortgages gaining popularity due to the country's cultural and religious context. Fixed-Rate Mortgages are favored for their stability, while Adjustable-Rate Mortgages attract those seeking lower initial payments.

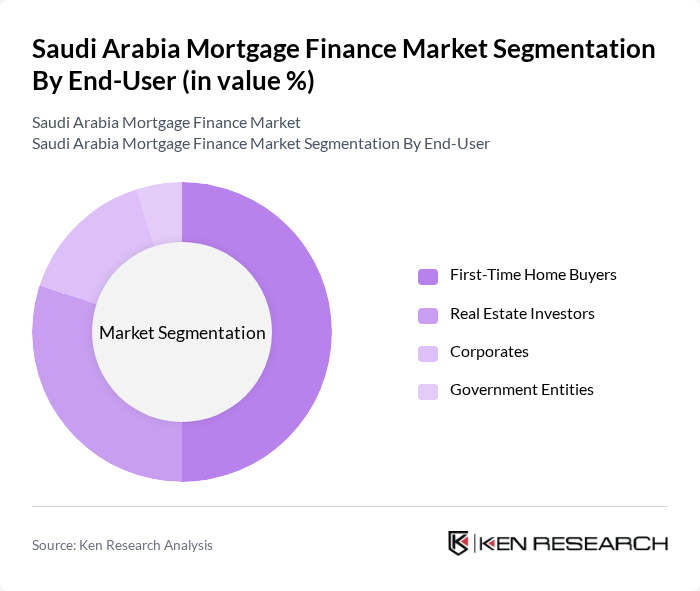

By End-User:The end-user segmentation includes First-Time Home Buyers, Real Estate Investors, Corporates, and Government Entities. First-Time Home Buyers represent a significant portion of the market, driven by government incentives and a growing desire for home ownership among the younger population. Real Estate Investors are also prominent, capitalizing on the expanding property market, while Corporates and Government Entities contribute to the demand for commercial and residential properties.

The Saudi Arabia Mortgage Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Bank, National Commercial Bank, Saudi British Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, Alinma Bank, Bank Aljazira, Saudi Investment Bank, Gulf International Bank, Alawwal Bank, Saudi Home Loans, Dar Al Arkan, Emaar Economic City, Jeddah Bank contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian mortgage finance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of digital platforms for mortgage processing is expected to enhance efficiency and accessibility, attracting a broader customer base. Additionally, the focus on sustainable housing solutions aligns with global trends, encouraging developers to innovate. As the market adapts to these changes, it is likely to witness increased competition among lenders, ultimately benefiting consumers through improved services and product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Rate Mortgages Adjustable-Rate Mortgages Islamic Mortgages Reverse Mortgages Others |

| By End-User | First-Time Home Buyers Real Estate Investors Corporates Government Entities |

| By Property Type | Residential Properties Commercial Properties Mixed-Use Developments Land Purchases |

| By Loan Amount | Low-Value Loans Mid-Value Loans High-Value Loans |

| By Loan Tenure | Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Distribution Channel | Direct Sales Online Platforms Brokers |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Mortgage Borrowers | 150 | First-time homebuyers, Existing homeowners |

| Commercial Property Investors | 100 | Real estate developers, Investment managers |

| Mortgage Lenders | 80 | Banking executives, Loan officers |

| Real Estate Agents | 70 | Residential and commercial agents, Brokers |

| Financial Advisors | 60 | Wealth managers, Financial planners |

The Saudi Arabia Mortgage Finance Market is valued at approximately USD 30 billion, reflecting significant growth driven by urbanization, government initiatives for home ownership, and a rising population in need of housing solutions.