Region:Middle East

Author(s):Rebecca

Product Code:KRAD2836

Pages:92

Published On:November 2025

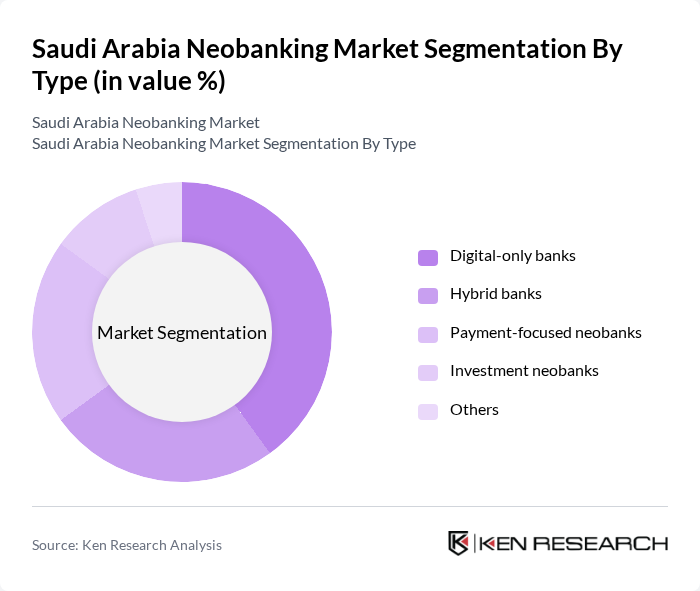

By Type:The neobanking market can be segmented into digital-only banks, hybrid banks, payment-focused neobanks, investment neobanks, and others. Digital-only banks are gaining traction due to their user-friendly interfaces, lower operational costs, and customer-centric services. Hybrid banks combine traditional banking features with digital services, appealing to a broader audience seeking both physical and digital access. Payment-focused neobanks address the rising demand for seamless, real-time payment solutions, while investment neobanks attract tech-savvy investors with innovative financial products and digital wealth management tools. The "others" segment includes niche neobanks offering specialized services such as SME lending, remittances, and sector-specific financial solutions , .

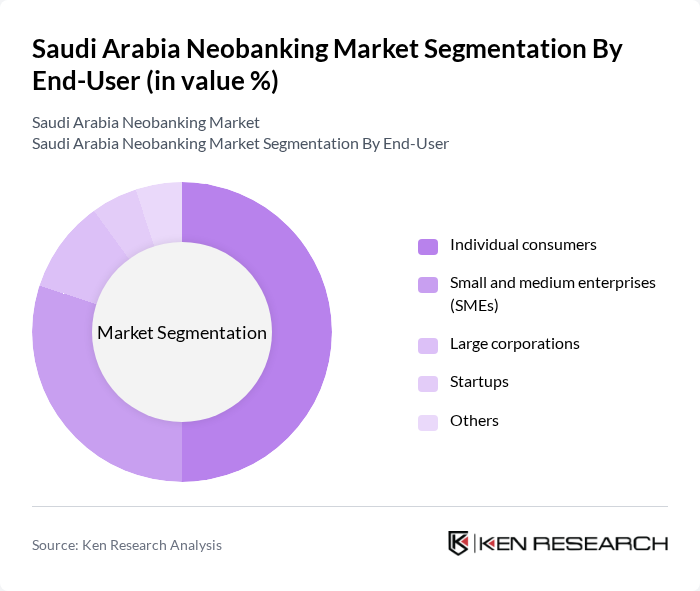

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, startups, and others. Individual consumers represent the largest segment, driven by increasing digital literacy, smartphone adoption, and a preference for convenient banking experiences. SMEs are rapidly adopting neobanking services for their flexibility, cost-effectiveness, and tailored financial products, including digital payment solutions and business accounts. Large corporations leverage neobanks for enhanced financial management, real-time analytics, and streamlined treasury operations. Startups utilize neobanks for innovative financial products, fast onboarding, and scalable banking solutions. The "others" segment comprises freelancers, micro-enterprises, and non-profit organizations seeking specialized digital banking services , .

The Saudi Arabia Neobanking Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Pay, Alinma Bank, National Commercial Bank (NCB), Riyad Bank, Bank AlJazira, QNB AlAhli, SABB (Saudi British Bank), Al Rajhi Bank, Arab National Bank, Banque Saudi Fransi, Alinma Investment, Al Baraka Banking Group, Saudi Investment Bank, Tamara, Lean Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the neobanking market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As digital financial services continue to gain traction, neobanks are expected to play a pivotal role in reshaping the banking landscape. The integration of artificial intelligence and data analytics will enhance customer experiences, while regulatory support will further facilitate market entry for new players, fostering innovation and competition in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-only banks Hybrid banks Payment-focused neobanks Investment neobanks Others |

| By End-User | Individual consumers Small and medium enterprises (SMEs) Large corporations Startups Others |

| By Customer Segment | Millennials Gen Z High-net-worth individuals Unbanked populations Others |

| By Service Offering | Savings accounts Loans and credit facilities Investment services Payment solutions Others |

| By Technology Utilization | Mobile banking applications AI-driven customer service Blockchain for transactions Data analytics for customer insights Others |

| By Geographic Presence | Urban areas Rural areas Regional hubs International markets Others |

| By Regulatory Compliance Level | Fully compliant neobanks Partially compliant neobanks Non-compliant neobanks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 120 | Millennials, Gen Z, and tech-savvy individuals |

| Small Business Owners | 80 | Entrepreneurs and financial decision-makers |

| Fintech Industry Experts | 40 | Consultants, analysts, and industry thought leaders |

| Regulatory Bodies | 40 | Officials from SAMA and other financial regulatory authorities |

| Potential Neobank Users | 100 | Individuals interested in digital banking solutions |

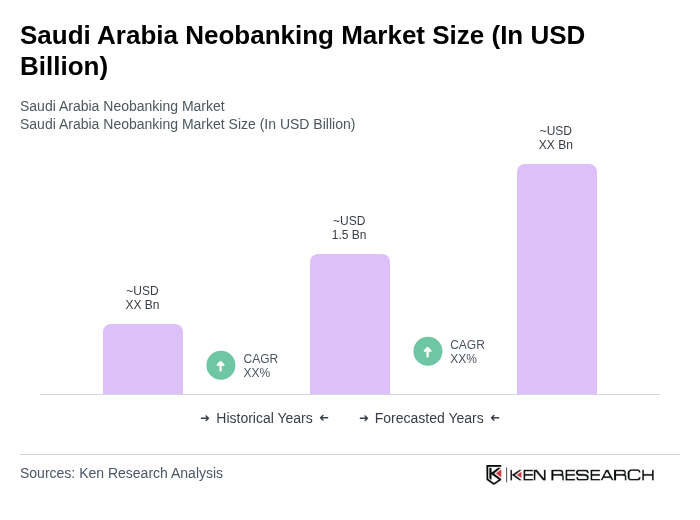

The Saudi Arabia Neobanking Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital banking solutions, smartphone penetration, and a preference for cashless transactions among consumers.