Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0996

Pages:87

Published On:October 2025

By Type:The market is segmented into Fixed-Rate Mortgages, Adjustable-Rate Mortgages, Islamic (Sharia-Compliant) Mortgages, Interest-Only Mortgages, Reverse Mortgages, and Others. Fixed-Rate Mortgages are the most popular, favored for their payment stability and predictability, which appeals to a broad consumer base. Adjustable-Rate Mortgages are gaining interest due to their lower introductory rates, attracting cost-sensitive borrowers. Islamic Mortgages have a significant presence in Oman, reflecting the country's adherence to Sharia principles and the growing demand for Sharia-compliant financial products .

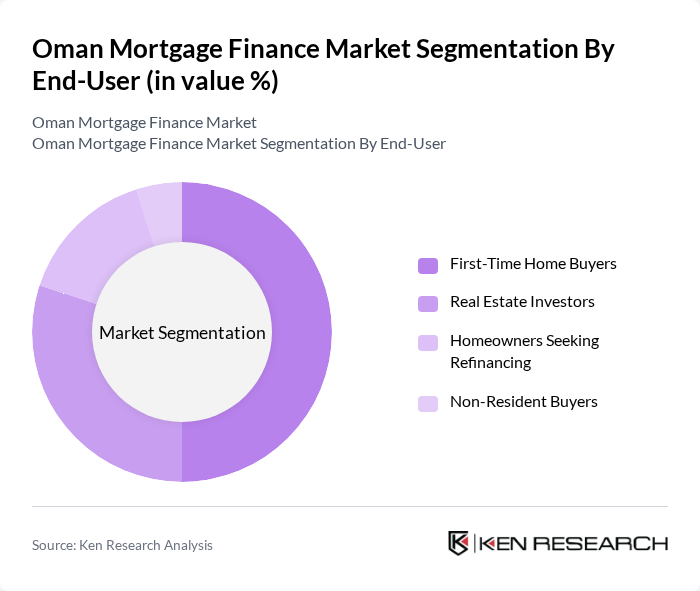

By End-User:The end-user segmentation comprises First-Time Home Buyers, Real Estate Investors, Homeowners Seeking Refinancing, and Non-Resident Buyers. First-Time Home Buyers represent the largest segment, propelled by government incentives and a rising aspiration for home ownership. Real Estate Investors are also prominent, leveraging increasing property values and rental demand in urban centers. Homeowners seeking refinancing are motivated by opportunities for better rates, while Non-Resident Buyers are drawn to Oman’s real estate market for investment and diversification .

The Oman Mortgage Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Housing Bank, National Bank of Oman, Bank Dhofar, Sohar International, Alizz Islamic Bank, Oman Arab Bank, Muscat Finance, Oman Investment and Finance Company (OIFC), Dhofar International Development & Investment Holding Company (DIDIC), National Finance Company, Taageer Finance Company, United Finance Company, Al Omaniya Financial Services, and Oman Development Bank contribute to innovation, geographic expansion, and service delivery in this space.

The Oman mortgage finance market is poised for significant transformation in the coming years, driven by technological advancements and evolving consumer preferences. The shift towards digital platforms for mortgage applications is expected to streamline processes, enhancing accessibility for borrowers. Additionally, the growing emphasis on sustainable housing solutions will likely lead to an increase in green mortgage products. As the market adapts to these trends, stakeholders must focus on improving financial literacy and addressing affordability challenges to ensure sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Rate Mortgages Adjustable-Rate Mortgages Islamic (Sharia-Compliant) Mortgages Interest-Only Mortgages Reverse Mortgages Others |

| By End-User | First-Time Home Buyers Real Estate Investors Homeowners Seeking Refinancing Non-Resident Buyers |

| By Property Type | Residential Properties Commercial Properties Mixed-Use Developments Affordable Housing |

| By Loan Amount | Low-Value Loans ( |

| By Loan Term | Short-Term Loans (<5 years) Medium-Term Loans (5–15 years) Long-Term Loans (>15 years) |

| By Payment Type | Monthly Payments Bi-Weekly Payments Lump-Sum Payments |

| By Policy Support | Subsidized Interest Rates Government-Backed Loans Tax Benefits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Mortgage Borrowers | 120 | First-time homebuyers, Existing homeowners |

| Commercial Property Investors | 80 | Real estate investors, Business owners |

| Banking Sector Professionals | 60 | Mortgage loan officers, Risk assessment managers |

| Real Estate Developers | 50 | Project managers, Sales directors |

| Regulatory Authorities | 40 | Policy makers, Financial regulators |

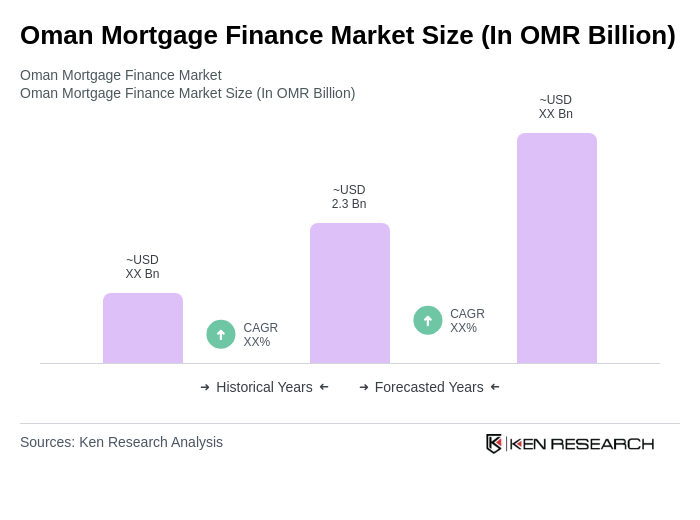

The Oman Mortgage Finance Market is valued at approximately OMR 2.3 billion, driven by increased mortgage agreements, affordability from falling property prices, and government initiatives aimed at promoting home ownership.