Region:Middle East

Author(s):Dev

Product Code:KRAE0114

Pages:95

Published On:December 2025

By Type:The market is segmented into various types of additives, including vitamins, amino acids, enzymes, probiotics, prebiotics, minerals, and others. Among these, vitamins and amino acids are the most dominant due to their essential roles in animal nutrition, promoting growth and enhancing overall health. The increasing awareness of animal welfare and the demand for high-quality animal products are driving the consumption of these additives.

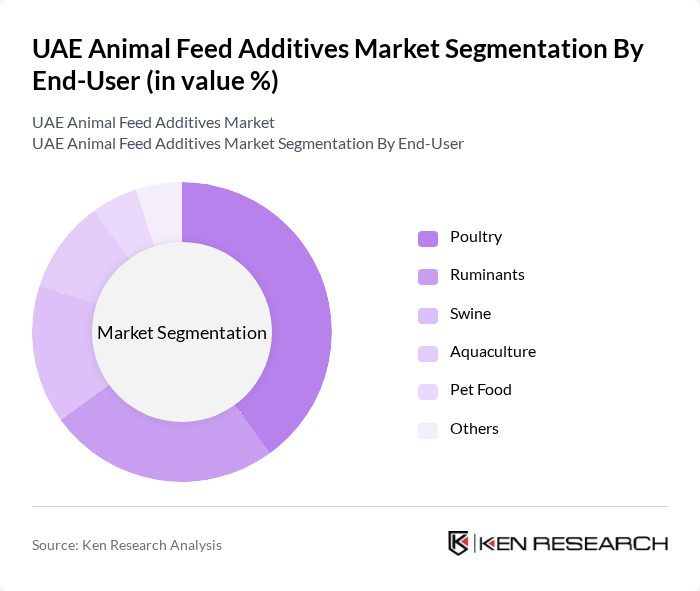

By End-User:The end-user segmentation includes poultry, ruminants, swine, aquaculture, pet food, and others. Poultry is the leading segment, driven by the high demand for chicken and eggs in the UAE. The increasing focus on poultry health and productivity has led to a rise in the use of specialized feed additives, making it a significant contributor to the market.

The UAE Animal Feed Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alltech, Cargill, BASF, DSM Nutritional Products, Nutreco, Evonik Industries, Archer Daniels Midland Company, Kemin Industries, Novus International, Phibro Animal Health Corporation, Adisseo, Provimi, Delacon Biotechnik, Biomin, Trouw Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE animal feed additives market appears promising, driven by increasing livestock production and a shift towards sustainable practices. As consumer preferences evolve, there will be a greater emphasis on organic and natural additives, aligning with global trends. Additionally, technological advancements in feed production are expected to enhance efficiency and product quality. The market is likely to witness significant growth opportunities, particularly in aquaculture and organic feed segments, as stakeholders adapt to changing consumer demands and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Amino Acids Enzymes Probiotics Prebiotics Minerals Others |

| By End-User | Poultry Ruminants Swine Aquaculture Pet Food Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Formulation | Liquid Powder Granules Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Application | Nutritional Supplements Growth Promoters Health Enhancers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Livestock Feed Manufacturers | 100 | Production Managers, Quality Control Officers |

| Veterinary Clinics | 80 | Veterinarians, Animal Health Technicians |

| Feed Distributors | 70 | Sales Managers, Logistics Coordinators |

| Farm Operators | 90 | Farm Managers, Livestock Nutritionists |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

The UAE Animal Feed Additives Market is valued at approximately USD 2.65 billion. This valuation reflects the market's growth driven by increased livestock populations, rising demand for pet and aquaculture feeds, and advancements in feed processing and distribution infrastructure.