Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9560

Pages:95

Published On:November 2025

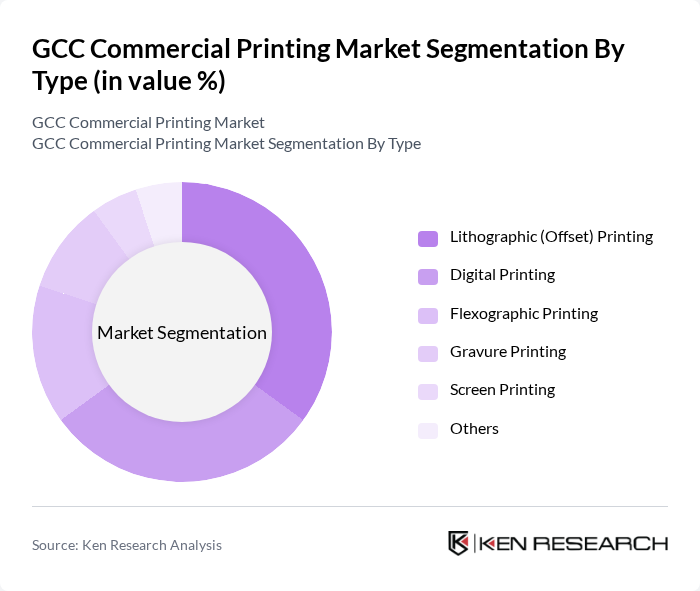

By Type:The market is segmented into various types of printing methods, including Lithographic (Offset) Printing, Digital Printing, Flexographic Printing, Gravure Printing, Screen Printing, and Others. Each type serves different purposes and industries, with specific advantages that cater to diverse customer needs. Lithographic (Offset) Printing holds the largest share, favored for its high-quality output and cost-effectiveness for large print runs. Digital Printing is rapidly gaining traction due to its flexibility, quick turnaround times, and suitability for short runs and personalized printing. Flexographic and gravure printing are primarily used in packaging, while screen printing is applied for specialty graphics and textiles .

The dominant sub-segment in the market is Lithographic (Offset) Printing, which is favored for its high-quality output and cost-effectiveness for large print runs. This method is widely used in commercial printing for brochures, magazines, and packaging materials. Digital Printing is also gaining traction due to its flexibility and quick turnaround times, making it suitable for short runs and personalized printing. The demand for these printing types is driven by the need for high-quality marketing materials and packaging solutions .

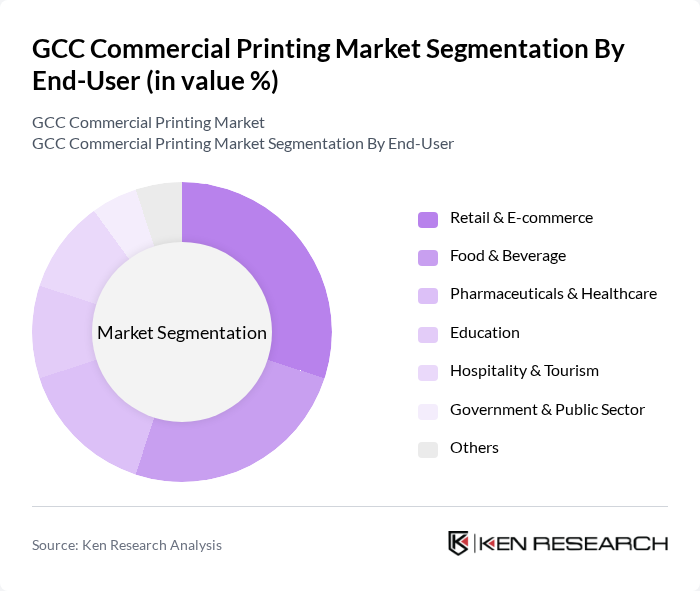

By End-User:The market is segmented by end-user industries, including Retail & E-commerce, Food & Beverage, Pharmaceuticals & Healthcare, Education, Hospitality & Tourism, Government & Public Sector, and Others. Each sector has unique printing needs that drive demand for various printing services. The Retail & E-commerce sector is the leading end-user segment, driven by the increasing need for promotional materials and packaging solutions. The Food & Beverage industry follows closely, requiring labels and packaging that comply with regulatory standards. The growth in these sectors is attributed to the rising consumer demand for branded products and effective marketing strategies .

The Retail & E-commerce sector is the leading end-user segment, driven by the increasing need for promotional materials and packaging solutions. The Food & Beverage industry follows closely, requiring labels and packaging that comply with regulatory standards. The growth in these sectors is attributed to the rising consumer demand for branded products and effective marketing strategies .

The GCC Commercial Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ghurair Printing & Publishing LLC, Emirates Printing Press LLC, United Printing & Publishing (UPP), Al Khat Packaging Co. Ltd., Print Arabia, Al Mufeed Printing Press, Al Ain Printing Press, Al Maktoum Printing Press, Al Fajr Printing Press, Al Noor Printing Press, Al Jazeera Printing Press, Qasar Al Murjan Printing Press, Al Waha Printing Press, Al Qasr Printing Press, Al Sada Printing Press contribute to innovation, geographic expansion, and service delivery in this space.

The GCC commercial printing market is poised for transformative growth driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt digital printing technologies, the demand for personalized and on-demand printing solutions is expected to rise. Additionally, the integration of eco-friendly practices will likely shape the industry's future, aligning with global sustainability trends. Companies that leverage these opportunities while navigating competitive pressures will be well-positioned to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithographic (Offset) Printing Digital Printing Flexographic Printing Gravure Printing Screen Printing Others |

| By End-User | Retail & E-commerce Food & Beverage Pharmaceuticals & Healthcare Education Hospitality & Tourism Government & Public Sector Others |

| By Product | Packaging Materials (Cartons, Flexible Packaging, Labels) Brochures & Catalogs Business Cards & Stationery Magazines & Books Promotional Materials (Flyers, Posters, Banners) Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Distributors Others |

| By Geography | Saudi Arabia UAE Qatar Oman Kuwait Bahrain Others |

| By Technology | Lithographic (Offset) Printing Digital Printing Flexographic Printing Screen Printing Gravure Printing Others |

| By Application | Packaging Advertising & Marketing Publishing Security Printing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Services | 70 | Print Shop Owners, Operations Managers |

| Packaging Printing | 70 | Product Managers, Supply Chain Managers |

| Digital Printing Solutions | 50 | Digital Print Technicians, Marketing Managers |

| Large Format Printing | 60 | Signage Managers, Event Coordinators |

| Textile Printing | 40 | Textile Manufacturers, Product Development Managers |

The GCC Commercial Printing Market is valued at approximately USD 8.2 billion, reflecting a robust growth trajectory driven by increasing demand for printed materials across various sectors, including retail, advertising, and packaging.