Region:Global

Author(s):Geetanshi

Product Code:KRAE0678

Pages:84

Published On:December 2025

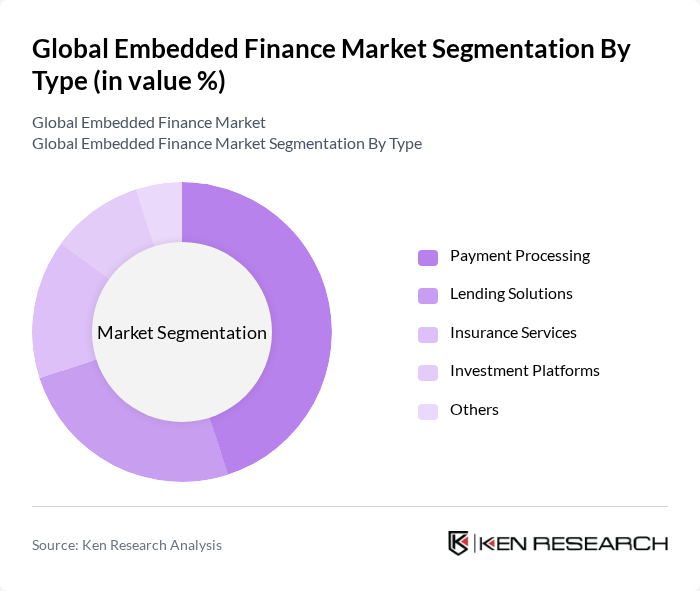

By Type:The embedded finance market is segmented into various types, including payment processing, lending solutions, insurance services, investment platforms, and others. Among these, payment processing is the leading sub-segment, driven by the increasing demand for seamless transactions in e-commerce and mobile applications. The rise of digital wallets and contactless payments has further accelerated the adoption of payment processing solutions, making it a critical component of the embedded finance ecosystem.

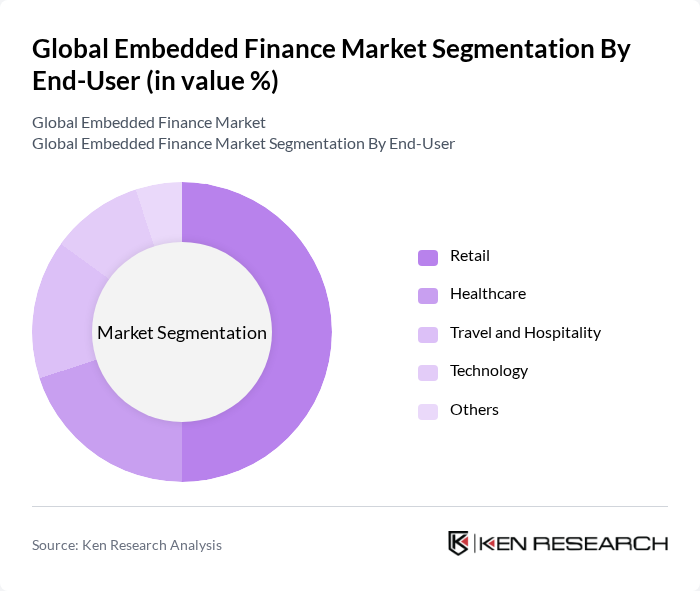

By End-User:The end-user segmentation includes retail, healthcare, travel and hospitality, technology, and others. The retail sector is the dominant end-user, as businesses increasingly integrate embedded finance solutions to enhance customer experiences and streamline payment processes. The growing trend of online shopping and the need for efficient payment methods have made retail a key driver of embedded finance adoption.

The Global Embedded Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stripe, Square, PayPal, Adyen, Plaid, Marqeta, Finastra, Solarisbank, Wise, Revolut, Affirm, Brex, Chime, N26, SoFi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the embedded finance market appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence and machine learning become more integrated into financial services, personalized offerings will enhance customer engagement. Additionally, the shift towards open banking will facilitate greater collaboration between fintechs and traditional banks, fostering innovation. These trends indicate a dynamic landscape where embedded finance solutions will continue to evolve, meeting the diverse needs of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Lending Solutions Insurance Services Investment Platforms Others |

| By End-User | Retail Healthcare Travel and Hospitality Technology Others |

| By Industry Vertical | E-commerce Telecommunications Transportation Real Estate Others |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Cryptocurrencies Others |

| By Technology Integration | API Integration SDK Integration White-Label Solutions Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Individual Consumers Others |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Embedded Finance Solutions | 150 | Chief Financial Officers, Payment Solution Managers |

| Healthcare Payment Integration | 100 | Healthcare Administrators, Financial Officers |

| Travel Industry Financial Services | 80 | Travel Agency Owners, Financial Analysts |

| Insurance Embedded Offerings | 70 | Insurance Product Managers, Underwriters |

| Fintech Partnerships and Collaborations | 90 | Business Development Managers, Strategic Partnership Leads |

The Global Embedded Finance Market is currently valued at approximately USD 150 billion. This valuation reflects the increasing demand for integrated financial services within non-financial platforms, driven by digitalization and the growth of e-commerce.