Region:Middle East

Author(s):Dev

Product Code:KRAC8825

Pages:93

Published On:November 2025

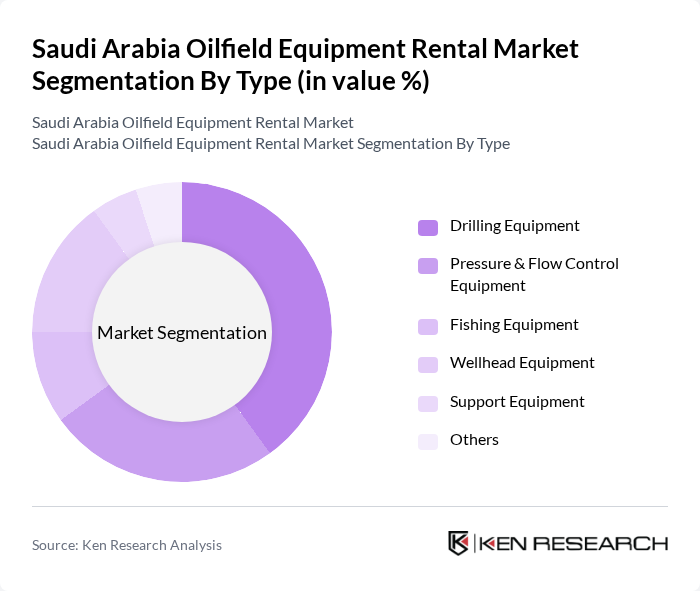

By Type:The market is segmented into various types of equipment, including drilling equipment, pressure & flow control equipment, fishing equipment, wellhead equipment, support equipment, and others. Among these, drilling equipment is the most dominant segment due to its essential role in the exploration and extraction of oil and gas. The increasing number of drilling projects, expansion of existing oilfield reserves, and the need for advanced drilling technologies are driving the demand for this segment. The adoption of automation and digital solutions is further enhancing operational efficiency in drilling activities .

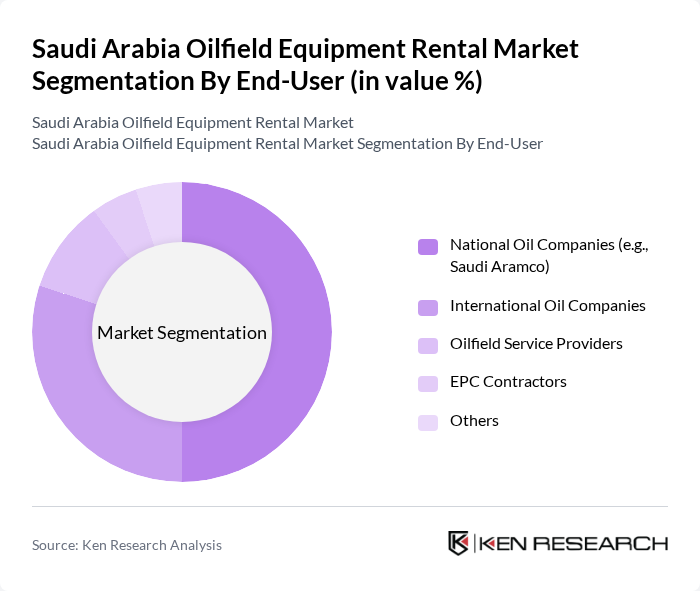

By End-User:The end-user segmentation includes national oil companies, international oil companies, oilfield service providers, EPC contractors, and others. National oil companies, particularly Saudi Aramco, dominate the market due to their extensive operations and significant investments in oilfield development. The increasing collaboration between national and international companies, as well as the growing presence of oilfield service providers and EPC contractors, is contributing to the growth of this segment. The focus on maximizing production efficiency and expanding exploration activities remains a key driver .

The Saudi Arabia Oilfield Equipment Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger, Halliburton, Baker Hughes, Weatherford International, National Oilwell Varco, Arabian Drilling Company, AlMansoori Specialized Engineering, Al Gihaz Holding, KCA Deutag, Nabors Industries, Petrofac, Superior Energy Services, Ensign Energy Services, Precision Drilling Corporation, Al Faris Equipment Rentals contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia oilfield equipment rental market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the government continues to invest in oilfield infrastructure, rental companies will need to adapt to evolving regulatory landscapes and market demands. The integration of digital solutions for equipment management will enhance operational efficiency, while the focus on safety and compliance will ensure long-term viability. Overall, the market is expected to navigate challenges while capitalizing on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Equipment Pressure & Flow Control Equipment Fishing Equipment Wellhead Equipment Support Equipment Others |

| By End-User | National Oil Companies (e.g., Saudi Aramco) International Oil Companies Oilfield Service Providers EPC (Engineering, Procurement, Construction) Contractors Others |

| By Region | Eastern Province Western Province Central Province Southern Province |

| By Application | Onshore Operations Offshore Operations Well Intervention & Workover Maintenance Services Others |

| By Equipment Size | Small Equipment Medium Equipment Large Equipment |

| By Rental Duration | Short-term Rentals Long-term Rentals |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Equipment Rental Services | 60 | Procurement Managers, Operations Directors |

| Drilling Equipment Rentals | 45 | Project Managers, Technical Leads |

| Completion and Production Equipment | 40 | Field Engineers, Equipment Specialists |

| Maintenance and Support Services | 42 | Service Managers, Maintenance Supervisors |

| Logistics and Transportation Services | 43 | Logistics Coordinators, Supply Chain Managers |

The Saudi Arabia Oilfield Equipment Rental Market is valued at approximately USD 1.2 billion, reflecting a robust growth driven by increased oil and gas exploration and production activities, as well as advancements in technology and outsourcing trends among oil companies.