Region:Middle East

Author(s):Shubham

Product Code:KRAD3678

Pages:87

Published On:November 2025

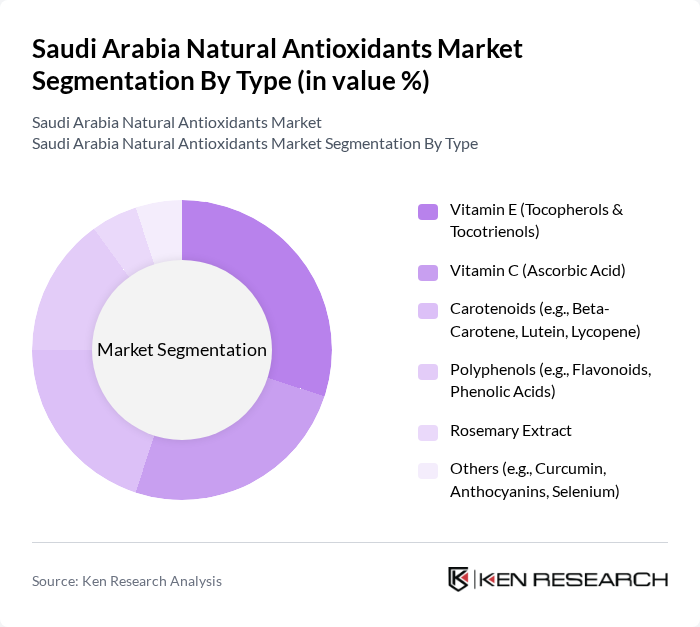

By Type:The market is segmented into various types of natural antioxidants, including Vitamin E (Tocopherols & Tocotrienols), Vitamin C (Ascorbic Acid), Carotenoids (e.g., Beta-Carotene, Lutein, Lycopene), Polyphenols (e.g., Flavonoids, Phenolic Acids), Rosemary Extract, and Others (e.g., Curcumin, Anthocyanins, Selenium). Among these, Vitamin E and Carotenoids are leading due to their extensive applications in food preservation and dietary supplements. The growing trend towards health and wellness has significantly increased the demand for these antioxidants, particularly in the food and beverage sector. The demand for polyphenols and rosemary extract is also rising due to their use in functional foods and natural cosmetics .

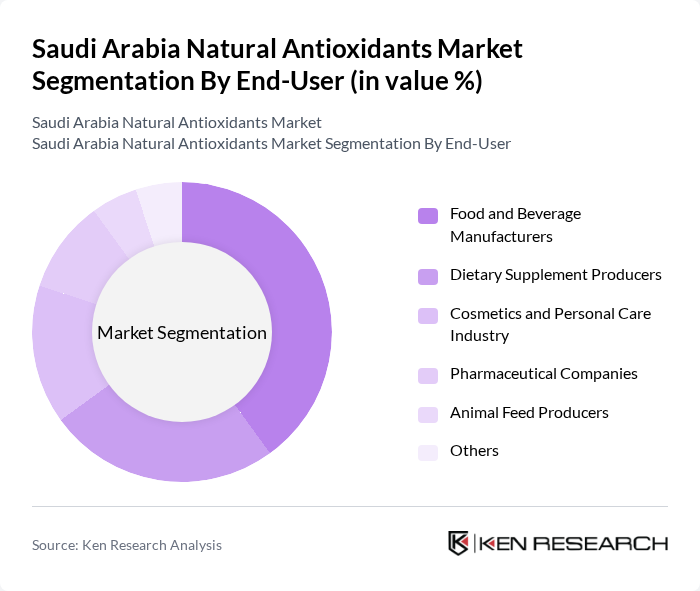

By End-User:The end-user segmentation includes Food and Beverage Manufacturers, Dietary Supplement Producers, Cosmetics and Personal Care Industry, Pharmaceutical Companies, Animal Feed Producers, and Others. The Food and Beverage Manufacturers segment is the largest due to the increasing incorporation of natural antioxidants in food products to enhance shelf life and nutritional value. The rising trend of clean-label products is also driving demand in this segment. The dietary supplement and cosmetics industries are also witnessing strong growth, fueled by consumer demand for natural and organic ingredients .

The Saudi Arabia Natural Antioxidants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arjuna Natural Extracts Ltd., Kemin Industries, Inc., BASF SE, DuPont de Nemours, Inc., Naturex S.A. (a Givaudan company), Archer Daniels Midland Company (ADM), DSM-Firmenich, Sabinsa Corporation, Kerry Group plc, BioCare Copenhagen A/S, Givaudan (including Naturex), Frutarom Industries Ltd. (now part of IFF), Synergy Flavors, Sensient Technologies Corporation, Aker BioMarine ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the natural antioxidants market in Saudi Arabia appears promising, driven by increasing consumer demand for health-oriented products and a growing emphasis on sustainability. As the market evolves, companies are likely to invest in innovative extraction technologies and expand their product lines to include plant-based antioxidants. Additionally, collaborations with food and beverage manufacturers will enhance product visibility and accessibility, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamin E (Tocopherols & Tocotrienols) Vitamin C (Ascorbic Acid) Carotenoids (e.g., Beta-Carotene, Lutein, Lycopene) Polyphenols (e.g., Flavonoids, Phenolic Acids) Rosemary Extract Others (e.g., Curcumin, Anthocyanins, Selenium) |

| By End-User | Food and Beverage Manufacturers Dietary Supplement Producers Cosmetics and Personal Care Industry Pharmaceutical Companies Animal Feed Producers Others |

| By Source | Plant-based (Fruits, Vegetables, Herbs, Spices) Microalgae and Seaweed Animal-based Synthetic (for benchmarking only) Others |

| By Application | Food Preservation Nutritional Supplements Cosmetic Formulations Animal Feed Additives Pharmaceuticals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Health Stores Direct B2B Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Control Specialists |

| Cosmetics and Personal Care Brands | 80 | Formulation Chemists, Brand Managers |

| Pharmaceutical Companies | 70 | Research Scientists, Regulatory Affairs Managers |

| Health and Wellness Retailers | 60 | Store Managers, Category Buyers |

| Nutrition and Dietary Supplement Firms | 50 | Marketing Directors, Product Line Managers |

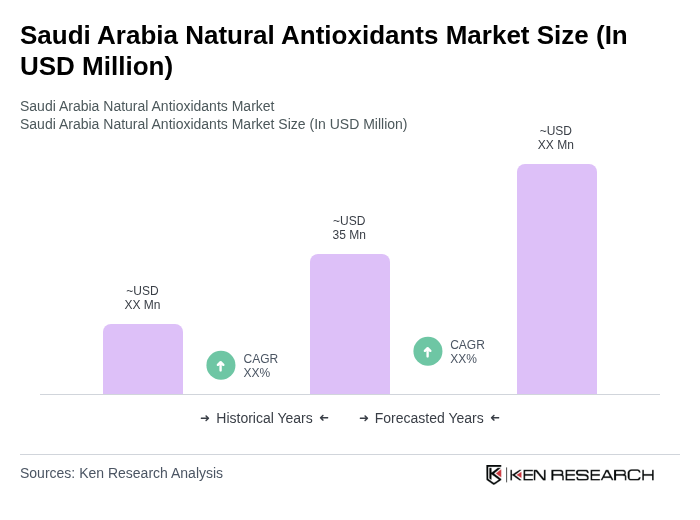

The Saudi Arabia Natural Antioxidants Market is valued at approximately USD 35 million, reflecting a significant growth trend driven by increasing consumer awareness of health benefits and a rising demand for natural food preservatives and cosmetics.