Region:Middle East

Author(s):Rebecca

Product Code:KRAD7472

Pages:94

Published On:December 2025

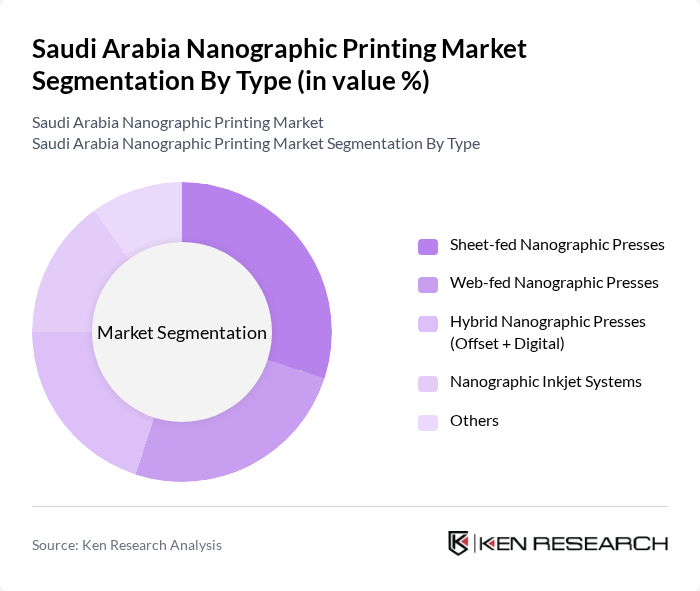

By Type:The segmentation of the market by type includes various technologies that cater to different printing needs. The subsegments are Sheet-fed Nanographic Presses, Web-fed Nanographic Presses, Hybrid Nanographic Presses (Offset + Digital), Nanographic Inkjet Systems, and Others. Each of these subsegments plays a crucial role in addressing specific market demands, with varying levels of adoption based on industry requirements, print run lengths, and substrate flexibility.

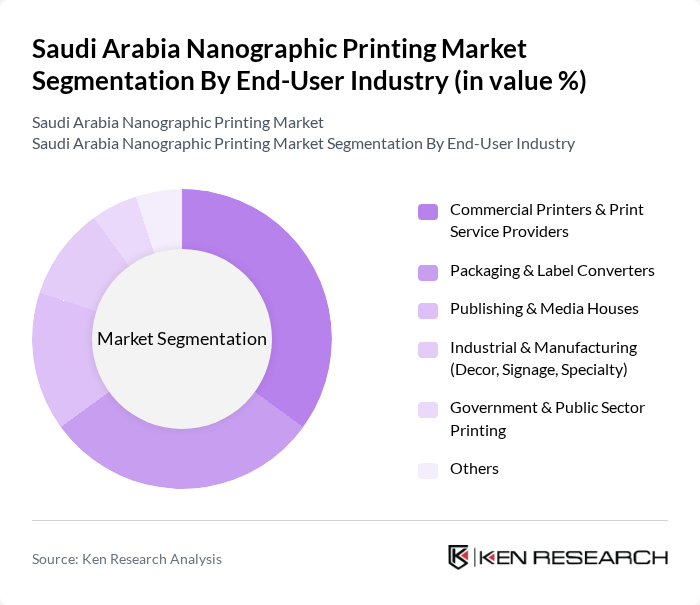

By End-User Industry:The end-user industry segmentation includes Commercial Printers & Print Service Providers, Packaging & Label Converters, Publishing & Media Houses, Industrial & Manufacturing (Decor, Signage, Specialty), Government & Public Sector Printing, and Others. Each segment reflects the diverse applications of nanographic printing technology across various sectors, highlighting the versatility and adaptability of this printing method, with especially strong uptake in packaging, commercial print, and label applications where high quality, customization, and shorter turnaround times are critical.

The Saudi Arabia Nanographic Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Landa Digital Printing, HP Inc., Canon Middle East (Canon Inc.), Xerox Corporation, Konica Minolta Business Solutions Middle East, Ricoh Company, Ltd., Fujifilm Holdings Corporation, Agfa-Gevaert Group, Durst Phototechnik AG, Heidelberg Middle East FZCO, Koenig & Bauer AG, EFI (Electronics For Imaging, Inc.), Saudi Printing & Packaging Company (SPPC), Al Kharji Printing Press, Obeikan Investment Group – Packaging & Printing Division contribute to innovation, geographic expansion, and service delivery in this space, primarily through the deployment of advanced digital, inkjet, and packaging presses that form the technological base for nanographic and next-generation printing solutions.

The future of the nanographic printing market in Saudi Arabia appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly recognize the benefits of high-quality, eco-friendly printing solutions, the market is likely to expand in future. Additionally, the integration of artificial intelligence and automation in printing processes is expected to enhance efficiency and reduce costs, further encouraging adoption. The ongoing digital transformation across industries will also play a crucial role in shaping the future landscape of nanographic printing.

| Segment | Sub-Segments |

|---|---|

| By Type | Sheet-fed Nanographic Presses Web-fed Nanographic Presses Hybrid Nanographic Presses (Offset + Digital) Nanographic Inkjet Systems Others |

| By End-User Industry | Commercial Printers & Print Service Providers Packaging & Label Converters Publishing & Media Houses Industrial & Manufacturing (Decor, Signage, Specialty) Government & Public Sector Printing Others |

| By Application | Folding Cartons & Corrugated Packaging Labels & Narrow-web Printing Commercial Printing (Brochures, Catalogs, Direct Mail) Publishing (Books, Magazines) Industrial & Security Printing Others |

| By Substrate / Material | Paper & Paperboard Flexible Plastics & Films Metal Foils Labels & Self-adhesive Materials Specialty Substrates (Textiles, Composites, Others) |

| By Sales / Deployment Model | Direct OEM Sales Local Distributors & System Integrators Managed Print Services (MPS) Leasing & Pay-per-use Models Others |

| By Region | Central Region (Riyadh & Surrounding Provinces) Eastern Region (Dammam, Al Khobar, Jubail) Western Region (Jeddah, Makkah, Madinah) Southern & Northern Regions |

| By Technology | Water-based Nanographic Inkjet UV-curable Nanographic Inkjet Hybrid Nanographic Printing (with Offset/Flexo) Specialty Nanographic Inks (Security, White, Metallic) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Stakeholders | 90 | Production Managers, Quality Control Supervisors |

| Textile Manufacturers | 70 | Design Engineers, Operations Managers |

| Electronics Printing Applications | 60 | Product Development Managers, Supply Chain Directors |

| Research Institutions and Universities | 40 | Academic Researchers, Technology Transfer Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

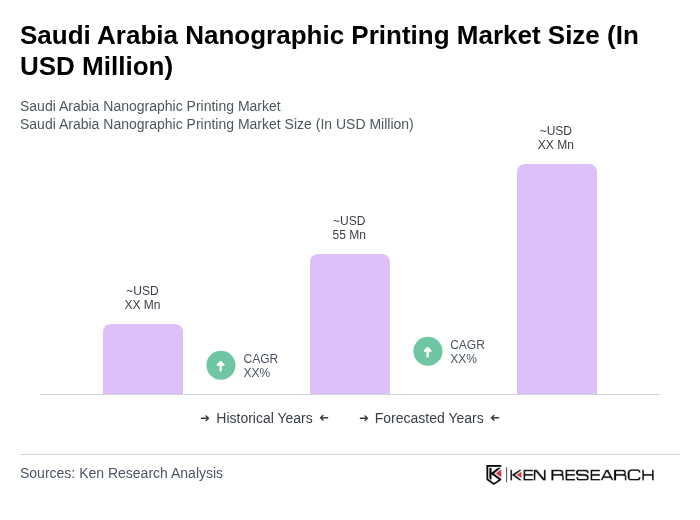

The Saudi Arabia Nanographic Printing Market is valued at approximately USD 55 million, reflecting a five-year historical analysis of revenues within the broader commercial and digital printing industry in the country.