Region:Middle East

Author(s):Dev

Product Code:KRAB7410

Pages:85

Published On:October 2025

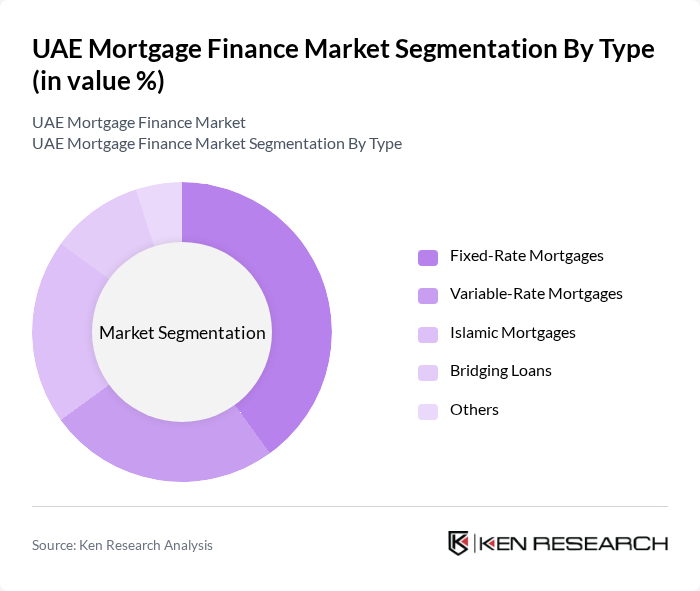

By Type:The mortgage finance market can be segmented into various types, including Fixed-Rate Mortgages, Variable-Rate Mortgages, Islamic Mortgages, Bridging Loans, and Others. Among these, Fixed-Rate Mortgages are particularly popular due to their stability and predictability, appealing to borrowers who prefer consistent monthly payments. Islamic Mortgages are also gaining traction, reflecting the cultural and religious preferences of a significant portion of the population.

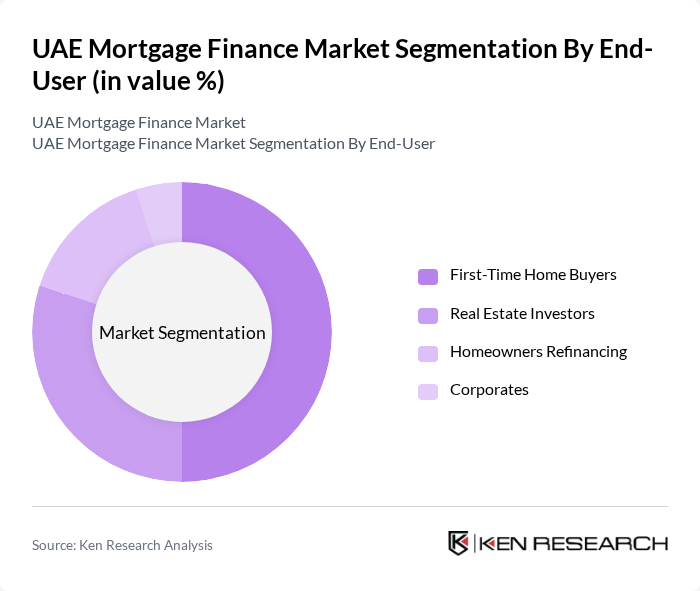

By End-User:The end-user segmentation includes First-Time Home Buyers, Real Estate Investors, Homeowners Refinancing, and Corporates. First-Time Home Buyers dominate the market as they are increasingly entering the property market, driven by favorable financing options and government incentives. Real Estate Investors also play a significant role, capitalizing on the growing property market and rental yields.

The UAE Mortgage Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, First Abu Dhabi Bank, Mashreq Bank, RAK Bank, Sharjah Islamic Bank, Ajman Bank, Noor Bank, Union National Bank, Abu Dhabi Islamic Bank, Dubai Investments, Al Hilal Bank, Bank of Sharjah, Emirates Islamic Bank contribute to innovation, geographic expansion, and service delivery in this space.

The UAE mortgage finance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital platforms gain traction, lenders are expected to enhance their service offerings, improving customer engagement and streamlining processes. Furthermore, the growing emphasis on sustainable housing solutions will likely shape product development, catering to environmentally conscious buyers. Overall, the market is anticipated to adapt to these trends, fostering innovation and expanding access to mortgage financing for a broader demographic.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Rate Mortgages Variable-Rate Mortgages Islamic Mortgages Bridging Loans Others |

| By End-User | First-Time Home Buyers Real Estate Investors Homeowners Refinancing Corporates |

| By Property Type | Residential Properties Commercial Properties Mixed-Use Developments Land Purchases |

| By Loan Amount | Low-Value Loans Mid-Value Loans High-Value Loans |

| By Loan Tenure | Short-Term Loans Medium-Term Loans Long-Term Loans |

| By Interest Rate Type | Fixed Interest Rates Variable Interest Rates |

| By Customer Segment | Individual Borrowers Corporate Borrowers Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Mortgage Borrowers | 150 | First-time Homebuyers, Existing Homeowners |

| Commercial Property Investors | 100 | Real Estate Developers, Investment Managers |

| Mortgage Lenders | 80 | Bank Managers, Loan Officers |

| Real Estate Agents | 70 | Residential and Commercial Agents |

| Financial Advisors | 60 | Mortgage Brokers, Financial Planners |

The UAE Mortgage Finance Market is valued at approximately USD 30 billion, driven by a robust real estate sector, an increasing expatriate population, and favorable government policies promoting home ownership.